HEALTH INSURANCE OPTIONS FOR RETIRED BANKERS

We acknowledge with thanks for the inputs provided by Sri Venkatabhattachar , retired officer from Indian Overseas Bank

READ OUR NEW ARTICLE ON GROUP HEALTH INSURANCE PLANS

WE HAVE UPDATED THIS ARTICLE ON 19.09.2021

Originally published on 24.08.2018 as continuation of our article Retired bankers and Health Insurance

Click to set custom HTML

BANK RETIREES TO HAVE ONE MORE CHANCE TO OPT FOR GROUP INSURANCE :

Dated 09.11.2021: Window to take Group Medical Insurance policy of National Insurance Company for bank retirees was closed by the end of last month . Now National insurance Company is permitting to pay the premium and join the scheme with the same premium and terms & conditions except for the following :

1. Any of the bank retirees who have not joined earlier can join for the scheme

2. Cover for the insurance will begin from 1st, December , 201 and end on 30.10.2022 .

3. New applicants have to pay the premium already prescribed and no pro-rata reduction in premium will be given .

4. Claims for the treatments / hospitalizations during month of November 2021 will not be entertained .

5. No further extension will be offered .

Bank retirees who are interested to join the scheme may contact their banks for further information .

Dated 09.11.2021: Window to take Group Medical Insurance policy of National Insurance Company for bank retirees was closed by the end of last month . Now National insurance Company is permitting to pay the premium and join the scheme with the same premium and terms & conditions except for the following :

1. Any of the bank retirees who have not joined earlier can join for the scheme

2. Cover for the insurance will begin from 1st, December , 201 and end on 30.10.2022 .

3. New applicants have to pay the premium already prescribed and no pro-rata reduction in premium will be given .

4. Claims for the treatments / hospitalizations during month of November 2021 will not be entertained .

5. No further extension will be offered .

Bank retirees who are interested to join the scheme may contact their banks for further information .

In our article on Retired bankers and Health Insurance , we had taken up the issue of health insurance for bankers who were under a group insurance .

Group insurance for retiree bankers were offered to bank retirees for the year 2020-21 by National insurance Company , a public sector indurance company which will end on 31.10.2021 . The insurer now has proposed and agreed by IBA a hike of insurance premium by around 35 % to 40 % for the renewal period of 01.11.2021 to 31.10.2022 . It has caused heartburn for the retirees . Many are unable to pay the enhanced premium as it may take away the pension they receive for few months . In this connection we here discuss the options available to retired bankers if there is no change in the hike . Apart from going in search for a new insurer , other avenues available are to agree for the enhancement , reduce the insurance amount or put limits on services availed at hospital .

Group insurance for retiree bankers were offered to bank retirees for the year 2020-21 by National insurance Company , a public sector indurance company which will end on 31.10.2021 . The insurer now has proposed and agreed by IBA a hike of insurance premium by around 35 % to 40 % for the renewal period of 01.11.2021 to 31.10.2022 . It has caused heartburn for the retirees . Many are unable to pay the enhanced premium as it may take away the pension they receive for few months . In this connection we here discuss the options available to retired bankers if there is no change in the hike . Apart from going in search for a new insurer , other avenues available are to agree for the enhancement , reduce the insurance amount or put limits on services availed at hospital .

LATEST TERMS & CONDITIONS OF GROUP INSURANCE POLICY OF NATIONAL INSURANCE COMPANY :

Dated 13.10.2021 : The following are the terms & conditions of the group insurance policy intimated by the National insurance company for renewal of the group policy for the year 2021-22 with regard to choice of options , room rent & super top up policy for both retired staff and retired officers :

1. Award staff can opt maximum of Rs 3 lakhs base policy and they can chose base insurance range of Rs 1 lakh , Rs 2 Lakhs & Rs 3 lakhs .

2. Officers can opt for base policies of Rs 1 lakh , Rs 2 Lakhs , Rs 3 lakh & Rs 4 lakhs .

3. Super top up policy is only available for retirees chosing either Rs 3 lakh or Rs 4 lakh base policy .

4. Under super top up policy , award staff can chose between Rs 1 lakh to Rs 4 lakhs

5 . Under super top up policy , retiree officers can chose between Rs 1 lakh to Rs 5 lakhs

Regarding Room Rent :

1. Maximum daily room rent payable will be 1.5 % of sum insured and 2 % of sum insured for ICU treatment for policies of base

cover Rs 1 lakh and Rs 2 lakhs .

