PERSONAL FINANCE FINANCIAL PLANNING TAX PLANNING BANK ACCOUNTS CREDIT CARDS INSURANCE DEPOSITS STOCKS MUTUAL FUNDS

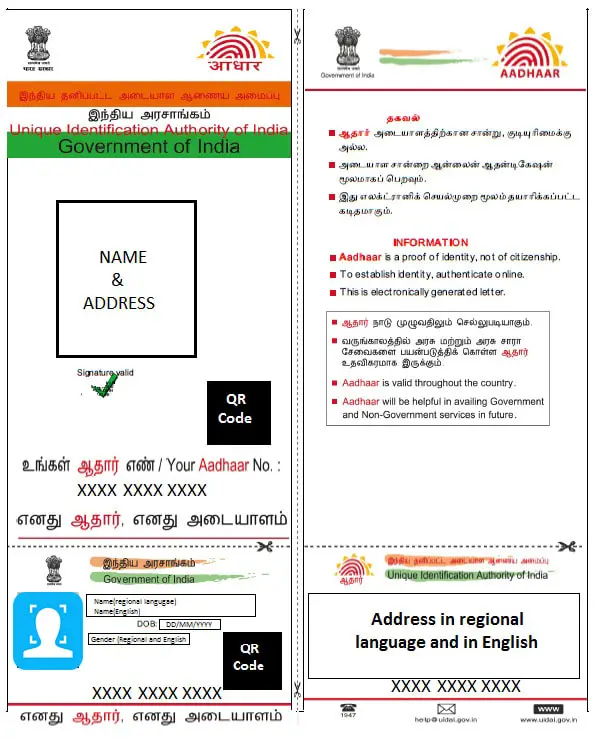

WHAT IS AADHAAR ? How to Enroll ?

What documents needed ?

For all information on Aadhaar , CLICK HERE

What documents needed ?

For all information on Aadhaar , CLICK HERE

LATEST AADHAAR NEWS

AADHAAR IS NO MORE A PROOF FOR DATE OF BIRTH :

Dated 19.01.2024 : Aadhaar is a document that establishes a proof of identity with biometric details and is not having any proof for the date of birth . Hence UIDAI has issued a circular confirming deletion of aadhaar from the list of documents which are used to confirm date of birth ( DOB ) of the individuals .

Ref : UIDAI CIRCULAR DATED 16.01.2024

Dated 19.01.2024 : Aadhaar is a document that establishes a proof of identity with biometric details and is not having any proof for the date of birth . Hence UIDAI has issued a circular confirming deletion of aadhaar from the list of documents which are used to confirm date of birth ( DOB ) of the individuals .

Ref : UIDAI CIRCULAR DATED 16.01.2024

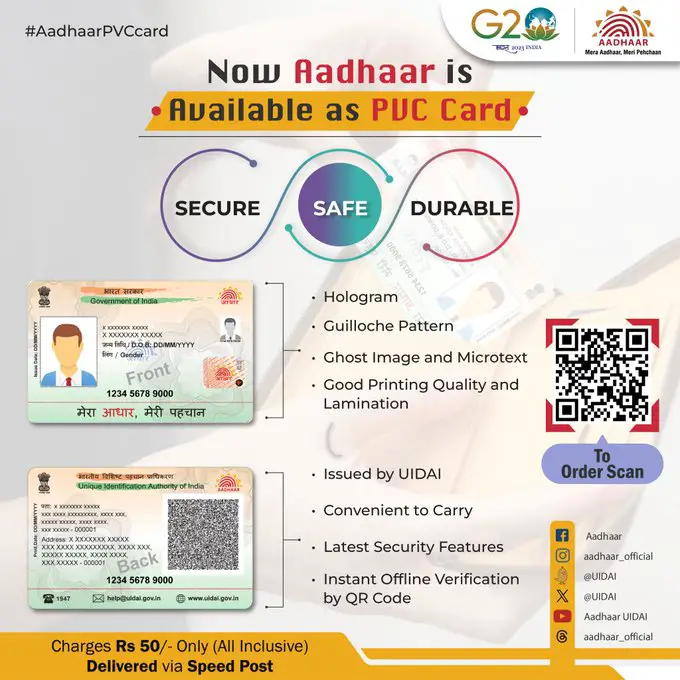

PVC AADHAR CARD FOR NOMINAL PAYMENT

GET WALLET FRIENDLY PVC AADHAAR CARD :

Dated 25.10.2023 : UIDAI is issuing the Aadhaar card printed on PVC card with latest features for a payment of nominal charges of Rs 50 only . ( The charges are not changed since its first issue in 2020 ) . Residents who do not have registered mobile number can also order using Non-Registered /Alternate Mobile Number. .

This card contains security features like Secure QR Code , Hologram , Micro text , Ghost image , Issue Date & Print Date , Guilloche Pattern

Embossed Aadhaar Logo . It comes in the size of a Debit card and can be easily carried in your wallet like credit cards .

HOW TO ORDER PVC AADHAAR CARD ?

1 . Go to UIDAI website by CLICKING HERE

2. Enter your 12 Digit Adhaar number

3. Enter Security code and ask for OTP

4. You will receive OTP on your registered mobile number

5. Once you enter otp , screen will be changed to pre-view Aadhaar card .

6 . If you find information is correct , then make payment of Rs 50 including GST by way of credit / debit cards or Net Banking or UPI .

7. On successful payment, you may receive the card in 5 days through Speedpost ( as per UIDAI )

Dated 25.10.2023 : UIDAI is issuing the Aadhaar card printed on PVC card with latest features for a payment of nominal charges of Rs 50 only . ( The charges are not changed since its first issue in 2020 ) . Residents who do not have registered mobile number can also order using Non-Registered /Alternate Mobile Number. .

This card contains security features like Secure QR Code , Hologram , Micro text , Ghost image , Issue Date & Print Date , Guilloche Pattern

Embossed Aadhaar Logo . It comes in the size of a Debit card and can be easily carried in your wallet like credit cards .

HOW TO ORDER PVC AADHAAR CARD ?

1 . Go to UIDAI website by CLICKING HERE

2. Enter your 12 Digit Adhaar number

3. Enter Security code and ask for OTP

4. You will receive OTP on your registered mobile number

5. Once you enter otp , screen will be changed to pre-view Aadhaar card .

6 . If you find information is correct , then make payment of Rs 50 including GST by way of credit / debit cards or Net Banking or UPI .

7. On successful payment, you may receive the card in 5 days through Speedpost ( as per UIDAI )

DO NOT SHARE AADHAAR DETAILS IN SOCIAL MEDIA : UIDAI

Dated 31.12.2022 : UIDAI has advised public to exercise caution while sharing their Aadhaar details . The Resident Indians can use their Aadhaar number to verify and validate their identity . But while sharing Aadhaar with any trusted entity, the same level of caution may be exercised which one does at the time of sharing Mobile number, Bank account number or any other identity document like Passport, Voter Id, PAN, Ration Card etc .

If one does not wish to share his or her Aadhaar number, UIDAI provides facility for generating Virtual Identifier (VID). One can easily generate VID by visiting the official website or via myaadhaar portal, and use it for authentication in place of the Aadhaar number. This VID can be changed after the end of the calendar day .

One can also utilize the facility of Aadhaar locking as well as biometric locking. If a resident is not likely to use Aadhaar for a period of time, he or she may lock Aadhaar or biometrics for such a time period. The same can be unlocked conveniently and instantly, as and when required.

UIDAI also urges residents not to leave Aadhaar letter / PVC Card, or its copy thereof, unattended. Public are also advised not to share Aadhaar openly in public domain particularly on social media and other public platforms. Aadhaar holders should not disclose Aadhaar OTP to any unauthorized entity and refrain from sharing m-Aahaar PIN with anyone .

To read the UIDAI Press Release on the subject , CLICK HERE

Dated 31.12.2022 : UIDAI has advised public to exercise caution while sharing their Aadhaar details . The Resident Indians can use their Aadhaar number to verify and validate their identity . But while sharing Aadhaar with any trusted entity, the same level of caution may be exercised which one does at the time of sharing Mobile number, Bank account number or any other identity document like Passport, Voter Id, PAN, Ration Card etc .

If one does not wish to share his or her Aadhaar number, UIDAI provides facility for generating Virtual Identifier (VID). One can easily generate VID by visiting the official website or via myaadhaar portal, and use it for authentication in place of the Aadhaar number. This VID can be changed after the end of the calendar day .

