BANK PENSIONERS LATEST NEWS

Important News Bank Pensioners /Retirees

FOR NEWS ON DEMONETISTION AND NEW CURRENCY FEATURES CLICK HERE

FOR BANKING TIPS , CLICK HERE FOR INCOME TAX NEWS , CLICK HERE FOR SAFE BANKING TIPS , CLICK HERE

FOR INCOME TAX RETURN FORMS AND INFORMATION , CLICK HERE

FOR BANKING NEWS CLICK HERE

FOR BANKING TIPS , CLICK HERE FOR INCOME TAX NEWS , CLICK HERE FOR SAFE BANKING TIPS , CLICK HERE

FOR INCOME TAX RETURN FORMS AND INFORMATION , CLICK HERE

FOR BANKING NEWS CLICK HERE

Bank pensioners Latest News today 2023

PLAN N PROGRESS CREATES NEW PAGE FOR EXCLUSIVE NEWS FOR BANKERS AND RETIREES

To read latest news for working bankers ,

CLICK HERE

FOR LATEST UPDATES ON BANK PRIVATIZATION :

CABINET PANEL MEETS TO DISCUSS NITI AYOG RECOMMENDATIONS

LATEST NEWS ON GROUP INSURANCE FOR 2023 IS NOW AVAILABLE ON A NEW PAGE .

CLICK HERE TO VISIT

CLICK HERE

FOR LATEST UPDATES ON BANK PRIVATIZATION :

CABINET PANEL MEETS TO DISCUSS NITI AYOG RECOMMENDATIONS

LATEST NEWS ON GROUP INSURANCE FOR 2023 IS NOW AVAILABLE ON A NEW PAGE .

CLICK HERE TO VISIT

FOR LATEST NEWS ON 12TH BIPARTITE NEGOTIATIONS , CLICK HERE

Bank Pensioners Latest News Today

PENSION OPTION FOR BANK RESIGNEES

Dated 17.03.2024 : In the month of November 2023 , Indian Bankers Association ( IBA ) had signed a MOU with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval .

Now the Department of Financial services , Ministry of Finance has conveyed their 'No Objccti‹›n’ for Extending an option of pension to the resignees who were otherwise eligible to join the Pension Scheme under the Bank Employees Pension regulations but were not offered second option to join the pension scheme as they had resigned.

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers. who were in service of the Banks on or after 1st, January 1986 and had joined the Banks before 1st , April 2010 and who have resigned from the service of the Bank on or before 26th , April 2010 and who were otherwise eligible to join the pension scheme while in service and In case of death after resignation, the surviving spouse or eligible family member can opt. (they will get family pension) . They should have completed 20 years service and above at the time of resignation

2. They should agree to refund to the Bank the entire Bank's contribution to Provident Fund (along with accumulated interest thereon) received by them at the time of their resignation from the Bank. (No additional interest thereon

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension .

Pension Payable : 50% of Pay if completed 33 years service at the time of resignation.Other cases (20 to 32 years) : 50% of Pay x service I 33. Pension/Family pension payable prospectively. No facility of commutation

Dated 17.03.2024 : In the month of November 2023 , Indian Bankers Association ( IBA ) had signed a MOU with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval .

Now the Department of Financial services , Ministry of Finance has conveyed their 'No Objccti‹›n’ for Extending an option of pension to the resignees who were otherwise eligible to join the Pension Scheme under the Bank Employees Pension regulations but were not offered second option to join the pension scheme as they had resigned.

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers. who were in service of the Banks on or after 1st, January 1986 and had joined the Banks before 1st , April 2010 and who have resigned from the service of the Bank on or before 26th , April 2010 and who were otherwise eligible to join the pension scheme while in service and In case of death after resignation, the surviving spouse or eligible family member can opt. (they will get family pension) . They should have completed 20 years service and above at the time of resignation

2. They should agree to refund to the Bank the entire Bank's contribution to Provident Fund (along with accumulated interest thereon) received by them at the time of their resignation from the Bank. (No additional interest thereon

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension .

Pension Payable : 50% of Pay if completed 33 years service at the time of resignation.Other cases (20 to 32 years) : 50% of Pay x service I 33. Pension/Family pension payable prospectively. No facility of commutation

Monthly ex-gratia for bank pensioners

EX-GRATIA FOR BANK PENSIONERS - QUANTUM FIXED

Dated 08.03.2024 : In the bipartite settlement signed today between IBA and UFBU , the quantum of ex-gratia fixed for the bank retirees is Full basic pension + DA for October 2022 multiplied by a factor below and rounded of to the nearest 100

FACTOR TABLE :

AWARD STAFF :

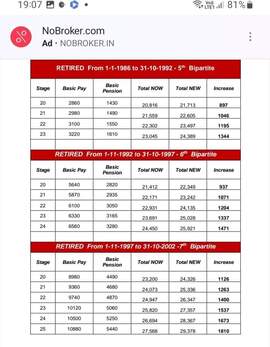

1. 4TH / 5TH BPS Retired between 01.01.1986 to 31.10.1992 - Factor 0.17

2. 6TH BPS Retired between 01.11.1992 to 31.03.1998 - Factor 0.15

3. 7TH BPS Retired between 01.04.1998 to 31.10. 2002 - Factor 0.12

4. 8TH BPS Retired between 01.11.2002 to 31.10. 2007 - Factor 0.07

5. 9TH BPS Retired between 01.11.2007 to 31.10. 2012 - Factor 0.05

6. 10TH BPS Retired between 01.11.2012 to 31.10. 2017 - Factor 0.03

7. 11TH BPS Retired between 01.11.2017 to 31.10. 2022 - Factor 0.02

FOR OFFICERS :

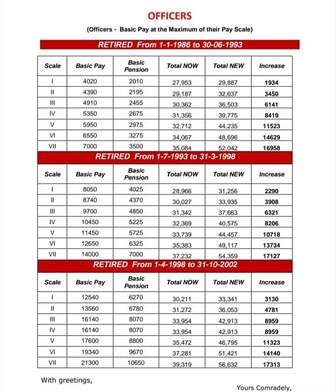

1. 1ST / 2ND JN Retired between 01.01.1986 to 30.06.1993 - Factor 0.17

2. 3RD JN Retired between 01.07.1993 to 31.03.1998 - Factor 0.15

3. 4TH JN Retired between 01.04.1998 to 31.10. 2002 - Factor 0.12

4. 5TH JN Retired between 01.11.2002 to 31.10. 2007 - Factor 0.07

5. 6TH JN Retired between 01.11.2007 to 31.10. 2012 - Factor 0.05

6. 7TH JN Retired between 01.11.2012 to 31.10. 2017 - Factor 0.03

7. 8TH JN Retired between 01.11.2017 to 31.10. 2022 - Factor 0.02

Dated 08.03.2024 : In the bipartite settlement signed today between IBA and UFBU , the quantum of ex-gratia fixed for the bank retirees is Full basic pension + DA for October 2022 multiplied by a factor below and rounded of to the nearest 100

FACTOR TABLE :

AWARD STAFF :

1. 4TH / 5TH BPS Retired between 01.01.1986 to 31.10.1992 - Factor 0.17

2. 6TH BPS Retired between 01.11.1992 to 31.03.1998 - Factor 0.15

3. 7TH BPS Retired between 01.04.1998 to 31.10. 2002 - Factor 0.12

4. 8TH BPS Retired between 01.11.2002 to 31.10. 2007 - Factor 0.07

5. 9TH BPS Retired between 01.11.2007 to 31.10. 2012 - Factor 0.05

6. 10TH BPS Retired between 01.11.2012 to 31.10. 2017 - Factor 0.03

7. 11TH BPS Retired between 01.11.2017 to 31.10. 2022 - Factor 0.02

FOR OFFICERS :