One can also utilize the facility of Aadhaar locking as well as biometric locking. If a resident is not likely to use Aadhaar for a period of time, he or she may lock Aadhaar or biometrics for such a time period. The same can be unlocked conveniently and instantly, as and when required.

UIDAI also urges residents not to leave Aadhaar letter / PVC Card, or its copy thereof, unattended. Public are also advised not to share Aadhaar openly in public domain particularly on social media and other public platforms. Aadhaar holders should not disclose Aadhaar OTP to any unauthorized entity and refrain from sharing m-Aahaar PIN with anyone .

To read the UIDAI Press Release on the subject , CLICK HERE

UIDAI WITHDRAWS ADVISORY ON PHOTOCOPES OF AADHAAR & MASKED AADHAAR

Dated 30.05.2022 : Bengaluru Regional office of UIDAI had issued an advisory to general public on 27.05.2022 . In the advisory , UIDAI had asked public not to share photocopies of the Aadhaar with any organization as it is fraught with security risk . Instead they had asked the public to use Masked Aadhaar . Now UIDAI has issued a fresh notification withdrawing their Bengaluru Regional office press release and asked the public to use normal precaution . UIDAI has assured that Aadhaar Identity Authentication ecosystem has provided adequate features for protecting and safeguarding the identity and privacy of the Aadhaar holder . However one can use due diligence while sharing aadhaar details and use masked aadhaar wherever accepted What is Masked Aadhaar and how to download it ?

Mask Aadhaar option allows you to mask your Aadhaar number in your downloaded e-Aadhaar. Masked Aadhaar number implies replacing of first 8 digits of Aadhaar number with some characters like “xxxx-xxxx” while only last 4 digits of the Aadhaar Number are visible.

1. Go to Download Aadhaar page of UIDAI WEBSITE

2. Enter Aadhaar number and captcha .

3. Click on " Do you want a Masked Aadhaar "

4. Enter the OTP received o Registered mobile number

5. Masked aadhaar will be downloaded . It's password protected .

Where to use Masked Aadhaar ?

You may use the Masked Aadhaar as identity proof when travelling in trains, at airports and for hotel bookings. It can also be used to prove your identity wherever required. However, it cannot be used for availing benefits provided under government welfare schemes through DBT.

Dated 30.05.2022 : Bengaluru Regional office of UIDAI had issued an advisory to general public on 27.05.2022 . In the advisory , UIDAI had asked public not to share photocopies of the Aadhaar with any organization as it is fraught with security risk . Instead they had asked the public to use Masked Aadhaar . Now UIDAI has issued a fresh notification withdrawing their Bengaluru Regional office press release and asked the public to use normal precaution . UIDAI has assured that Aadhaar Identity Authentication ecosystem has provided adequate features for protecting and safeguarding the identity and privacy of the Aadhaar holder . However one can use due diligence while sharing aadhaar details and use masked aadhaar wherever accepted What is Masked Aadhaar and how to download it ?

Mask Aadhaar option allows you to mask your Aadhaar number in your downloaded e-Aadhaar. Masked Aadhaar number implies replacing of first 8 digits of Aadhaar number with some characters like “xxxx-xxxx” while only last 4 digits of the Aadhaar Number are visible.

1. Go to Download Aadhaar page of UIDAI WEBSITE

2. Enter Aadhaar number and captcha .

3. Click on " Do you want a Masked Aadhaar "

4. Enter the OTP received o Registered mobile number

5. Masked aadhaar will be downloaded . It's password protected .

Where to use Masked Aadhaar ?

You may use the Masked Aadhaar as identity proof when travelling in trains, at airports and for hotel bookings. It can also be used to prove your identity wherever required. However, it cannot be used for availing benefits provided under government welfare schemes through DBT.

AADHAAR UPDATE STATUS BY PHONE

Dated 25.11.2020 : If you have requested for Aadhaar update like change of address , correction in name , gender , language or date of birth , you may now get the latest status of your update request by phone . Hitherto one has to check it on-line only .

You may dial 1947 , furnish URN Number of Aadhaar and obtain the present position of the request earlier made . When you had submitted update request , you would have got a 14 digit number called URN or Update Request Number. This URN would have also received via SMS to your mobile number .

Dated 25.11.2020 : If you have requested for Aadhaar update like change of address , correction in name , gender , language or date of birth , you may now get the latest status of your update request by phone . Hitherto one has to check it on-line only .

You may dial 1947 , furnish URN Number of Aadhaar and obtain the present position of the request earlier made . When you had submitted update request , you would have got a 14 digit number called URN or Update Request Number. This URN would have also received via SMS to your mobile number .

CHANGE OF ADDRESS MADE EASY

Dated 14.11.2019 : As per Gazette notification dated 13.11.2019 , new current address , other than recorded in the Aadhaar card may be provided to authorities by way of self declaration .

People who migrate to new places on taking up jobs were finding it difficult to avail services like banking as their address in Aadhaar card would be of their permanent residence in their native place and the current address will not match that in Aadhaar card . The rule change will help such persons in availing various services like banking , electricity or any other facility in the new place . With this change , banks and other authorities can record current address and communication will be easier .

The changes in rules have been made by amending the Prevention of Money-laundering (Maintenance of Records) Rules, 2005 .

For Gazette Notification dated 13.11.2019 , CLICK HERE

MISQUOTING OF AADHAAR MAY ATTRACT PENALTY OF RS 10,000 :

Dated 13.11.2019 : While delivering budget speech on 05.07.2019 , Finance minister Ms Nirmala Sitharaman had announced making of PAN and Aadhaar interchangeable and allowing those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN . It was also announced that the Income Tax Department would allot PAN to such person on the basis of Aadhaar after obtaining demographic data from the Unique Identification Authority of India (UIDAI). It was also proposed to provide that a person who has already linked his Aadhaar with his PAN may at his option use Aadhaar in place of PAN under the Act. Now the relevant sections of Income tax Act have been amended and have been amended and penalty of Rs 10,000 levied on misquoting of PAN number has been extended to misquoting of Aadhaar number

Now as per amended section 139A of the Income Tax act ,

" (a )A person who has not been allotted a permanent account number but possesses the Aadhaar number, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number, and such person shall be allotted a permanent account number in such manner as may be prescribed;

(b) A person who has been allotted a permanent account number, and who has intimated his Aadhaar number in accordance with provisions of sub-section (2) of section 139AA, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number.]

Thus PAN number and Aadhaar number have been made interchangeable for the purpose of the provisions of the Income tax act . Hence Aaadhaar number may be used for all transactions that needed quoting of PAN number . ( You may get the list of transactions that need quoting PAN number by clicking here ) This liberalization extends now to the penalty being imposed on misquoting of PAN to Aadhaar also .

Now as per amended section 272B of the Income Tax act , penalty extends to misquoting of aadhaar as under :

" 1. If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees.

(2) If a person who is required to quote his permanent account number 81[or Aadhaar number, as the case may be,] in any document referred to in clause (c) of sub-section (5) of section 139A, or to intimate such number as required by sub-section (5A) or sub-section (5C) of that section, quotes or intimates a number which is false, and which he either knows or believes to be false or does not believe to be true, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees 81[for each such default].

Further penalty of Rs 10,000 is levied on each transaction where Aadhaar number is misquoted . Hence if you quote wrong number , say in two transactions like remitting cash above Rs 10,000 or opening of SB account , you may be levied a penalty of Rs 20,000 . Hence one should be careful while quoting Aadhaar Number while using in lieu of PAN Number

For section 272B and 139A of income tax act , CLICK HERE and type relevant number to view them

Dated 13.11.2019 : While delivering budget speech on 05.07.2019 , Finance minister Ms Nirmala Sitharaman had announced making of PAN and Aadhaar interchangeable and allowing those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN . It was also announced that the Income Tax Department would allot PAN to such person on the basis of Aadhaar after obtaining demographic data from the Unique Identification Authority of India (UIDAI). It was also proposed to provide that a person who has already linked his Aadhaar with his PAN may at his option use Aadhaar in place of PAN under the Act. Now the relevant sections of Income tax Act have been amended and have been amended and penalty of Rs 10,000 levied on misquoting of PAN number has been extended to misquoting of Aadhaar number

Now as per amended section 139A of the Income Tax act ,

" (a )A person who has not been allotted a permanent account number but possesses the Aadhaar number, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number, and such person shall be allotted a permanent account number in such manner as may be prescribed;

(b) A person who has been allotted a permanent account number, and who has intimated his Aadhaar number in accordance with provisions of sub-section (2) of section 139AA, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number.]