1. 1ST / 2ND JN Retired between 01.01.1986 to 30.06.1993 - Factor 0.17

2. 3RD JN Retired between 01.07.1993 to 31.03.1998 - Factor 0.15

3. 4TH JN Retired between 01.04.1998 to 31.10. 2002 - Factor 0.12

4. 5TH JN Retired between 01.11.2002 to 31.10. 2007 - Factor 0.07

5. 6TH JN Retired between 01.11.2007 to 31.10. 2012 - Factor 0.05

6. 7TH JN Retired between 01.11.2012 to 31.10. 2017 - Factor 0.03

7. 8TH JN Retired between 01.11.2017 to 31.10. 2022 - Factor 0.02

BANK PENSIONERS DA WILL GO UP BY 61 SLABS FROM FEBRUARY 2024

Dated 01.02.2024 : The average consumer index points have increased in the quarter ending December 2023 to 9,122.33 from earlier average of 8,881.28 points in June 2023 . Accordingly the DA slabs have gone up by 61 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2024 to July 2024 will be enhanced by 61 slabs .New DA Rates from February 2024 to July 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 48.51 % of Basic Pay ( 693 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 117.10% of Basic pension ( 1171 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 235.80 % of Basic pension ( 1572 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 307.62 % of Basic pension ( 1709 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 446.40 % + Rs 800

b. Basic pension between Rs 3,551 to Rs 5,650 : 446.40 % + Rs 450

c. Basic pension between Rs 5,651 : 446.40 %

Similarly the pensioners retired earlier will also get DA enhancement .

To read AIBEA Circular , click here

Dated 01.02.2024 : The average consumer index points have increased in the quarter ending December 2023 to 9,122.33 from earlier average of 8,881.28 points in June 2023 . Accordingly the DA slabs have gone up by 61 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2024 to July 2024 will be enhanced by 61 slabs .New DA Rates from February 2024 to July 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 48.51 % of Basic Pay ( 693 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 117.10% of Basic pension ( 1171 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 235.80 % of Basic pension ( 1572 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 307.62 % of Basic pension ( 1709 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 446.40 % + Rs 800

b. Basic pension between Rs 3,551 to Rs 5,650 : 446.40 % + Rs 450

c. Basic pension between Rs 5,651 : 446.40 %

Similarly the pensioners retired earlier will also get DA enhancement .

To read AIBEA Circular , click here

" EX-GRATIA FOR BANK PENSIONERS DECIDED " :

Dated 13.01.2024 : Yesterday 12.01.2024 late night , IBA signed cost sheet with UFBU representatives. The cost sheet allocates funds needed for various components of the agreement . It is reported that cost of monthly ex-gratia amount payable to bank pensioners is also taken in to account for working out the cost sheet .

Mr C.H.Venkatachalam , General secretary of AIBEA has tweeted that " Ex gratia for pensioners has also been decided " . However the formula for granting ex-gratia and total cost is not yet revealed . The information will be divulged only after signing of the settlement which is expected to take place in the next week .

The anxious pensioners are left to guess the quantum of ex-gratia and arrears . Many pensioners are not happy with the ad-hoc ex-gratia while they expected regular updation of their pensions .

Dated 13.01.2024 : Yesterday 12.01.2024 late night , IBA signed cost sheet with UFBU representatives. The cost sheet allocates funds needed for various components of the agreement . It is reported that cost of monthly ex-gratia amount payable to bank pensioners is also taken in to account for working out the cost sheet .

Mr C.H.Venkatachalam , General secretary of AIBEA has tweeted that " Ex gratia for pensioners has also been decided " . However the formula for granting ex-gratia and total cost is not yet revealed . The information will be divulged only after signing of the settlement which is expected to take place in the next week .

The anxious pensioners are left to guess the quantum of ex-gratia and arrears . Many pensioners are not happy with the ad-hoc ex-gratia while they expected regular updation of their pensions .

MONTHLY EX-GRATIA FOR BANK PENSIONERS :

Dated 08.12.2023 : In the MOU signed with UFBU yesterday , IBA has agreed to consider monthly ex-gratia amount along with pension by PSBs to pensioners and family pensioners, who were drawing pension as on 31/10/2022. The applicability of the said ex-gratia for the retirees of the current settlement period will be discussed further. The said ex-gratia amount will not attract any other allowance including dearness allowance.

This is a one-time measure applicable for the current bipartite / Joint Note period and it's Without prejudice to the demand of unions/associations for updation of pension for all retirees .

However quantum and the modalities for payment are to be discussed while finalizing the 12th bipartite salary negotiations .

Dated 08.12.2023 : In the MOU signed with UFBU yesterday , IBA has agreed to consider monthly ex-gratia amount along with pension by PSBs to pensioners and family pensioners, who were drawing pension as on 31/10/2022. The applicability of the said ex-gratia for the retirees of the current settlement period will be discussed further. The said ex-gratia amount will not attract any other allowance including dearness allowance.

This is a one-time measure applicable for the current bipartite / Joint Note period and it's Without prejudice to the demand of unions/associations for updation of pension for all retirees .

However quantum and the modalities for payment are to be discussed while finalizing the 12th bipartite salary negotiations .

SBI PENSIONERS LATEST NEWS

Latest news on pension updation of bank retirees by IBA SBI GOI

SBI PENSIONERS TO GET PENSION AT 50 % COMPUTATION :

Dated 14.11 2023 : It is reported that Government of India has approved computation of pension at uniform 50 % rate for all the pensioners of State Bank of India . GOI has directed the bank to make necessary modification in its regulations to complete the process .

The existing pension computation formula is as follows , Which is going to be amended now :

(a) No. of years pensionable service x Average substantive salary drawn during the last 12 months’ pensionable Service (not to be rounded off)

(b) (i).Where the average of monthly substantive salary drawn during the last 12 months’ pensionable service is upto Rs. 51,490/- p.m. : 50% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service + ½ of PQP + 1/2 of incremental component of FPP, wherever applicable.

(ii).Where the average of monthly substantive salary drawn during thelast 12months’pensionable service is above Rs. 51,490/- p.m. :

40% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service subject to minimum of Rs. 25,745/- + ½ of PQP + ½ of incremental component of FPP, wherever applicable.

In the case of (b)(i) : Lower of (a) and (b)(i) will be the basic Pension.

In the case of (b)(ii) : Lower of (a) and (b)(ii) will be the basic Pension.

Dated 14.11 2023 : It is reported that Government of India has approved computation of pension at uniform 50 % rate for all the pensioners of State Bank of India . GOI has directed the bank to make necessary modification in its regulations to complete the process .

The existing pension computation formula is as follows , Which is going to be amended now :

(a) No. of years pensionable service x Average substantive salary drawn during the last 12 months’ pensionable Service (not to be rounded off)

(b) (i).Where the average of monthly substantive salary drawn during the last 12 months’ pensionable service is upto Rs. 51,490/- p.m. : 50% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service + ½ of PQP + 1/2 of incremental component of FPP, wherever applicable.

(ii).Where the average of monthly substantive salary drawn during thelast 12months’pensionable service is above Rs. 51,490/- p.m. :

40% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service subject to minimum of Rs. 25,745/- + ½ of PQP + ½ of incremental component of FPP, wherever applicable.

In the case of (b)(i) : Lower of (a) and (b)(i) will be the basic Pension.

In the case of (b)(ii) : Lower of (a) and (b)(ii) will be the basic Pension.

PENSION OPTION FOR BANK RESIGNEES

Dated 10.11.2023 : Memorandum of Understanding has been signed between the representatives of UFBU and IBA with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers who were in service between 01.01.1986 and 01.04.2010 and have resigned from the services of the banks before 26.04.2010 and who were otherwise eligible for pension

2. Who are agreeable to refund the entire Provident fund along with interest .

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension . .

To read complete details of MOU , you may go through AIBEA circular by clicking here

Dated 10.11.2023 : Memorandum of Understanding has been signed between the representatives of UFBU and IBA with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers who were in service between 01.01.1986 and 01.04.2010 and have resigned from the services of the banks before 26.04.2010 and who were otherwise eligible for pension

2. Who are agreeable to refund the entire Provident fund along with interest .

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension . .

To read complete details of MOU , you may go through AIBEA circular by clicking here

IBA WORKING OUT FOR PENSION IMPROVEMENT : UFBU

Dated 10.11.2023 : IBA has informed United Forum of Bank unions ( UFBU ) , in the negotiation meeting held yesterday that they are working out for improvement of pensions , keeping the cost implications of the exercise . It is expected that all the bank retirees from 01.01.1986 up to 31.10.2022 will be benefitted by the IBA move .

The above information is disclosed by AIBEA in their circular dated today

Dated 10.11.2023 : IBA has informed United Forum of Bank unions ( UFBU ) , in the negotiation meeting held yesterday that they are working out for improvement of pensions , keeping the cost implications of the exercise . It is expected that all the bank retirees from 01.01.1986 up to 31.10.2022 will be benefitted by the IBA move .

The above information is disclosed by AIBEA in their circular dated today

PRE 2002 BANK PENSIONERS : Dearness Allowance Rates from October 2023

Dated 15.10.2023 : Consequent to 100 % neutralization of Dearness Allowance to pre 2002 bank retirees , the new DA rates effective from October 2023 till January 2024 will be as follows :

1. Retired staff between 01.01.1986 to 31.10.1992 and officers retired before 30.06.1993 - DA Rate of 1386.90 % of the basic pay

2. Retired staff between 01.11.1992 to 31.03.1998 and officers retired before 01.07.1993 to 31.03.1998 - DA Rate of 676.55 % of the basic pay

3. Retired between 01.04.1998 to 31.10.2002 for both staff and officers - DA Rate of 431.76 % of the basic pay

Dated 15.10.2023 : Consequent to 100 % neutralization of Dearness Allowance to pre 2002 bank retirees , the new DA rates effective from October 2023 till January 2024 will be as follows :

1. Retired staff between 01.01.1986 to 31.10.1992 and officers retired before 30.06.1993 - DA Rate of 1386.90 % of the basic pay

2. Retired staff between 01.11.1992 to 31.03.1998 and officers retired before 01.07.1993 to 31.03.1998 - DA Rate of 676.55 % of the basic pay

3. Retired between 01.04.1998 to 31.10.2002 for both staff and officers - DA Rate of 431.76 % of the basic pay

PRE 2002 BANK PENSIONERS :Neutralization of Dearness Allowance

UPDATE DATED 07.10.2023 : Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . The effective date is 01.10.2023 . The pension will be revised from October 2023 and no arrears will be payable for earlier period . It is reported that MOF has already informed the clearance to IBA and have asked them to instruct the bank managements suitably .

UPDATE DATED 07.10.2023 : Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . The effective date is 01.10.2023 . The pension will be revised from October 2023 and no arrears will be payable for earlier period . It is reported that MOF has already informed the clearance to IBA and have asked them to instruct the bank managements suitably .

PRE 2002 BANK PENSIONERS :Neutralization of Dearness Allowance

UPDATE DATED 04.10.2023 : It has been reported that Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . Now official instruction from IBA is awaited

Dated 28.07.2023 : UFBU has today signed an agreement with IBA for. the revision of Dearness Relief ( D A ) from staggered four slab to uniform 100 % neutralization for all those retirees who retired from the bank's services up to 31.10.2002 .

DA will be rates will be on uniform basis of 100 % neutralization as in the case of employees / officers / pensioners / family pensioners of period on and from 1st, November 2002 as provided herein below :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992 , DA shall be taken. at the uniform rate of 0.67 % per slab over 600 points .

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997 , DA shall be taken. at the uniform rate of 0.35 % per slab over 1148 points .

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002 , DA shall be taken. at the uniform rate of 0.24 % per slab over 1684 points .

Further following ex-gratia is also agreed up on :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992

a. For basic pension / family pension up to Rs 1250 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 1250 , ex-gratia of Rs 450/ - per month

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997.

a. For basic pension / family pension up to Rs 2,400 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 2,400 , ex-gratia of Rs 450/ - per month

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002

a. For basic pension / family pension up to Rs 3,550 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 3,550 , ex-gratia of Rs 450/ - per month

To read UFBU circular on the issue. , CLICK HERE

UPDATE DATED 04.10.2023 : It has been reported that Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . Now official instruction from IBA is awaited

Dated 28.07.2023 : UFBU has today signed an agreement with IBA for. the revision of Dearness Relief ( D A ) from staggered four slab to uniform 100 % neutralization for all those retirees who retired from the bank's services up to 31.10.2002 .

DA will be rates will be on uniform basis of 100 % neutralization as in the case of employees / officers / pensioners / family pensioners of period on and from 1st, November 2002 as provided herein below :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992 , DA shall be taken. at the uniform rate of 0.67 % per slab over 600 points .

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997 , DA shall be taken. at the uniform rate of 0.35 % per slab over 1148 points .

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002 , DA shall be taken. at the uniform rate of 0.24 % per slab over 1684 points .

Further following ex-gratia is also agreed up on :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992

a. For basic pension / family pension up to Rs 1250 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 1250 , ex-gratia of Rs 450/ - per month

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997.

a. For basic pension / family pension up to Rs 2,400 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 2,400 , ex-gratia of Rs 450/ - per month

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002

a. For basic pension / family pension up to Rs 3,550 , ex-gratia of Rs 800/ - per month

b. For basic pension / family pension above Rs 3,550 , ex-gratia of Rs 450/ - per month

To read UFBU circular on the issue. , CLICK HERE

BANK PENSIONERS DA WILL GO UP BY 44 SLABS FROM AUGUST 2023

Dated 31.07.2023 : The average consumer index points have increased in the quarter ending June 2023 to 8881.28 from earlier average of 8,706 points . Accordingly the DA slabs have gone up by 44 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2023 to January 2024 will be enhanced by 44 slabs .New DA Rates from August 2023 to January 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 44.24 % of Basic Pay ( 632 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 111.00% of Basic pension ( 1100 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 226.65 % of Basic pension ( 1511 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 296.64% of Basic pension ( 1648 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 431.76 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 359.80 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 215.88 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 107.94 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

Dated 31.07.2023 : The average consumer index points have increased in the quarter ending June 2023 to 8881.28 from earlier average of 8,706 points . Accordingly the DA slabs have gone up by 44 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2023 to January 2024 will be enhanced by 44 slabs .New DA Rates from August 2023 to January 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 44.24 % of Basic Pay ( 632 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 111.00% of Basic pension ( 1100 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 226.65 % of Basic pension ( 1511 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 296.64% of Basic pension ( 1648 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 431.76 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 359.80 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 215.88 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 107.94 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

NEW ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

NEW ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

PENSION OF RBI RETIREES REVISED

Dated 14.07.2023 : Reserve Bank of India has revised the pension payable to its pensioners who retired before 01.11.2017.

As per the revised pension ,basic pension will be revised by a factor of 1.63 ( basic pension of Rs 100 will become 163 ) from the month of June 2023. DA will be paid on the basis of CPI 6352. No arrears will be paid for the earlier periods.

Dated 14.07.2023 : Reserve Bank of India has revised the pension payable to its pensioners who retired before 01.11.2017.

As per the revised pension ,basic pension will be revised by a factor of 1.63 ( basic pension of Rs 100 will become 163 ) from the month of June 2023. DA will be paid on the basis of CPI 6352. No arrears will be paid for the earlier periods.

AIBPARC DELEGATION MEETS FINANCE MINISTER :

UPDATE DATED 21.06.2023 : As per a circular issued by AIBPARC , their delegates during the meeting on 19th , June 2023 with the FM , raised the following long pending issues :

(1) Pension updation for all eligible Pensioners

(2)100 per cent DA neutralization for Pre-November 2002 Retirees

(3) Medical insurance premium to be borne by the banks. Alternatively, a new scheme akin to CGHS may be

introduced by collecting one time contribution from the beneficiaries.

(4) Reckoning of Special Allowance introduced wef 01.11.1012 for calculation of gratuity and pension.

(5) One more option for pension to all the eligible Resignees and left outs.

(6) Formal consultative status for the Pensioners organisations.

As Government of India is the principal stake holder of the Banks, AIBPARC delegates requested for her intervention for early

resolution of the long pending issues.