Thus PAN number and Aadhaar number have been made interchangeable for the purpose of the provisions of the Income tax act . Hence Aaadhaar number may be used for all transactions that needed quoting of PAN number . ( You may get the list of transactions that need quoting PAN number by clicking here ) This liberalization extends now to the penalty being imposed on misquoting of PAN to Aadhaar also .

Now as per amended section 272B of the Income Tax act , penalty extends to misquoting of aadhaar as under :

" 1. If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees.

(2) If a person who is required to quote his permanent account number 81[or Aadhaar number, as the case may be,] in any document referred to in clause (c) of sub-section (5) of section 139A, or to intimate such number as required by sub-section (5A) or sub-section (5C) of that section, quotes or intimates a number which is false, and which he either knows or believes to be false or does not believe to be true, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees 81[for each such default].

Further penalty of Rs 10,000 is levied on each transaction where Aadhaar number is misquoted . Hence if you quote wrong number , say in two transactions like remitting cash above Rs 10,000 or opening of SB account , you may be levied a penalty of Rs 20,000 . Hence one should be careful while quoting Aadhaar Number while using in lieu of PAN Number

For section 272B and 139A of income tax act , CLICK HERE and type relevant number to view them

RAJYASABHA PASSES BILL MAKING AADHAAR VOLUNTARY :

Dated 10.07.2019 : Rajyasabha on 8th, July 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill was passed by Loksabha on 24th, June 2019 and it replaces an ordinance passed by the Government in March 2019 .

A clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user's consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract penalty up to Rs 1 crore and jail term .

The bill seeks parent's permission while enrolling a child in to Aadhaar ecosystem.

Dated 10.07.2019 : Rajyasabha on 8th, July 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill was passed by Loksabha on 24th, June 2019 and it replaces an ordinance passed by the Government in March 2019 .

A clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user's consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract penalty up to Rs 1 crore and jail term .

The bill seeks parent's permission while enrolling a child in to Aadhaar ecosystem.

PAN AND AADHAAR MADE INTERCHANGEABLE

Dated 08.07.2019 : While delivering budget speech on 05.07.2019 , Finance minister Ms Nirmala Sitharaman announced making of PAN and Aadhaar interchangeable and allowing those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN .

She also made following announcements :

1. Interchangeability of PAN and Aadhaar: It is proposed to provide interchangeability of PAN and Aadhaar to enable a person who does not have PAN but has Aadhaar to use Aadhaar in place of PAN under the Act. The Income Tax Department shall allot PAN to such person on the basis of Aadhaar after obtaining demographic data from the Unique Identification Authority of India (UIDAI). It is also proposed to provide that a person who has already linked his Aadhaar with his PAN may at his option use Aadhaar in place of PAN under the Act.

2. Presently, the Act provides for making PAN invalid if it is not linked with Aadhaar within a notified date. In order to protect past transactions carried out through such PAN, it is proposed to provide that if a person fails to intimate the Aadhaar number, the PAN allotted to such person shall be made inoperative in the prescribed manner after the date notified for the said linking.

3. Government to consider issuing Aadhaar Card for Non-Resident Indians with Indian Passports after their arrival in India without waiting for 180 days.

LINKING AADHAAR MANDATORY TO FILE IT RETURN FOR FY 2018-19 : SUPREME COURT

Dated 08.02.2019 : A two member bench of the Supreme Court reiterated the mandatory linking of Adhaar to PAN card for filing of IT Returns .

As per the latest verdict passed by the bench consisting of judges Mr A K Sikri and Mr Abdul Nazeer in a case filed by the government of India against a judgement of Delhi High court , the bench observed that linkage of PAN with Aadhaar is mandatory fot filing IT Returns for the financial year 2018-19 ( Assessment year 2019-20 ) .

The Supreme Court has already upheld the constitutional validity of Aadhaar in its September 2018 judgement wherein it had upheld the mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department .

It is necessary to produce Aadhaar number while applying for a PAN card now . Ministry of Finance has already extended in July 2018 the time limit for linking Aadhar number to PAN number to 31.03.2019 .

Ina separate news , it is reported that just 230 million PAN cards out of 420 million PAN cards issued have been linked to Aadhaar now . Remaining PAN cards are yet to be linked . Hence all the persons who may have to submit IT Returns for fy 2018-19 may now take steps for linking their Aadhaar to PAN account if already not done .

Source : Various Media reports

HOW TO LINK AADHAAR TO PAN NUMBER , CLICK HERE

Dated 08.02.2019 : A two member bench of the Supreme Court reiterated the mandatory linking of Adhaar to PAN card for filing of IT Returns .

As per the latest verdict passed by the bench consisting of judges Mr A K Sikri and Mr Abdul Nazeer in a case filed by the government of India against a judgement of Delhi High court , the bench observed that linkage of PAN with Aadhaar is mandatory fot filing IT Returns for the financial year 2018-19 ( Assessment year 2019-20 ) .

The Supreme Court has already upheld the constitutional validity of Aadhaar in its September 2018 judgement wherein it had upheld the mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department .

It is necessary to produce Aadhaar number while applying for a PAN card now . Ministry of Finance has already extended in July 2018 the time limit for linking Aadhar number to PAN number to 31.03.2019 .

Ina separate news , it is reported that just 230 million PAN cards out of 420 million PAN cards issued have been linked to Aadhaar now . Remaining PAN cards are yet to be linked . Hence all the persons who may have to submit IT Returns for fy 2018-19 may now take steps for linking their Aadhaar to PAN account if already not done .

Source : Various Media reports

HOW TO LINK AADHAAR TO PAN NUMBER , CLICK HERE

New Updated Article

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

LOKSABHA PASSES BILL MAKING AADHAAR VOLUNTARY :

Dated 06.01.2019 : Loksabha on 4th, Jan 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill complies with Supreme court order passed in September 2018 ( See news dated 26.09.2018 below ) .

The amendment to Telegraph Act passed on Friday makes Aadhaar based identification voluntary for mobile phone services and prohibits storage of adhaar biometric data or number by the mobile service providers in their storage system . Amendment to Prevention to Money Laundering Act makes Aadhaar voluntary for banking services . Further amenments make it clear that the services cannot be denied to a citizen for not providing aadhaar identification .

Further a new clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user's consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract a term up to 10 years of jail .

Source : Various Media Reports

Dated 06.01.2019 : Loksabha on 4th, Jan 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill complies with Supreme court order passed in September 2018 ( See news dated 26.09.2018 below ) .

The amendment to Telegraph Act passed on Friday makes Aadhaar based identification voluntary for mobile phone services and prohibits storage of adhaar biometric data or number by the mobile service providers in their storage system . Amendment to Prevention to Money Laundering Act makes Aadhaar voluntary for banking services . Further amenments make it clear that the services cannot be denied to a citizen for not providing aadhaar identification .

Further a new clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user's consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract a term up to 10 years of jail .

Source : Various Media Reports

DOT STOPS E-KYC VERIFICATION BASED ON AADHAAR FOR MOBILE CONNECTIONS :

Dated 27.10.2018 : The Department of Telecommunications has advised telephone companies to stop Aadhaar based digital verification of E-KYC for existing / new mobile connections , in line with Supreme Court order dated 26.09.2018 . As per notification , telephone companies will not be able to use Aadhaaar E-KYC service of UIDAI . Now the telephone companies / mobile companies like Jio , Airtel , Vodafone have to return to the old system of verification of KYC using traditional identification documents and physical verification of customers . Telephone operators have been given time up to 5th, November , 2018 for compliance of notification .

Source : Various Media Reports

Dated 27.10.2018 : The Department of Telecommunications has advised telephone companies to stop Aadhaar based digital verification of E-KYC for existing / new mobile connections , in line with Supreme Court order dated 26.09.2018 . As per notification , telephone companies will not be able to use Aadhaaar E-KYC service of UIDAI . Now the telephone companies / mobile companies like Jio , Airtel , Vodafone have to return to the old system of verification of KYC using traditional identification documents and physical verification of customers . Telephone operators have been given time up to 5th, November , 2018 for compliance of notification .

Source : Various Media Reports

SUPREME COURT UPHOLDS CONSTITUTIONAL VALIDITY OF AADHAAR

Dated 26.09.2018 : Supreme Court today upheld the constitutional validity Of Aadhaar Act passed as money bill . However Justice Mr Chandrachud expressed his reservation about passing the bill as money bill to bypass Rajyasabha . But section 57 of Aadhaar Act , which allows private enteties to verify aadhaar , has been struck down by the Supreme Court . Similarly section 33 ( 2 ) that allows UIDAI to share data with authorised officers in the interest of national security is deleted .

It also upheld mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department . One is not required to produce Aadhaar for appearing in NEET , UGC and CBSE examinations. However Supreme court says it is not mandatory for opening Bank accounts , having mobile phones or school admissions. Further it made clear that private entities cannot demand aadhaar .

It also made clear that children cannot be denied any benefit including school admission for want of Adhaar .

Supreme Court asked the government to bring a robust law for protection of data as soon as possible . It also asked the centre to provide more security measures and less time of storage for data collected under Aadhaar .

The five bench division of Supreme Court is giving its decision on 27 petitions submitted to them challenging various aspect of Aadhaar , bio-metric identification system promoted by Government of India .

Dated 26.09.2018 : Supreme Court today upheld the constitutional validity Of Aadhaar Act passed as money bill . However Justice Mr Chandrachud expressed his reservation about passing the bill as money bill to bypass Rajyasabha . But section 57 of Aadhaar Act , which allows private enteties to verify aadhaar , has been struck down by the Supreme Court . Similarly section 33 ( 2 ) that allows UIDAI to share data with authorised officers in the interest of national security is deleted .

It also upheld mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department . One is not required to produce Aadhaar for appearing in NEET , UGC and CBSE examinations. However Supreme court says it is not mandatory for opening Bank accounts , having mobile phones or school admissions. Further it made clear that private entities cannot demand aadhaar .

It also made clear that children cannot be denied any benefit including school admission for want of Adhaar .

Supreme Court asked the government to bring a robust law for protection of data as soon as possible . It also asked the centre to provide more security measures and less time of storage for data collected under Aadhaar .

The five bench division of Supreme Court is giving its decision on 27 petitions submitted to them challenging various aspect of Aadhaar , bio-metric identification system promoted by Government of India .

INCOME TAX RETURN ITR-1 , ITR 2 , ITR 3 AND ITR4 CAN NOW BE SUBMITTED ON LINE FOR FY 18-19

LAST DATE FOR SUBMISSION IS 31.07.2019 FOR DETAILS CLICK HERE

LAST DATE FOR SUBMISSION IS 31.07.2019 FOR DETAILS CLICK HERE

FOR DETAILS ON AAYKAR SETHU ,

NEW MOBILE APPLICATION FROM INCOME TAX DEPT , CLICK HERE

CLICK BELOW TO READ ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

NEW MOBILE APPLICATION FROM INCOME TAX DEPT , CLICK HERE

CLICK BELOW TO READ ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

FACE RECOGNITION TO BE ADDITIONAL AUTHENTICATION FOR AADHAAR

Dated 24.08.2018 : UIDAI has announced phased roll out of Face Recognition as additional means of Aadhaar along with the existing ways of authentication . It is reported that it will be initially mandated to telecom service providers for issue of SIMs for mobiles from September 15 , 2018 . The measure will be extended to other services like banks , public distribution services later on .

With this measure , live face photo capture and matching it with photo provided in e-KYC document will be mandatory in the cases where Aadhaar is taken as identification for issuing of SIM card . The measure is intended to curb possibility of finger print spoofing or cloning . However the face recognition or iris recognition will be additional with existing finger print verification .

The instruction of UIDAI will only apply to those cases where Aadhaar is taken as basis for issuance of SIM and not for other cases where different ID like Voter's ID , Passport etc is obtained without Aadhaar .

For the news item from Asian Age dated 19.08.2018 CLICK HERE

Dated 24.08.2018 : UIDAI has announced phased roll out of Face Recognition as additional means of Aadhaar along with the existing ways of authentication . It is reported that it will be initially mandated to telecom service providers for issue of SIMs for mobiles from September 15 , 2018 . The measure will be extended to other services like banks , public distribution services later on .

With this measure , live face photo capture and matching it with photo provided in e-KYC document will be mandatory in the cases where Aadhaar is taken as identification for issuing of SIM card . The measure is intended to curb possibility of finger print spoofing or cloning . However the face recognition or iris recognition will be additional with existing finger print verification .

The instruction of UIDAI will only apply to those cases where Aadhaar is taken as basis for issuance of SIM and not for other cases where different ID like Voter's ID , Passport etc is obtained without Aadhaar .

For the news item from Asian Age dated 19.08.2018 CLICK HERE

DO NOT SHARE YOUR AADHAAR NUMBER ON INTERNET / SOCIAL MEDIA : UIDAI WARNS

Dated 02.08.2018 : UIDAI has warned general public , through a press notification , to refrain from making their Aadhaar number on internet or social media and posing challenges to others . UIDAI has advised public not to share personal details or aadhaar number to third parties or in public .

The advisory from UIDAI has come in the wake of news paper reports that TRAI chief Mr R.S.Sharma had challenged hackers , by revealing his Aadhaar number , to cause harm to him by knowing his aadhaar number . While few hackers were successful in knowing his personal information like address , telephone number etc , Mr Sharma had dismissed the claim and had said that no harm was done to him by hacking . However UIDAI has pooh-poohed the claim put up by some hackers and said that the so called "hacked information " on Mr R.S .Sharma was already available in public domains . UIDAI has reiterated that data on aadhaar data base is safe from hacking . ( For press note date 29.07.2018 , CLICK HERE

Now UIDAI has advised that such activities are uncalled for , as any hacking is against the law . Further the authority is repeatedly requesting the public not to share their aadhaar numbers in public to unauthorised entities unless it is needed by law . It also warns public that sharing of personally sensitive information like bank number , PAN number etc in public may make the personal vulnerable for misuse .

For press release of UIDAI dated 31.07.2018 on this regard . CLICK HERE

Dated 02.08.2018 : UIDAI has warned general public , through a press notification , to refrain from making their Aadhaar number on internet or social media and posing challenges to others . UIDAI has advised public not to share personal details or aadhaar number to third parties or in public .

The advisory from UIDAI has come in the wake of news paper reports that TRAI chief Mr R.S.Sharma had challenged hackers , by revealing his Aadhaar number , to cause harm to him by knowing his aadhaar number . While few hackers were successful in knowing his personal information like address , telephone number etc , Mr Sharma had dismissed the claim and had said that no harm was done to him by hacking . However UIDAI has pooh-poohed the claim put up by some hackers and said that the so called "hacked information " on Mr R.S .Sharma was already available in public domains . UIDAI has reiterated that data on aadhaar data base is safe from hacking . ( For press note date 29.07.2018 , CLICK HERE

Now UIDAI has advised that such activities are uncalled for , as any hacking is against the law . Further the authority is repeatedly requesting the public not to share their aadhaar numbers in public to unauthorised entities unless it is needed by law . It also warns public that sharing of personally sensitive information like bank number , PAN number etc in public may make the personal vulnerable for misuse .

For press release of UIDAI dated 31.07.2018 on this regard . CLICK HERE

VIRTUAL ID SYSTEM FOR AADHAAR IS NOW OPERATIONAL :

Dated 02.07.2018 :

Newspapers reported that UIDAI has announced that Virtual ID system where service providers accept VIRTUAL ID in lieu of Aadhaar numbers is operational now . However banks which authenticate aadhaar information have time up to 31, August 2018 to deploy the tool to verify aadhaar using virtual ID system . Hence virtual ID system will be available at present only from those agencies who have upgraded their system to verify virtual ID .

In January 2018 , UIDAI had announced that it would come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per this initiative , Aadhaar ID holder need not share his / her Aadhaar number for authentication of his /her identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Now the virtual ID announced in January 2018 is available on UIDAI website where one can go and get a virtual ID for his /her aadhaar number by entering Aadhaar number . UIDAI will send OTP for the transaction to your registered mobile number . .On entering OTP , you may go for generating VID option and you will receive 16 digit virtual ID number for your Aadhaar on your registered mobile number now . The virtual ID can be retrieved by Aadhaar holder only and he/ she can revoke / change the VID anytime .