The delegates also submitted a memorandum to the Hon'ble Finance Minister. She directed the officials present in the meeting to ensure that IBA looks into the demands seriously and makes a detailed presentation to her early next week on all the issues contained in our memorandum.

DATED 20.06.2023 : Yesterday , a delegation of All India Bank Pensioners & Retirees Confederation (AIBPARC) led by President Shri K.V. Acharya ,met the Finance minister Smt Nirmala Sitaraman . AIBPARC delegation comprised of Dr.J.D .Sharma , Sri Suprita Sarkar and and Mr G.V.V.S.N. Varma The delegation presented the long pending issues that are bothering the Retirees and again requested her for an early resolution of the same. Senior Officials of the Ministry were also present during the discussion..

In the mean time , Moneycontrol.com has reported that the FM has directed IBA , as a follow up action after the meeting , to look in to the pending issues of the bank retirees and report to her within seven days ( as told to them by Sri K.V Acharya ) .

UPDATE DATED 21.06.2023 : As per a circular issued by AIBPARC , their delegates during the meeting on 19th , June 2023 with the FM , raised the following long pending issues :

(1) Pension updation for all eligible Pensioners

(2)100 per cent DA neutralization for Pre-November 2002 Retirees

(3) Medical insurance premium to be borne by the banks. Alternatively, a new scheme akin to CGHS may be

introduced by collecting one time contribution from the beneficiaries.

(4) Reckoning of Special Allowance introduced wef 01.11.1012 for calculation of gratuity and pension.

(5) One more option for pension to all the eligible Resignees and left outs.

(6) Formal consultative status for the Pensioners organisations.

As Government of India is the principal stake holder of the Banks, AIBPARC delegates requested for her intervention for early

resolution of the long pending issues.

The delegates also submitted a memorandum to the Hon'ble Finance Minister. She directed the officials present in the meeting to ensure that IBA looks into the demands seriously and makes a detailed presentation to her early next week on all the issues contained in our memorandum.

DATED 20.06.2023 : Yesterday , a delegation of All India Bank Pensioners & Retirees Confederation (AIBPARC) led by President Shri K.V. Acharya ,met the Finance minister Smt Nirmala Sitaraman . AIBPARC delegation comprised of Dr.J.D .Sharma , Sri Suprita Sarkar and and Mr G.V.V.S.N. Varma The delegation presented the long pending issues that are bothering the Retirees and again requested her for an early resolution of the same. Senior Officials of the Ministry were also present during the discussion..

In the mean time , Moneycontrol.com has reported that the FM has directed IBA , as a follow up action after the meeting , to look in to the pending issues of the bank retirees and report to her within seven days ( as told to them by Sri K.V Acharya ) .

Bank Retirees Pension Updation Latest News 2023

New Updated Article

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

Pension updation latest news

PENSION UPDATION

MEETING OF UFBU WITH IBA :

Dated 01 .03 .2023 : It is reported that the meeting between IBA and UFBU constituents took place yesterday . In the meeting , residual issues including pension updation and 5 day banking were discussed .

With regard to updation of pension , IBA informed the UFBU representatives that it would study the complete data such as no. of pensioners, present outgo and future burden etc and a meeting would take place thereafter . Hence bank pensioners have to wait further for any progress in the matter .

It is also reported that the 5 day banking issue has been settled amicably and an agreement has been reached between IBA and UFBU .

For the details of the meeting , CLICK HERE

MEETING OF UFBU WITH IBA :

Dated 01 .03 .2023 : It is reported that the meeting between IBA and UFBU constituents took place yesterday . In the meeting , residual issues including pension updation and 5 day banking were discussed .

With regard to updation of pension , IBA informed the UFBU representatives that it would study the complete data such as no. of pensioners, present outgo and future burden etc and a meeting would take place thereafter . Hence bank pensioners have to wait further for any progress in the matter .

It is also reported that the 5 day banking issue has been settled amicably and an agreement has been reached between IBA and UFBU .

For the details of the meeting , CLICK HERE

PRE -1986 RETIREES : EX-GRATIA TO BE IMPROVED

Dated 21.02.2023 : Indian Bankers Association ( IBA ) has asked State Bank of India and other public sector banks to improve the ex-gratia being paid to the pre- 1986 retirees or their surviving spouses .

IBA has advised the banks to pay an additional ex-gratia over the existing pension to make a minimum of Rs 10,000 per month as ex-gratia .

It is expected that the pre -1986 will get an additional amount of Rs 4,899 and the surviving spouses would receive an additional amount of Rs 7,450 every month .

Individual banks have to take permission from their boards and the revision will take place with immediate effect .

The last revision of ex-gratia payable to pre -1986 pensioners was made in 2013 .

Dated 21.02.2023 : Indian Bankers Association ( IBA ) has asked State Bank of India and other public sector banks to improve the ex-gratia being paid to the pre- 1986 retirees or their surviving spouses .

IBA has advised the banks to pay an additional ex-gratia over the existing pension to make a minimum of Rs 10,000 per month as ex-gratia .

It is expected that the pre -1986 will get an additional amount of Rs 4,899 and the surviving spouses would receive an additional amount of Rs 7,450 every month .

Individual banks have to take permission from their boards and the revision will take place with immediate effect .

The last revision of ex-gratia payable to pre -1986 pensioners was made in 2013 .

UFBU NOW SEEKS PENSION UPDATION FOR ALL PAST RETIREES :

Dated 02.02.2023 : In a letter addressed to IBA , UFBU has demanded the pension updation for all the existing pensioners from 01- 01-1986 and up to those who retired on or before 31-10-2017 . They have demanded that the present pension paid to all these retirees on and from 01-01-1986 to 31-10-2017 be brought/updated to the level of the pay scales as applicable under the 11th Bipartite Settlement / 8th Joint Note signed on 11-11- 2020.

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represent bank employees unions and bank officers associations .

Dated 02.02.2023 : In a letter addressed to IBA , UFBU has demanded the pension updation for all the existing pensioners from 01- 01-1986 and up to those who retired on or before 31-10-2017 . They have demanded that the present pension paid to all these retirees on and from 01-01-1986 to 31-10-2017 be brought/updated to the level of the pay scales as applicable under the 11th Bipartite Settlement / 8th Joint Note signed on 11-11- 2020.

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represent bank employees unions and bank officers associations .

BANK PENSIONERS DA WILL GO UP BY 62 SLABS FROM FEBRUARY 2023

Dated 31.01.2023 : The average consumer index points have increased in the quarter ending June 2022 to 8705.98 from earlier average of 8,495 points . Accordingly the DA slabs have gone up by 62 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2023 to July 2023 will be enhanced by 62 slabs .New DA Rates from February 2023 to July 2023 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 41.16 % of Basic Pay ( 588 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 106.60 % of Basic pension ( 1066 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 220.05 % of Basic pension ( 1467 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 288.72 % of Basic pension ( 1604 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 421.20 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 351.00 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 210.06 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 105.30 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

Dated 31.01.2023 : The average consumer index points have increased in the quarter ending June 2022 to 8705.98 from earlier average of 8,495 points . Accordingly the DA slabs have gone up by 62 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2023 to July 2023 will be enhanced by 62 slabs .New DA Rates from February 2023 to July 2023 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 41.16 % of Basic Pay ( 588 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 106.60 % of Basic pension ( 1066 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 220.05 % of Basic pension ( 1467 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 288.72 % of Basic pension ( 1604 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 421.20 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 351.00 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 210.06 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 105.30 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

AIBPARC TRIENNIAL MEETING BEGINS :

Dated 29.01.2023 : As scheduled , the Triennial Meeting of All India Bank Pensioners & Retirees Confederation ( AIBPARC ) is progressing at Bengaluru , Karnataka . The meeting is scheduled for the Saturday & Sunday 28th & 29th , January 2023 . Over 700 Delegates/Observers from all over India from various affiliates are expected to participate in the Conference.

In the inaugural session yesterday , President of AIBPARC Com. K V Acharya ji addressed the 4th Triennial General Body Conference which is being held in Jnana Jyothi Auditorium, Bangalore City University, Bangalore . Chief Guest Justice V. Gopala Gowda j addressed the gathering in its evening session .

The meeting will conclude today .

Dated 29.01.2023 : As scheduled , the Triennial Meeting of All India Bank Pensioners & Retirees Confederation ( AIBPARC ) is progressing at Bengaluru , Karnataka . The meeting is scheduled for the Saturday & Sunday 28th & 29th , January 2023 . Over 700 Delegates/Observers from all over India from various affiliates are expected to participate in the Conference.

In the inaugural session yesterday , President of AIBPARC Com. K V Acharya ji addressed the 4th Triennial General Body Conference which is being held in Jnana Jyothi Auditorium, Bangalore City University, Bangalore . Chief Guest Justice V. Gopala Gowda j addressed the gathering in its evening session .

The meeting will conclude today .

BANK PENSION UPDATION : LATEST NEWS

PENSION UPDATION : UFBU FOR PRIORITIZING PRE-2002 RETIREES :

Dated 18.12.2022 : In a meeting held at Chennai by the constituents of UFBU , it was decided to achieve the updation of pensions for the retirees covered by 5th , 6th & 7th Bipartite wage settlement ( pre-2002 retirees ) first and to follow-up for the remaining retirees with a clear roadmap for their pension updation .

Hence bank retirees , who have retired after 2002 , may have to wait for more time to get their dream of updation materialized and it may not happen near soon .

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represent bank employees unions and bank officers associations .

Dated 18.12.2022 : In a meeting held at Chennai by the constituents of UFBU , it was decided to achieve the updation of pensions for the retirees covered by 5th , 6th & 7th Bipartite wage settlement ( pre-2002 retirees ) first and to follow-up for the remaining retirees with a clear roadmap for their pension updation .

Hence bank retirees , who have retired after 2002 , may have to wait for more time to get their dream of updation materialized and it may not happen near soon .

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represent bank employees unions and bank officers associations .

AIBPARC TO HOLD TRIENNIAL MEETING IN BENGALURU :

Dated 21.11.2022 : All India Bank Pensioners & Retirees Confederation ( AIBPARC ) will hold a triennial General Body Conference on the Saturday & Sunday 28th & 29th , January 2023 in Bengaluru .

The venue proposed for the meeting is

JNANA JYOTHI AUDITORIUM , BENGALURU CITY UNIVERSITY,

CENTRAL COLLEGE CAMPUS, PALACE ROAD, BENGALURU

AIBPARC , presided by Mr K.V. Acharya , has completed ten years after it was sponsored by AIBOC . The membership of AIBPARC is open for bank retirees of all cadres .

Dated 21.11.2022 : All India Bank Pensioners & Retirees Confederation ( AIBPARC ) will hold a triennial General Body Conference on the Saturday & Sunday 28th & 29th , January 2023 in Bengaluru .

The venue proposed for the meeting is

JNANA JYOTHI AUDITORIUM , BENGALURU CITY UNIVERSITY,

CENTRAL COLLEGE CAMPUS, PALACE ROAD, BENGALURU

AIBPARC , presided by Mr K.V. Acharya , has completed ten years after it was sponsored by AIBOC . The membership of AIBPARC is open for bank retirees of all cadres .

IBA MEETS AIBPARC REPRESENTATIVES TO DISCUSS PENSIONERS ISSUES

Dated 12.10.2022 : Indian Bankers Association ( IBA ) met the office bearers of AIBPARC ( All India Bank Pensioners & Retirees Confederation ) yesterday . In the meeting the AIBPARC representatives put up the following issues concerning the bank retirees :

1.Updation of Pension for all who are eligible upto 11th Bipartite Settlement.

2.100 per cent DA neutralization to pre November 2002 Retirees.

3.Mediclaim insurance cover for Retirees-- premium to be borne by Banks.

4.Special allowance to reckon for superannuation benefits viz. Pension and Gratuity.

5.Option for pension for the resignees who completed Pensionable service.

6.Improvement in Ex-gratia for Pre-1986 Retirees / Surviving spouses.

7.Consultative status for Retirees' Organisations.

The meeting was attended by Mr K.V.Acharya , president and Mr Suprita Sarkar , General secretary along with other representatives of the Retirees association . They had also met the Finance Minister Ms Nirmala Sitharaman on 4th , October to put forth the demands of the retirees .

Dated 12.10.2022 : Indian Bankers Association ( IBA ) met the office bearers of AIBPARC ( All India Bank Pensioners & Retirees Confederation ) yesterday . In the meeting the AIBPARC representatives put up the following issues concerning the bank retirees :

1.Updation of Pension for all who are eligible upto 11th Bipartite Settlement.

2.100 per cent DA neutralization to pre November 2002 Retirees.

3.Mediclaim insurance cover for Retirees-- premium to be borne by Banks.

4.Special allowance to reckon for superannuation benefits viz. Pension and Gratuity.

5.Option for pension for the resignees who completed Pensionable service.

6.Improvement in Ex-gratia for Pre-1986 Retirees / Surviving spouses.

7.Consultative status for Retirees' Organisations.

The meeting was attended by Mr K.V.Acharya , president and Mr Suprita Sarkar , General secretary along with other representatives of the Retirees association . They had also met the Finance Minister Ms Nirmala Sitharaman on 4th , October to put forth the demands of the retirees .

IBA TAKES DIVERSE POSITIONS IN THE MATTER OF PENSION UPDATION :

Dated 16.09.2022 : Indian Bankers Association , on the one hand , invited representatives of UFBU for a meeting on 23rd September 2022 for a discussion on residual matters of wage settlements which includes Pension updation . On the other hand , it is reported that it has submitted an affidavit in a court case in the Supreme Court stating " it would neither be appropriate nor possible for the Banks to consider the request of the Representation/Claim requesting for Updation of Pension. "

The reason submitted by the IBA is " That there is no provision in Pension Regulations in 1995 (BEPR, 1995) for any Updation in the Pension of Bank Employees and Officers. That, therefore, it would neither be appropriate in-principle nor would be financially viable for the Banks to accept the Representation/Claim of the Employees for Updation of Pension at par with Central Government Employees, particularly, when there is no parity between the two set of Employees i.e. the Central Government Employees and Bank Employees, inter-alia,for the reasons that the Pension in the Banks is paid out of Pension Funds created out of the Banks contribution to the PF, whereas, in respect of Central Government Employees the Pension is paid NOT out of Pension Fund but is treated as Revenue Expenditure and paid out of Budgetary

Allocation. "

We have to to wait and see the reaction of UFBU and Retirees associations with regard to the IBA statement .

OUR VIEW : Normally parties take tough stand in a court case as a tactic , while they can negotiate for an amicable settlement outside the court . Even courts encourage out of court settlements . Hence it's not surprising that IBA is taking very harsh and negative stand in the court , while inviting unions for a negotiation . Bank retirees need not become unduly panic and unions should continue for a negotiated settlement . In fact unions may also fight in the court for an early settlement , while keeping negotiation doors wide open .

Dated 16.09.2022 : Indian Bankers Association , on the one hand , invited representatives of UFBU for a meeting on 23rd September 2022 for a discussion on residual matters of wage settlements which includes Pension updation . On the other hand , it is reported that it has submitted an affidavit in a court case in the Supreme Court stating " it would neither be appropriate nor possible for the Banks to consider the request of the Representation/Claim requesting for Updation of Pension. "

The reason submitted by the IBA is " That there is no provision in Pension Regulations in 1995 (BEPR, 1995) for any Updation in the Pension of Bank Employees and Officers. That, therefore, it would neither be appropriate in-principle nor would be financially viable for the Banks to accept the Representation/Claim of the Employees for Updation of Pension at par with Central Government Employees, particularly, when there is no parity between the two set of Employees i.e. the Central Government Employees and Bank Employees, inter-alia,for the reasons that the Pension in the Banks is paid out of Pension Funds created out of the Banks contribution to the PF, whereas, in respect of Central Government Employees the Pension is paid NOT out of Pension Fund but is treated as Revenue Expenditure and paid out of Budgetary

Allocation. "

We have to to wait and see the reaction of UFBU and Retirees associations with regard to the IBA statement .