It is hoped that all service providers will start accepting virtual ID in place of aadhaar number at the earliest . As an disincentive , UID will charge Rs 0.20 per transaction for the telecom companies and e-sign agencies , who are classified as local AUA ( Authentication Use Agency ) , if they have not implemented Virtual ID system .

For generating virtual ID for your Aadhaar , CLICK HERE

Dated 02.07.2018 :

Newspapers reported that UIDAI has announced that Virtual ID system where service providers accept VIRTUAL ID in lieu of Aadhaar numbers is operational now . However banks which authenticate aadhaar information have time up to 31, August 2018 to deploy the tool to verify aadhaar using virtual ID system . Hence virtual ID system will be available at present only from those agencies who have upgraded their system to verify virtual ID .

In January 2018 , UIDAI had announced that it would come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per this initiative , Aadhaar ID holder need not share his / her Aadhaar number for authentication of his /her identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Now the virtual ID announced in January 2018 is available on UIDAI website where one can go and get a virtual ID for his /her aadhaar number by entering Aadhaar number . UIDAI will send OTP for the transaction to your registered mobile number . .On entering OTP , you may go for generating VID option and you will receive 16 digit virtual ID number for your Aadhaar on your registered mobile number now . The virtual ID can be retrieved by Aadhaar holder only and he/ she can revoke / change the VID anytime .

It is hoped that all service providers will start accepting virtual ID in place of aadhaar number at the earliest . As an disincentive , UID will charge Rs 0.20 per transaction for the telecom companies and e-sign agencies , who are classified as local AUA ( Authentication Use Agency ) , if they have not implemented Virtual ID system .

For generating virtual ID for your Aadhaar , CLICK HERE

AADHAAR DATA NOT FOR CRIMINAL PROBES :

Dated 23.06.2018 :

Newspapers reported that UIDAI has refused to accept a proposal seeking usage of Aadhaar data for criminal probes . The proposal had originated from Mr Ish kumar , chief of National Crimes Record Bureau ( NCRB ) .

UIDAI has clarified that usage of Aadhaar data for criminal investigations is not possible as Aadhaar Act does not permit the same . As per section 29 of Aadhaar Act , biometric data collected by UIDAI can be used only for the purpose of generating aadhaar and authentication of identity of aadhaar holders and cannot be used for any other purpose . However under section 33 of Aadhaar Act , a limited exception is available for usage of biometric details in cases involving national security , subject to pre-authorization by an oversight committee headed by a cabinet secretary .

UIDAI has further clarified tat it had never shared aadhaar data with police or any other investigating agency in the past .

To read original Aadhaar act , CLICK HERE

Dated 23.06.2018 :

Newspapers reported that UIDAI has refused to accept a proposal seeking usage of Aadhaar data for criminal probes . The proposal had originated from Mr Ish kumar , chief of National Crimes Record Bureau ( NCRB ) .

UIDAI has clarified that usage of Aadhaar data for criminal investigations is not possible as Aadhaar Act does not permit the same . As per section 29 of Aadhaar Act , biometric data collected by UIDAI can be used only for the purpose of generating aadhaar and authentication of identity of aadhaar holders and cannot be used for any other purpose . However under section 33 of Aadhaar Act , a limited exception is available for usage of biometric details in cases involving national security , subject to pre-authorization by an oversight committee headed by a cabinet secretary .

UIDAI has further clarified tat it had never shared aadhaar data with police or any other investigating agency in the past .

To read original Aadhaar act , CLICK HERE

DEADLINE EXTENDED FOR VIRTUAL ID SYSTEM FOR AADHAAR :

Dated 02.06.2018 :

Newspapers reported that UIDAI has extended deadline to July 1 , 2018 for service providers like banks , mobile companies to fully deploy Virtual ID system and to accept VIRTUAL ID in lieu of Aadhaar numbers . As per earlier announcement , service providers had to implement the system by 1, June 2018 .

Dated 02.06.2018 :

Newspapers reported that UIDAI has extended deadline to July 1 , 2018 for service providers like banks , mobile companies to fully deploy Virtual ID system and to accept VIRTUAL ID in lieu of Aadhaar numbers . As per earlier announcement , service providers had to implement the system by 1, June 2018 .

BIO-METRIC VERIFICATION RELAXED FOR OLD AGED AND INJURED FOR OPENING BANK ACCOUNTS

21.05.2018 : Finance Ministry , Government of India , through a gazette notification on 16.05.2018 , relaxed rules for bio-metric verification of the identity for opening bank accounts in case the persons are unable to offer bio metric verification due to injury , illness or infirmity due to old age or otherwise . In such cases banks will not be able to verify the identity on the basis of aadhaar card they hold . Such persons can now provide alternate proofs of identity to open bank accounts and to continue banking operations without difficulty .

For Gazette Notification , CLICK HERE

AADHAAR NOT MANDATORY FOR MOBILE :

Dated 02.05.2018 : Newspapers reported that Government of India has asked telecom companies in India to accept alternative methods of identification from existing / new telecom subscribers instead of insisting on linking of Aadhaar number . Alternate documents that can be accepted for identification include voter's ID , Passport , Driving Licence etc .

It is reported that Telecom Secretary Aruna Sundarrajan informed journalists that necessary instructions have already been issued to all telecom companies in this regard . The companies have been directed not to deny SIM number for those who do not have / provide aadhaar numbers . It is hoped that nagging tele -calls and unsolicited messages from telecom companies urging linking of aadhaar would stop now .

The move from the government emanates from recent proceeding in Supreme court where in it was clarified that court had not asked for mandatory authentication of telecom users with Aadhaar numbers .

Dated 02.05.2018 : Newspapers reported that Government of India has asked telecom companies in India to accept alternative methods of identification from existing / new telecom subscribers instead of insisting on linking of Aadhaar number . Alternate documents that can be accepted for identification include voter's ID , Passport , Driving Licence etc .

It is reported that Telecom Secretary Aruna Sundarrajan informed journalists that necessary instructions have already been issued to all telecom companies in this regard . The companies have been directed not to deny SIM number for those who do not have / provide aadhaar numbers . It is hoped that nagging tele -calls and unsolicited messages from telecom companies urging linking of aadhaar would stop now .

The move from the government emanates from recent proceeding in Supreme court where in it was clarified that court had not asked for mandatory authentication of telecom users with Aadhaar numbers .

NOW YOU CAN GENERATE VIRTUAL ID FOR AADHAAR :

Dated 04.04.2018 : We refer to UIDAI announcement made in January 2018 that it would come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per this initiative , Aadhaar ID holder need not share his / her Aadhaar number for authentication of his /her identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Now the virtual ID announced in January 2018 is available on UIDAI website where one can go and get a virtual ID for his /her aadhaar number by entering Aadhaar number . UIDAI will send OTP for the transaction to your registered mobile number . .On entering OTP , you may go for generating VID option and you will receive 16 digit virtual ID number for your Aadhaar on your registered mobile number now . The virtual ID can be retrieved by Aadhaar holder only and he/ she can revoke / change the VID anytime .

It is hoped that service providers will start accepting virtual ID in place of aadhaar number .

For generating virtual ID for your Aadhaar , CLICK HERE

Dated 04.04.2018 : We refer to UIDAI announcement made in January 2018 that it would come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per this initiative , Aadhaar ID holder need not share his / her Aadhaar number for authentication of his /her identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Now the virtual ID announced in January 2018 is available on UIDAI website where one can go and get a virtual ID for his /her aadhaar number by entering Aadhaar number . UIDAI will send OTP for the transaction to your registered mobile number . .On entering OTP , you may go for generating VID option and you will receive 16 digit virtual ID number for your Aadhaar on your registered mobile number now . The virtual ID can be retrieved by Aadhaar holder only and he/ she can revoke / change the VID anytime .

It is hoped that service providers will start accepting virtual ID in place of aadhaar number .

For generating virtual ID for your Aadhaar , CLICK HERE

GOVERNMENT : DEADLINE FOR LINKING AADHAAR TO GOVERNMENT SCHEMES EXTENDED TILL 30.06.2018

Dated 29.03.2018 : Newspapers reported that Government of India has extended deadline for linking Aadhaar to various social benefit schemes under section 7 of Aadhaar ( Targeted Delivery of Financial subsidies , Benefits and Services ) act 2016 to 30.06.2018 from existing 31.03.2018 . The extension covers various social benefit schemes including LPG to poor women , MGNREGA , Kerosene and Fertilizer subsidy , scholarships etc .

Dated 29.03.2018 : Newspapers reported that Government of India has extended deadline for linking Aadhaar to various social benefit schemes under section 7 of Aadhaar ( Targeted Delivery of Financial subsidies , Benefits and Services ) act 2016 to 30.06.2018 from existing 31.03.2018 . The extension covers various social benefit schemes including LPG to poor women , MGNREGA , Kerosene and Fertilizer subsidy , scholarships etc .

SUPREME COURT EXTENDS DEADLINE FOR LINKING AADHAAR TO BANK ACCOUNTS & MOBILES

Dated 13.03.2018 : Today , Five- Judge constitutional bench of Supreme Court ordered extension of deadline for linking Aadhaar to bank accounts , Mobile phones , tatkal passports etc from existing 31.03.2018 till it gives verdict on validity of Aadhaar . .However , deadline for linking aadhaar to various government schemes like subsidies will continue to be 31.03.2018 .

It is reported that deadline for linking services provided by government is not extended as it comes under section 7 of Aadhaar act while all other were effected through executive actions .

The five judge bench is headed by the chief justice Deepak Mehra and other members include Justices A.K Sikri , A.M .Khanwilkar , D.Y.Chandrachud and Ashok Bhushan . ( Source : Various newspapers and TV channels Report )

Dated 13.03.2018 : Today , Five- Judge constitutional bench of Supreme Court ordered extension of deadline for linking Aadhaar to bank accounts , Mobile phones , tatkal passports etc from existing 31.03.2018 till it gives verdict on validity of Aadhaar . .However , deadline for linking aadhaar to various government schemes like subsidies will continue to be 31.03.2018 .

It is reported that deadline for linking services provided by government is not extended as it comes under section 7 of Aadhaar act while all other were effected through executive actions .

The five judge bench is headed by the chief justice Deepak Mehra and other members include Justices A.K Sikri , A.M .Khanwilkar , D.Y.Chandrachud and Ashok Bhushan . ( Source : Various newspapers and TV channels Report )

BETTER TO AVOID LAMINATION OF AADHAAR CARDS :

Dated 12.03.2018 : UIDAI has clarified that paper Aadhaar card or mAadhaar downloaded on your mobile is a perfectly valid document and hence lamination of your aadhaar card is unnecessary . Lamination may cost you between Rs 50 to Rs 300 . Further you are handing over your card details to third party vendor which is not desirable . Sometimes laminated card may not recognize QR of your aadhaar properly . Hence UIDAI has advised public not to share personal details or aadhaar number to third parties for lamination purpose or getting it printed on a plastic card also .

If your aadhaar card is lost , you can go to their website https://eaadhaar.uidai.gov.in/#/ . You may download your aadhaar letter with card . You may print the card either in black & white or colour on a plain paper . Both are valid .

For press release of UIDAI on this regard . CLICK HERE

Dated 12.03.2018 : UIDAI has clarified that paper Aadhaar card or mAadhaar downloaded on your mobile is a perfectly valid document and hence lamination of your aadhaar card is unnecessary . Lamination may cost you between Rs 50 to Rs 300 . Further you are handing over your card details to third party vendor which is not desirable . Sometimes laminated card may not recognize QR of your aadhaar properly . Hence UIDAI has advised public not to share personal details or aadhaar number to third parties for lamination purpose or getting it printed on a plastic card also .

If your aadhaar card is lost , you can go to their website https://eaadhaar.uidai.gov.in/#/ . You may download your aadhaar letter with card . You may print the card either in black & white or colour on a plain paper . Both are valid .

For press release of UIDAI on this regard . CLICK HERE

YOU CAN LOCK / UNLOCK YOUR BIOMETRICS OF AADHAAR :

Dated 08.03.2018 : You would have provided your biometric verification of your aadhaar number to mobile companies , banks etc to enable to verify your identification . However possession of your biometrics details with third parties may help them to carry out transactions later without your knowledge . For example take the case of Airtel where identification provided to Airtel , the mobile company was used for opening of an account with Airtel Payment Bank without the knowledge of customers

In order to protect yourself from unauthorized use of your biometrics , you may lock your biometric details of your Aadhaar like finger prints , iris etc so that third parties would not be able to do aadhaar verification without your knowledge . Whenever you want to provide your aadhaar identification , you may unlock the application . Unlocking will be temporary for just 10 minutes , after which the application gets locked .

For locking / unlocking of biometrics of your Aadhaar , visit UIDAI website BY CLICKING HERE .

To avail the facility , your mobile number should be registered with UIDAI . The facility is available only for Indian Residents .

Dated 08.03.2018 : You would have provided your biometric verification of your aadhaar number to mobile companies , banks etc to enable to verify your identification . However possession of your biometrics details with third parties may help them to carry out transactions later without your knowledge . For example take the case of Airtel where identification provided to Airtel , the mobile company was used for opening of an account with Airtel Payment Bank without the knowledge of customers

In order to protect yourself from unauthorized use of your biometrics , you may lock your biometric details of your Aadhaar like finger prints , iris etc so that third parties would not be able to do aadhaar verification without your knowledge . Whenever you want to provide your aadhaar identification , you may unlock the application . Unlocking will be temporary for just 10 minutes , after which the application gets locked .

For locking / unlocking of biometrics of your Aadhaar , visit UIDAI website BY CLICKING HERE .

To avail the facility , your mobile number should be registered with UIDAI . The facility is available only for Indian Residents .

BLUE AADHAAR FOR CHILDREN

Dated 03.03.2018 : UIDAI has introduced ' Baal Aadhar ' for children below 5 years . The aadhaar card issued will be of blue colour . To enroll , parent has to go to enrollment center along with the child with the following documents .

1. Birth certificate of the child to be enrolled .

2. Aadhaar card of any one of the parents .

The Baal AAdhaar will not include biometric information of the child like fingerprint or iris . However child is to be taken to Aadhaar center on attaining 5 years of age to get mandatory update of biometric information of the child . Further one more biometric update is required when child attains 15 years of age .

For enrolling children , ID issued by a recognized school can also be used as valid ID along with other documents . For enrolling children above 5 years up to 18 years , child has to go along with one of the parents , submit application with necessary documents . Photo and biometric will be taken for the child and card will be issued .

You may also get details on UIDAI TWITTER SITE by CLICKING HERE

Dated 03.03.2018 : UIDAI has introduced ' Baal Aadhar ' for children below 5 years . The aadhaar card issued will be of blue colour . To enroll , parent has to go to enrollment center along with the child with the following documents .

1. Birth certificate of the child to be enrolled .

2. Aadhaar card of any one of the parents .

The Baal AAdhaar will not include biometric information of the child like fingerprint or iris . However child is to be taken to Aadhaar center on attaining 5 years of age to get mandatory update of biometric information of the child . Further one more biometric update is required when child attains 15 years of age .

For enrolling children , ID issued by a recognized school can also be used as valid ID along with other documents . For enrolling children above 5 years up to 18 years , child has to go along with one of the parents , submit application with necessary documents . Photo and biometric will be taken for the child and card will be issued .

You may also get details on UIDAI TWITTER SITE by CLICKING HERE

FACE RECOGNITION AS A TOOL FOR AADHAAR AUTHENTICATION

Dated 16.01.2018 : UIDAI announced that face recognition would be added as a tool for Aadhaar authentication along with existing other methods like Finger prints , OTP and Iris . However face recognition will be allowed in " Fusion " mode along with , any one of the other modes like Finger print or iris or one time password . The new initiative will be activated from July 1 , 2018 .

One need not go afresh to Aadhaar center for uploading photos , as UIDAI has got photos of all those enrolled for Aadhaar programme . The new initiative is expected to help those who are finding it difficult to be recognized by finger prints or iris . Registration of mobile number linked to Aadhaar is a must for utilizing the face recognition option .

Dated 16.01.2018 : UIDAI announced that face recognition would be added as a tool for Aadhaar authentication along with existing other methods like Finger prints , OTP and Iris . However face recognition will be allowed in " Fusion " mode along with , any one of the other modes like Finger print or iris or one time password . The new initiative will be activated from July 1 , 2018 .