OUR VIEW : Normally parties take tough stand in a court case as a tactic , while they can negotiate for an amicable settlement outside the court . Even courts encourage out of court settlements . Hence it's not surprising that IBA is taking very harsh and negative stand in the court , while inviting unions for a negotiation . Bank retirees need not become unduly panic and unions should continue for a negotiated settlement . In fact unions may also fight in the court for an early settlement , while keeping negotiation doors wide open .

WAGE SETTLEMENT - RESIDUAL ISSUES : IBA HAS SCHEDULED NEXT MEETING ON 23.09.2022 . For Details , CLICK HERE

Bank pensioners DA set for hike from AUGUST 2022

.BANK PENSIONERS DA WILL GO UP BY 55 SLABS FROM AUGUST 2022

Dated 30.07.2022 : The average consumer index points have increased in the quarter ending June 2022 to 8495 from earlier average of 8,240 points . Accordingly the DA slabs have gone up by 55 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2022 to January 2023 will be enhanced by 55 slabs .New DA Rates from August 2022 to January 2023 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 36.82 % of Basic Pay ( 526 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 100.40 % of Basic pension ( 1004 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 210.75 % of Basic pension ( 1405 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 277.56 % of Basic pension ( 1542 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 406.32 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 338.60 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 203.16 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 101.58 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

For DA payable to surviving spouses of bank retirees , CLICK HERE

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

To read IBA CIRCULAR dated 01st , August 2022 , CLICK HERE

Dated 30.07.2022 : The average consumer index points have increased in the quarter ending June 2022 to 8495 from earlier average of 8,240 points . Accordingly the DA slabs have gone up by 55 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2022 to January 2023 will be enhanced by 55 slabs .New DA Rates from August 2022 to January 2023 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 36.82 % of Basic Pay ( 526 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 100.40 % of Basic pension ( 1004 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 210.75 % of Basic pension ( 1405 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 277.56 % of Basic pension ( 1542 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 406.32 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 338.60 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 203.16 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 101.58 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

For DA payable to surviving spouses of bank retirees , CLICK HERE

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

To read IBA CIRCULAR dated 01st , August 2022 , CLICK HERE

RENEWAL OF GROUP INSURANCE POLICY FOR BANK RETIREES :

UFBU suggests Merging of policies for staff and Retirees , and request banks to bear the cost :

Dated 09.07.2022 : The group insurance policy taken for bank retirees will expire on 31.10.2022 . The present policy is taken with National Insurance Company .

IBA had constituted a committee of CGMS/ GMS of various public sector banks to handle the issue of renewal of group health insurance policy . A meeting between the committee and UBFU was held on 8th , June , 2002 to discuss the issues involving group policy especially for retirees .

Now UFBU has come out with the various suggestions including clubbing of policies for staff and retirees . It has also urged IBA to bear the expenses for the combined policy as the cost involved for retirees may be borne out of staff welfare fund . The other modifications suggested by UFBU are

1. The existing uniform rate of bed charges/room rent per day at Rs. 5000 uniformly applicable all over the country may be revised and re-fixed in a graded manner according to the areas like, metro, urban, semi-urban, etc. or based on population bracket of the centres.

2. For certain specific treatments, some ceiling or cap may be worked out, if found necessary.

3. The Basic policy can be designed to cover all treatments of normal diseases, surgical treatments but exclude very major and complicated surgical treatments like kidney transplantation, major heart/brain surgeries, etc.

4. These complicated surgeries and otherwise uncommon treatments in the normal course may be made optional at the choice of the insured and at additional premium.

5. The policy relating to in-service employees and retirees can be clubbed together as a single composite Policy with Part I for in-service employees and Part II for retirees.

6. While Part I of the Policy will be applicable to in-service employees and officers, Part II of the Policy to be made applicable to retirees.

7. Part I of the Policy can cover insured amount as per existing Settlement and for Part II applicable to retirees, a separate graded and minimum basic sum assured can be mutually worked out.

8. The premium on this composite and combined Policy to be paid by the respective Banks. As per Government guidelines to Banks F. No. 12/6/32/2006-IR dated 7-2-2007 and IBA communication to Banks No. PD/76/674/ 2006-07/1330 dated 28-2-2007, Banks were advised to allocate a portion of the Staff Welfare Fund towards welfare of retirees. Hence Banks would not find it difficult to pay the premium of

the Policy up to the Basic sum assured.

9. Over and above this, other flexible and additional cover may be offered by the Insurance Companies on an optional basis, for which the retirees would bear the cost of such additional premium.

10. Since medical expenses are not directly related to consumption of goods and services by the insured, Government to be approached for exemption of GST on the premium.

UFBU suggests Merging of policies for staff and Retirees , and request banks to bear the cost :

Dated 09.07.2022 : The group insurance policy taken for bank retirees will expire on 31.10.2022 . The present policy is taken with National Insurance Company .

IBA had constituted a committee of CGMS/ GMS of various public sector banks to handle the issue of renewal of group health insurance policy . A meeting between the committee and UBFU was held on 8th , June , 2002 to discuss the issues involving group policy especially for retirees .

Now UFBU has come out with the various suggestions including clubbing of policies for staff and retirees . It has also urged IBA to bear the expenses for the combined policy as the cost involved for retirees may be borne out of staff welfare fund . The other modifications suggested by UFBU are

1. The existing uniform rate of bed charges/room rent per day at Rs. 5000 uniformly applicable all over the country may be revised and re-fixed in a graded manner according to the areas like, metro, urban, semi-urban, etc. or based on population bracket of the centres.

2. For certain specific treatments, some ceiling or cap may be worked out, if found necessary.

3. The Basic policy can be designed to cover all treatments of normal diseases, surgical treatments but exclude very major and complicated surgical treatments like kidney transplantation, major heart/brain surgeries, etc.

4. These complicated surgeries and otherwise uncommon treatments in the normal course may be made optional at the choice of the insured and at additional premium.

5. The policy relating to in-service employees and retirees can be clubbed together as a single composite Policy with Part I for in-service employees and Part II for retirees.

6. While Part I of the Policy will be applicable to in-service employees and officers, Part II of the Policy to be made applicable to retirees.

7. Part I of the Policy can cover insured amount as per existing Settlement and for Part II applicable to retirees, a separate graded and minimum basic sum assured can be mutually worked out.

8. The premium on this composite and combined Policy to be paid by the respective Banks. As per Government guidelines to Banks F. No. 12/6/32/2006-IR dated 7-2-2007 and IBA communication to Banks No. PD/76/674/ 2006-07/1330 dated 28-2-2007, Banks were advised to allocate a portion of the Staff Welfare Fund towards welfare of retirees. Hence Banks would not find it difficult to pay the premium of

the Policy up to the Basic sum assured.

9. Over and above this, other flexible and additional cover may be offered by the Insurance Companies on an optional basis, for which the retirees would bear the cost of such additional premium.

10. Since medical expenses are not directly related to consumption of goods and services by the insured, Government to be approached for exemption of GST on the premium.

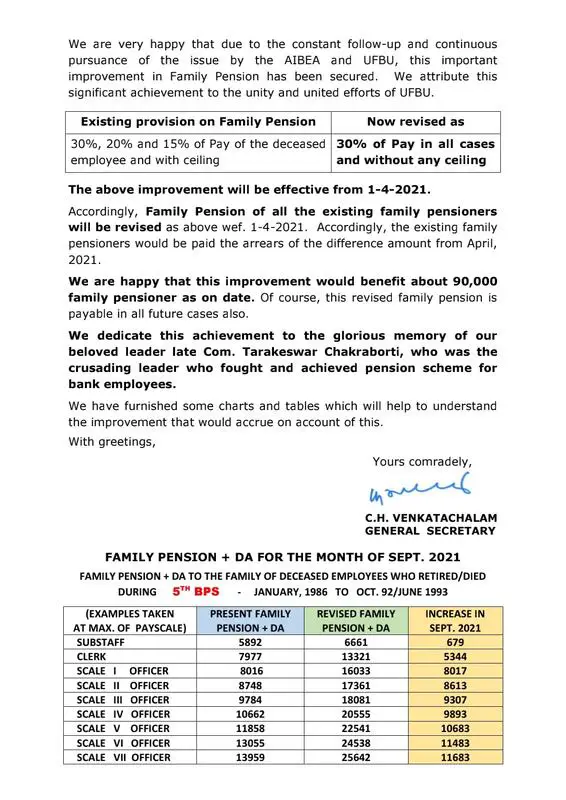

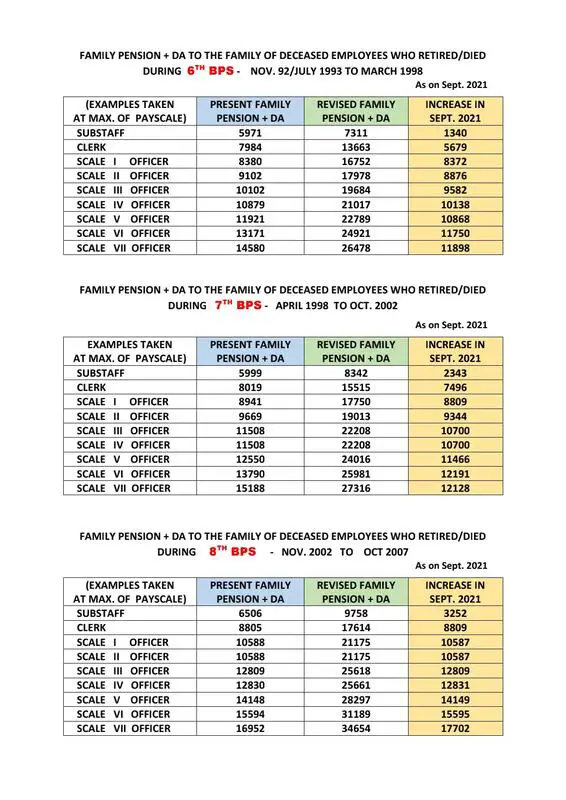

FAMILY PENSION : CLARIFICATION ON MINIMUM PAYABLE

Dated 05.07.2022 : Ceiling on Family Pension was removed and an uniform 30% without any ceiling , effective from 01.04.2021 . Earlier family pensions were administered with 10 % , 20 % 0r 30% with an upper ceiling and a minimum family pension payable .

Now some banks had sought clarification with IBA with regard to minimum pension payable to the family pensioners as some pensioners would be affected by removal of minimum payable . IBA has clarified that the earlier guidelines will continue in all the matters relating to family pension as per earlier guidelines except for implementation of 30 % uniform rate of salary of the deceased employee without any ceiling . Hence minimum family pension as per the earlier guidelines will continue and there will be no reduction of family pension on account of new guidelines .

Source: AIBEA CIRCULAR DATED 04.07.2022

Dated 05.07.2022 : Ceiling on Family Pension was removed and an uniform 30% without any ceiling , effective from 01.04.2021 . Earlier family pensions were administered with 10 % , 20 % 0r 30% with an upper ceiling and a minimum family pension payable .

Now some banks had sought clarification with IBA with regard to minimum pension payable to the family pensioners as some pensioners would be affected by removal of minimum payable . IBA has clarified that the earlier guidelines will continue in all the matters relating to family pension as per earlier guidelines except for implementation of 30 % uniform rate of salary of the deceased employee without any ceiling . Hence minimum family pension as per the earlier guidelines will continue and there will be no reduction of family pension on account of new guidelines .

Source: AIBEA CIRCULAR DATED 04.07.2022

PENSION UPDATION AND IMPROVEMENT OF PENSION SCHEME :

UFBU discusses the subject with IBA :

Dated 03.07.2022 : In the meeting held between IBA and UFBU , UFBU has taken up the following issues relating to pensioners like updation of pension , improvement of pension scheme and income tax exemption on retirement benefits .

UPDATION OF PENSION : IBA told that proposition involves additional cost . Already banks are making additional provisions to meet the shortfall of pension funds . UFBU demanded ex-gratia payment to pre 1986 retirees and improvement of pension for all retirees up to 1st , November 2002 . For retirees after 1.11.2022 , additional cost may be taken out and spread over . As no decision were arrived at , discussions will continue

IMPROVE IN PENSION SCHEME : Other issues discussed included that of Inclusion of a clause allowing periodic updation of pension along with bipartite settlements , full pension of 50% for those retired after 20 years of service , calculation of retirement both on last 10 months pay and the last pay for allowing the most beneficial to the retirees . IBA wanted more time to study and get approval from the government

EXEMPTION OF RETIREMENT BENEFITS FROM INCOME TAX : IBA agreed to take up the matter with the government .

SOURCE : UFBU circular dated 02.07.2022

UFBU discusses the subject with IBA :

Dated 03.07.2022 : In the meeting held between IBA and UFBU , UFBU has taken up the following issues relating to pensioners like updation of pension , improvement of pension scheme and income tax exemption on retirement benefits .

UPDATION OF PENSION : IBA told that proposition involves additional cost . Already banks are making additional provisions to meet the shortfall of pension funds . UFBU demanded ex-gratia payment to pre 1986 retirees and improvement of pension for all retirees up to 1st , November 2002 . For retirees after 1.11.2022 , additional cost may be taken out and spread over . As no decision were arrived at , discussions will continue

IMPROVE IN PENSION SCHEME : Other issues discussed included that of Inclusion of a clause allowing periodic updation of pension along with bipartite settlements , full pension of 50% for those retired after 20 years of service , calculation of retirement both on last 10 months pay and the last pay for allowing the most beneficial to the retirees . IBA wanted more time to study and get approval from the government

EXEMPTION OF RETIREMENT BENEFITS FROM INCOME TAX : IBA agreed to take up the matter with the government .

SOURCE : UFBU circular dated 02.07.2022

AIBEA SEEKS GST CONCESSION ON GROUP INSURANCE PREMIUM FOR RETIREES

Dated 28.06.2022 : In a letter addressed to the Finance Minister Ms Nirmala Sitharaman , AIBEA ( All India Bank Employees Association ) has urged the FM to consider extension of concession / waiver on GST added to the premium payable by Bank retirees on the Group insurance policy .

The letter details how the group insurance policy was introduced as a welfare measure to the retirees and how the steep premium hike that has taken place in the recent years on the group insurance policies . Along with steep hike in the premium , GST component has also grown proportionately and bank retirees are paying up to Rs 6,597 as GST alone along with annual premium up to Rs 36,652 for a mere Rs 4.00 lakhs insurance . Hence AIBEA has requested the FM to consider the plea sympathetically and offer some relief to the bank retirees on GST component .

We have to wait and see the response of the FM on the plea .

To read AIBEA letter dated 28.06.2022 , CLICK HERE

Dated 28.06.2022 : In a letter addressed to the Finance Minister Ms Nirmala Sitharaman , AIBEA ( All India Bank Employees Association ) has urged the FM to consider extension of concession / waiver on GST added to the premium payable by Bank retirees on the Group insurance policy .

The letter details how the group insurance policy was introduced as a welfare measure to the retirees and how the steep premium hike that has taken place in the recent years on the group insurance policies . Along with steep hike in the premium , GST component has also grown proportionately and bank retirees are paying up to Rs 6,597 as GST alone along with annual premium up to Rs 36,652 for a mere Rs 4.00 lakhs insurance . Hence AIBEA has requested the FM to consider the plea sympathetically and offer some relief to the bank retirees on GST component .

We have to wait and see the response of the FM on the plea .

To read AIBEA letter dated 28.06.2022 , CLICK HERE

UFBU suggestions on Group Insurance Policy renewal

RENEWAL OF GROUP INSURANCE POLICY FOR BANK RETIREES :

UFBU suggests Changes :

Dated 11.06.2022 : The group insurance policy taken for bank retirees will expire on 31.10.2022 . The present policy is taken with National Insurance Company .