One need not go afresh to Aadhaar center for uploading photos , as UIDAI has got photos of all those enrolled for Aadhaar programme . The new initiative is expected to help those who are finding it difficult to be recognized by finger prints or iris . Registration of mobile number linked to Aadhaar is a must for utilizing the face recognition option .

VIRTUAL ID AND LIMITED KYC FOR AADHAAR :

Dated 12.01.2018 : In the wake of recent reports of Data leak of Aadhaar by Newspaper Tribune , Misuse of Aadhaar Info for opening unauthorized bank accounts etc and privacy concerns raised in Supreme court , UIDAI has come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per the initiative to be introduced in March 2018 , Aadhaar ID holder need not share his Aadhaar number for authentication of his identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Further Authorized users of Aadhaar will be categorized as Global AUAs and Local AUASs ( Authorized user agency ) . While Global AUAs will have access to full KYC with Aadhaar number , local AUAs will be having limited access to KYC and they will not be allowed to store Aadhaar numbers in their system . For the purpose UIDAI will allot UID tokens to these agencies . It is expected that Global AUAs are those agencies like Banks , post office , PDA etc who are mandated by law to collect Aadhaar details . Others who use Aadhaar for identification of persons may be treated as local AUA s

With the introduction of Virtual ID , Limited KYC and UID tokens , UIDAI hopes to address the concerns of privacy and data breach in the coming days . We have to wait and see how the new system will strengthen the trust of Indian citizens in Adhaar .

The software application is expected be ready by 1st March , 2018 and all implementing agencies are advised to roll out the scheme before June 2018 .

For Circular on the subject by Government of India , CLICK HERE

Dated 12.01.2018 : In the wake of recent reports of Data leak of Aadhaar by Newspaper Tribune , Misuse of Aadhaar Info for opening unauthorized bank accounts etc and privacy concerns raised in Supreme court , UIDAI has come out with an additional security layer called " Virtual ID " ( VID ) for Aadhaar number . As per the initiative to be introduced in March 2018 , Aadhaar ID holder need not share his Aadhaar number for authentication of his identity . Instead one can generate a temporary " Virtual ID " ( VID ) from the system which would be mapped to his Aadhaar Number . The agencies using Aadhaar data for authenticating information can utilize Virtual ID instead of Aadhaar number for limited verification purpose . Aadhaar holder can revoke an virtual ID any time and obtain a fresh replacement .

Further Authorized users of Aadhaar will be categorized as Global AUAs and Local AUASs ( Authorized user agency ) . While Global AUAs will have access to full KYC with Aadhaar number , local AUAs will be having limited access to KYC and they will not be allowed to store Aadhaar numbers in their system . For the purpose UIDAI will allot UID tokens to these agencies . It is expected that Global AUAs are those agencies like Banks , post office , PDA etc who are mandated by law to collect Aadhaar details . Others who use Aadhaar for identification of persons may be treated as local AUA s

With the introduction of Virtual ID , Limited KYC and UID tokens , UIDAI hopes to address the concerns of privacy and data breach in the coming days . We have to wait and see how the new system will strengthen the trust of Indian citizens in Adhaar .

The software application is expected be ready by 1st March , 2018 and all implementing agencies are advised to roll out the scheme before June 2018 .

For Circular on the subject by Government of India , CLICK HERE

UIDAI SUSPENDS AIRTEL , AIRTEL BANK'S LICENCE TO E-KYC LICENCE TO VERIFY AADHAAR

Dated 18.12.2017 : It is reported that Unique Identification Authority of India ( UIDAI ) has temporarily barred mobile operator Airtel and its banking wing Airtel Payment Bank from conducting Aadhaar based SIM verification of mobile customers using eKYC process and eKYC of Payment bank's customers . The UIDAI notification comes with immediate effect .

It is alleged that the mobile operator opened the bank accounts in Airtel Payment Bank using KYC of its customers without informing them and without their consent . It is also alleged that LPG subsidies of some customers were routed to such accounts opened without their knowledge .

It is reported that Price Water House Cooper , an audit firm to conduct audit of the two entities to ascertain whether they are complying with provisions of Aadhaar Act .

Dated 18.12.2017 : It is reported that Unique Identification Authority of India ( UIDAI ) has temporarily barred mobile operator Airtel and its banking wing Airtel Payment Bank from conducting Aadhaar based SIM verification of mobile customers using eKYC process and eKYC of Payment bank's customers . The UIDAI notification comes with immediate effect .

It is alleged that the mobile operator opened the bank accounts in Airtel Payment Bank using KYC of its customers without informing them and without their consent . It is also alleged that LPG subsidies of some customers were routed to such accounts opened without their knowledge .

It is reported that Price Water House Cooper , an audit firm to conduct audit of the two entities to ascertain whether they are complying with provisions of Aadhaar Act .

SUPREME COURT EXTENDS DEADLINE FOR LINKING AADHAAR OF ALL SCHEMES 31.03.2018

Dated 15.12.2017 : Today , Five- Judge constitutional bench of Supreme Court ordered , agreeing on the suggestion of Government of India , to extend deadline for linking Aadhaar to bank accounts , PAN , Mobile phones and all government schemes . However , as per order one need to show proof of applying for Aadhaar in case of fresh account is to be opened with a bank . The order is interim one and will last till the Supreme court decides on various petitions challenging the validity of Aadhaar and other related issues . The five judge bench is headed by the chief justice Deepak Mehra and other members include Justices A.K Sikri , A.M .Khanwilkar , D.Y.Chandrachud and Ashok Bhushan . The court advised that hearing will start on December 17, 2017 ( Source : Various newspapers and TV channels Report )

Already Government of India had extended on 12.12.2017 deadline for linking Aadhaar and PAN number or Form 60 for financial products with various reporting authorities is extended up to 31.03.2018 or 6 months from the date of commencement of relationship whichever is later . Earlier the deadline was 31.12.2017 and was applicable to Bank accounts , credit cards , loans , insurance , mutual funds , equities , small savings accounts like post office accounts , National savings scheme ( NSC ) , Kisan Vikas Patra ( KVP ) etc .

Dated 15.12.2017 : Today , Five- Judge constitutional bench of Supreme Court ordered , agreeing on the suggestion of Government of India , to extend deadline for linking Aadhaar to bank accounts , PAN , Mobile phones and all government schemes . However , as per order one need to show proof of applying for Aadhaar in case of fresh account is to be opened with a bank . The order is interim one and will last till the Supreme court decides on various petitions challenging the validity of Aadhaar and other related issues . The five judge bench is headed by the chief justice Deepak Mehra and other members include Justices A.K Sikri , A.M .Khanwilkar , D.Y.Chandrachud and Ashok Bhushan . The court advised that hearing will start on December 17, 2017 ( Source : Various newspapers and TV channels Report )

Already Government of India had extended on 12.12.2017 deadline for linking Aadhaar and PAN number or Form 60 for financial products with various reporting authorities is extended up to 31.03.2018 or 6 months from the date of commencement of relationship whichever is later . Earlier the deadline was 31.12.2017 and was applicable to Bank accounts , credit cards , loans , insurance , mutual funds , equities , small savings accounts like post office accounts , National savings scheme ( NSC ) , Kisan Vikas Patra ( KVP ) etc .

DEADLINE FOR LINKING AADHAAR TO VARIOUS FINANCIAL PRODUCTS EXTENDED UP TO 31.03.2018

Dated 13.12.2017 : As per press release issued by Ministry of Finance , Government of India , deadline for linking Aadhaar and PAN number or Form 60 for financial products with various reporting authorities is extended up to 31.03.2018 or 6 months from the date of commencement of relationship whichever is later . Earlier the deadline was 31.12.2017 and was applicable to Bank accounts , credit cards , loans , insurance , mutual funds , equities , small savings accounts like post office accounts , National savings scheme ( NSC ) , Kisan Vikas Patra ( KVP ) etc .

For Press Release of Ministry of Finance , CLICK HERE

Dated 13.12.2017 : As per press release issued by Ministry of Finance , Government of India , deadline for linking Aadhaar and PAN number or Form 60 for financial products with various reporting authorities is extended up to 31.03.2018 or 6 months from the date of commencement of relationship whichever is later . Earlier the deadline was 31.12.2017 and was applicable to Bank accounts , credit cards , loans , insurance , mutual funds , equities , small savings accounts like post office accounts , National savings scheme ( NSC ) , Kisan Vikas Patra ( KVP ) etc .