IBA has constituted a committee of CGMS/ GMS of various public sector banks to handle the issue of renewal of group health insurance policy and the committee had called for a meeting with various constituents of UFBU ( except BEFI ) to discuss the issue on the Wednesday 08th , June 2022 at their office of IBA in Mumbai . The meeting was called to find ways and means of reducing the premium burden on the bank retirees , as premiums have escalated in the last few years and has become unbearable .

In the meeting UFBU representatives have suggested graded rates for bed charges depending up on the place where hospital is situated depending up on Rural , semi-urban or urban center . It has also suggested capping on certain medical packages . Presently the ccap per bed charges for a day is fixed at Rs 5,000 uniformly irrespective of nature of the center .

As the meeting was preliminary in nature , further discussions are expected .

Source : UFBU Circular

UFBU suggests Changes :

Dated 11.06.2022 : The group insurance policy taken for bank retirees will expire on 31.10.2022 . The present policy is taken with National Insurance Company .

IBA has constituted a committee of CGMS/ GMS of various public sector banks to handle the issue of renewal of group health insurance policy and the committee had called for a meeting with various constituents of UFBU ( except BEFI ) to discuss the issue on the Wednesday 08th , June 2022 at their office of IBA in Mumbai . The meeting was called to find ways and means of reducing the premium burden on the bank retirees , as premiums have escalated in the last few years and has become unbearable .

In the meeting UFBU representatives have suggested graded rates for bed charges depending up on the place where hospital is situated depending up on Rural , semi-urban or urban center . It has also suggested capping on certain medical packages . Presently the ccap per bed charges for a day is fixed at Rs 5,000 uniformly irrespective of nature of the center .

As the meeting was preliminary in nature , further discussions are expected .

Source : UFBU Circular

AIBEA Circular on pension updation / DA updation

Dated 31.01.2022 : The average consumer index points have increased in the quarter ending December 2021 to 8239.24 from earlier average of 8088 points . Accordingly the DA slabs have gone up by 37 slabs from 434 slabs to 471 .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2022 to July 2022 will be enhanced by 37 slabs .New DA Rates from February 2022 to July 2022 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 32.97 % of Basic Pay ( 471 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 94.90 % of Basic pension ( 949 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 202.50 % of Basic pension ( 1350 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 267.66 % of Basic pension ( 1487 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 393.12 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 327.60 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 196.56 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 98.28 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

SOURCE: AIBEA circular . AND UPDATED OFFICIAL CIRCULAR FROM IBA

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2022 to July 2022 will be enhanced by 37 slabs .New DA Rates from February 2022 to July 2022 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 32.97 % of Basic Pay ( 471 slabs over 6352 points )

2. Pensioners retired between 01.11.2012 to 31.10 2017 : 94.90 % of Basic pension ( 949 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 202.50 % of Basic pension ( 1350 slabs over 2836 points)

2. Pensioners retired between 01.11.2002 to 31.10 2007 : 267.66 % of Basic pension ( 1487 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 393.12 %

b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 327.60 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 196.56 % of Basic pension exceeding Rs 5,650

d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 98.28 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

SOURCE: AIBEA circular . AND UPDATED OFFICIAL CIRCULAR FROM IBA

BANKPENSIONERS NEWS

Kind Attention BANK PENSIONER Groups : Many bank pensioners and retirees have formed various groups in Google , Facebook and What's app . We invite them to share the contents of this page to their members in the respective groups .

Bank retirees pension updation latest News

UFBU TO PURSUE PENSION UPDATION ISSUE

Dated 15.11.2021 : It is reported that UFBU , in their recent meet held in Mumbai , has decided to follow up on the issue of pension updation and other residual issues with the Chairman of IBA . It will submit a memorandum to him seeking early discussion of the following issues :

1. All Residual issues

2. Updation of pension

3. Medical Insurance scheme for retirees

4. FAQ on issues referred by banks on wage settlement .

UFBU has also decided to run a campaign against privatisation of banks by submitting petition to the Prime Minister , Dharna in all states during Parliament Session and Dharna before parliament .

Dated 15.11.2021 : It is reported that UFBU , in their recent meet held in Mumbai , has decided to follow up on the issue of pension updation and other residual issues with the Chairman of IBA . It will submit a memorandum to him seeking early discussion of the following issues :

1. All Residual issues

2. Updation of pension

3. Medical Insurance scheme for retirees

4. FAQ on issues referred by banks on wage settlement .

UFBU has also decided to run a campaign against privatisation of banks by submitting petition to the Prime Minister , Dharna in all states during Parliament Session and Dharna before parliament .

Bank Family Pension latest News

ENHANCEMENT OF FAMILY PENSION : RBI CLEARS THE DECK

05.10.2021 : Reserve Bank of India ( RBI ) has permitted banks to amortize the expense incurred by them for making payment of enhanced Family Pension . RBI has permitted the banks to amortize the expenses for 5 years from the Financial year 2021-22 and asked the bank to take 20% of the expenses incurred to the Profit & Loss account each year .

Normally the additional liability on account of revision in family pension should be fully charged to the Profit and Loss Account in the current financial year. But, IBA had advised RBI that it would be difficult for some banks to absorb the large amount involved in a single year. Hence RBI has permitted amortization as a special case . The move will help the banks to disburse family pension along with arrears without troubling the financial statements of the bank totally this year .

. It is expected that the enhancement of family pension would make family pension go up to as much as Rs 30,000 to Rs 35,000 per family of bank employees.

To read RBI Notification in this regard , CLICK HERE

05.10.2021 : Reserve Bank of India ( RBI ) has permitted banks to amortize the expense incurred by them for making payment of enhanced Family Pension . RBI has permitted the banks to amortize the expenses for 5 years from the Financial year 2021-22 and asked the bank to take 20% of the expenses incurred to the Profit & Loss account each year .

Normally the additional liability on account of revision in family pension should be fully charged to the Profit and Loss Account in the current financial year. But, IBA had advised RBI that it would be difficult for some banks to absorb the large amount involved in a single year. Hence RBI has permitted amortization as a special case . The move will help the banks to disburse family pension along with arrears without troubling the financial statements of the bank totally this year .

. It is expected that the enhancement of family pension would make family pension go up to as much as Rs 30,000 to Rs 35,000 per family of bank employees.

To read RBI Notification in this regard , CLICK HERE

Pension News

BANKERS PENSION REVISION: RAJYASABHA COMMITTEE VISITS BHUBANESHWAR AND KOLKATTA

Dated 23.09.2021 : It is reported that a Rajya sabha committee has visited Bhabaneshwar in Orissa and Kolkatta in West Bengal as a study tour to examine the assurance given with regard to revision of pension of retired bank employees in reference to 11th Bipartite agreement signed between UFBU and IBA .

The committee had a schedule of meeting representatives of some banks & IBA in the matter on 20.09.2021 at Bhubaneshwar & 23.09.2021 at Kolkata . Representatives of Union bank of India , Indian Overseas Bank and Indian Bank were to meet the committee at Bhubaneshwar while Representatives of UCO Bank , Indian Bank & Punjab National bank are to meet the committee in Kolkatta .

Further it is reported that representatives of various Bank retirees associations have also met and have submitted their memorandum and demands the committee members of the Rajya Sabha .

Dated 23.09.2021 : It is reported that a Rajya sabha committee has visited Bhabaneshwar in Orissa and Kolkatta in West Bengal as a study tour to examine the assurance given with regard to revision of pension of retired bank employees in reference to 11th Bipartite agreement signed between UFBU and IBA .

The committee had a schedule of meeting representatives of some banks & IBA in the matter on 20.09.2021 at Bhubaneshwar & 23.09.2021 at Kolkata . Representatives of Union bank of India , Indian Overseas Bank and Indian Bank were to meet the committee at Bhubaneshwar while Representatives of UCO Bank , Indian Bank & Punjab National bank are to meet the committee in Kolkatta .