For Press Release of Ministry of Finance , CLICK HERE

DEADLINE FOR LINKING AADHAAR TO VARIOUS FINANCIAL / NON- FINANCIAL ACCOUNTS

Dated 06.12.2017 : Following are the deadlines set by the government for linking Aadhaar with various financial / non- financial products / benefits and services .

1. 31st December 2017 : For linking Aadhaar with PAN

2. 31st December 2017 : For linking Aadhaar with Bank Accounts / Insurance Accounts / Mutual Funds / Post Office Accounts

3. 31st December 2017 : For linking Aadhaar with Social Security Benefits like LPG / Pension / Scholarships .

4. 06th February 2018 : For linking Aadhaar with Mobile Numbers ( SIM ) .

As per government instructions , failure to link Aadhaar with in deadline may result in Non- processing of IT returns in case of PAN , blocking of accounts in case of banks and post office accounts. One may not be able to operate Mutual Funds and access insurance policies if fails to link Aadhaar with in deadline . Mobile phone numbers may be deactivated in case of mobile phones .

Many banks and Life insurance corporation of India have provided facilities on their website to link Aadhaar , where one can do the linking at the comfort of the house . In case of many other service providers , one has to physically visit their offices / branches to get the linking done .

One can go to the website of his / her bank , insurance company , mutual fund to find out whether on-line services are being provided by individual companies and if so utilize the on-line services .

We give herein the list of banks who have their websites and you may go to the website of your bank to find out whether you can link your Aadhaar with the bank account held by you with them . CLICK HERE FOR THE BANK LIST

Get the list of various Life Insurance companies and their websites by CLICKING HERE and for the list of general insurance companies and their websites CLICK HERE . Foe the list of health insurance companies and their websites , CLICK HERE .

For the websites of Mutual Fund companies , CLICK HERE

As the last date for linking Aadhaar draws near , there could be queues and delays in the concerned offices and it is better to get the links done early to avoid the rush .

Dated 06.12.2017 : Following are the deadlines set by the government for linking Aadhaar with various financial / non- financial products / benefits and services .

1. 31st December 2017 : For linking Aadhaar with PAN

2. 31st December 2017 : For linking Aadhaar with Bank Accounts / Insurance Accounts / Mutual Funds / Post Office Accounts

3. 31st December 2017 : For linking Aadhaar with Social Security Benefits like LPG / Pension / Scholarships .

4. 06th February 2018 : For linking Aadhaar with Mobile Numbers ( SIM ) .

As per government instructions , failure to link Aadhaar with in deadline may result in Non- processing of IT returns in case of PAN , blocking of accounts in case of banks and post office accounts. One may not be able to operate Mutual Funds and access insurance policies if fails to link Aadhaar with in deadline . Mobile phone numbers may be deactivated in case of mobile phones .

Many banks and Life insurance corporation of India have provided facilities on their website to link Aadhaar , where one can do the linking at the comfort of the house . In case of many other service providers , one has to physically visit their offices / branches to get the linking done .

One can go to the website of his / her bank , insurance company , mutual fund to find out whether on-line services are being provided by individual companies and if so utilize the on-line services .

We give herein the list of banks who have their websites and you may go to the website of your bank to find out whether you can link your Aadhaar with the bank account held by you with them . CLICK HERE FOR THE BANK LIST

Get the list of various Life Insurance companies and their websites by CLICKING HERE and for the list of general insurance companies and their websites CLICK HERE . Foe the list of health insurance companies and their websites , CLICK HERE .

For the websites of Mutual Fund companies , CLICK HERE

As the last date for linking Aadhaar draws near , there could be queues and delays in the concerned offices and it is better to get the links done early to avoid the rush .

UIDAI RELAXES NORMS FOR BANKS ON AADHAAR

Dated 21.11.2017 : During July of this year , Unique Identification Authority of India ( UIDAI ) had asked all commercial banks to establish Aadhaar Enrollment centers in at least 10 % of their branch network . Further in September 2017 , it had extended deadline for implementation up to 20.09.2017 , failing which banks were asked to shell out penalty of Rs 20,000 per month for their unopened centers. It is reported that banks have opened only about 3000 such centres against a target of 15,300 in spite of monetary penalty imposed on non-compliance of earlier instruction .

As UIDAI wants to reduce the role of private agencies in updating of Aadhaar and restrict them to fresh enrollments only , the role of banks and post offices are becoming more imperative in coming days .

Now , in order to speed up opening of such Aadhaar centres in Bank branches , UIDAI has permitted banks to hire private data entry operators and to hire enrollment machines . With this relaxation , UIDAI hopes establishment of Aadhaar centres will improve over the coming weeks .

To search an Enrolment Centre near you , CLICK HERE

Source : Various newspapers

Dated 21.11.2017 : During July of this year , Unique Identification Authority of India ( UIDAI ) had asked all commercial banks to establish Aadhaar Enrollment centers in at least 10 % of their branch network . Further in September 2017 , it had extended deadline for implementation up to 20.09.2017 , failing which banks were asked to shell out penalty of Rs 20,000 per month for their unopened centers. It is reported that banks have opened only about 3000 such centres against a target of 15,300 in spite of monetary penalty imposed on non-compliance of earlier instruction .

As UIDAI wants to reduce the role of private agencies in updating of Aadhaar and restrict them to fresh enrollments only , the role of banks and post offices are becoming more imperative in coming days .

Now , in order to speed up opening of such Aadhaar centres in Bank branches , UIDAI has permitted banks to hire private data entry operators and to hire enrollment machines . With this relaxation , UIDAI hopes establishment of Aadhaar centres will improve over the coming weeks .

To search an Enrolment Centre near you , CLICK HERE

Source : Various newspapers

- LINKING AADHAAR WITH MOBILES GOING TO BE EASY

- Dated 26.10.2017 : Department of Telecommunications , Government of India has now simplified the process of linking Aadhaar with mobile numbers with introduction of three new methods of linking namely 1. OTP ( One Time Password ) based method ,

With the introduction of new methods , DOT is bidding to expedite compliance of telecom service operators of the Supreme Court Judgement dated 06.02.2017

For press release of Government of India on the matter , CLICK HERE

GOVERNMENT : DEADLINE FOR LINKING AADHAAR TO GOVERNMENT SCHEMES EXTENDED

Dated 26.10.2017 : Newspapers reported that Government of India has submitted to Supreme court that

1. Deadline for Aadhar linkage to avail social benefit schemes is extended up to 31.03.2018

2. Government will not take any coercive actions against those who do not have enrolled under Aadhaar , and they can continue to avail social benefit schemes till 31.03.2018 .

The extension covers various social benefit schemes including LPG to poor women , MGNREGA , Kerosene and Fertilizer subsidy . .

Dated 26.10.2017 : Newspapers reported that Government of India has submitted to Supreme court that

1. Deadline for Aadhar linkage to avail social benefit schemes is extended up to 31.03.2018

2. Government will not take any coercive actions against those who do not have enrolled under Aadhaar , and they can continue to avail social benefit schemes till 31.03.2018 .

The extension covers various social benefit schemes including LPG to poor women , MGNREGA , Kerosene and Fertilizer subsidy . .

RBI CLARIFIES THAT LINKING AADHAAR TO BANK ACCOUNTS MANDATORY

Dated 21.10.2017 : In wake of newspaper report suggesting Aadhar linkage is not mandatory , Reserve Bank of India has come out with clarification that linking of Aadhaar with bank accounts is mandatory .

In its press release dated 21.10.2017 , RBI clarifies " In applicable cases , linkage of Aadhaar numbers to bank account is mandatory under the Prevention of Money-laundering ( Maintenance of Records ) Second Amendment Rules 2017 published in the official Gazette on June 1 , 2017 . As these rules are statutory force and as such banks have to implement without awaiting for further instructions " . For copy of Gazette notification , CLICK HERE For RBI Press Release , CLICK HERE

However RBI has not clarified what are the applicable cases.

We observed that all Indians who are eligible to obtain Aaadhaar have to provide Aadhaar number or enrollment number for opening all accounts except for " Small Accounts " . Opening of small accounts without Aadhar is allowed with certain terms and conditions like no foreign remittance etc .