2. Maximum room rent payable will be Rs 5,000 per day and Rs 7,500 for ICU treatment for policies of base

cover Rs 3 lakh and Rs 4 lakhs .

3. OPD and domiciliary treatments are not covered under super top up policy .

Dated 13.10.2021 : The following are the terms & conditions of the group insurance policy intimated by the National insurance company for renewal of the group policy for the year 2021-22 with regard to choice of options , room rent & super top up policy for both retired staff and retired officers :

1. Award staff can opt maximum of Rs 3 lakhs base policy and they can chose base insurance range of Rs 1 lakh , Rs 2 Lakhs & Rs 3 lakhs .

2. Officers can opt for base policies of Rs 1 lakh , Rs 2 Lakhs , Rs 3 lakh & Rs 4 lakhs .

3. Super top up policy is only available for retirees chosing either Rs 3 lakh or Rs 4 lakh base policy .

4. Under super top up policy , award staff can chose between Rs 1 lakh to Rs 4 lakhs

5 . Under super top up policy , retiree officers can chose between Rs 1 lakh to Rs 5 lakhs

Regarding Room Rent :

1. Maximum daily room rent payable will be 1.5 % of sum insured and 2 % of sum insured for ICU treatment for policies of base

cover Rs 1 lakh and Rs 2 lakhs .

2. Maximum room rent payable will be Rs 5,000 per day and Rs 7,500 for ICU treatment for policies of base

cover Rs 3 lakh and Rs 4 lakhs .

3. OPD and domiciliary treatments are not covered under super top up policy .

PRESENT POSITION OF THE INSURANCE

The existing group policy is expiring on 31st , October 2021 . National Insurance company which has issued the present policy has offered following premium for the next one year :

The existing group policy is expiring on 31st , October 2021 . National Insurance company which has issued the present policy has offered following premium for the next one year :

1. WITHOUT DOMICILIARY

A. AWARD STAFF FOR SUM ASSURED RS 3,00,000 PREMIUM : RS 28,715 + GST RS 5,160 = TOTAL PAYABLE RS 33,884

B. OFFICERS FOR SUM ASSURED RS 4,00,000 PREMIUM : RS 36,652 + GST RS 6,597 = TOTAL PAYABLE RS 43,249

A. AWARD STAFF FOR SUM ASSURED RS 3,00,000 PREMIUM : RS 28,715 + GST RS 5,160 = TOTAL PAYABLE RS 33,884

B. OFFICERS FOR SUM ASSURED RS 4,00,000 PREMIUM : RS 36,652 + GST RS 6,597 = TOTAL PAYABLE RS 43,249

2. WITH DOMICILIARY

A. AWARD STAFF FOR SUM ASSURED RS 3,00,000 PREMIUM : RS 55,175 + GST RS 9,932 = TOTAL PAYABLE RS 65,107

B. OFFICERS FOR SUM ASSURED RS 4,00,000 PREMIUM : RS 72,917 + GST RS 13,125 = TOTAL PAYABLE RS 86,042

A. AWARD STAFF FOR SUM ASSURED RS 3,00,000 PREMIUM : RS 55,175 + GST RS 9,932 = TOTAL PAYABLE RS 65,107

B. OFFICERS FOR SUM ASSURED RS 4,00,000 PREMIUM : RS 72,917 + GST RS 13,125 = TOTAL PAYABLE RS 86,042

The above quotation is around 30 % to 40 % higher than the amount of the premium paid for 2020-21 and hence there is lot of anger / frustration for the retirees . Further the quotation for insurance with domiciliary is of no use to the insured as additional amount payable for domiciliary treatment is much more than the insurance amount . For award staff an amount of Rs 31,223 to be paid additionally for obtaining domiciliary treatment cover of Rs 30,000 . Similarly for officers , additional payment of Rs 42,793 is expected for a cover of Rs 40,000 . Hence the quotes will have no interest to the retirees and practically proposal is as good as saying no cover for domiciliary treatment .

Group policy offered by National insurance Company to bank retirees has some flexibility . The retirees who are unable to pay the premium quoted above can opt for lesser cover amounts from Rs 1.00 lakh to Rs 3.00 lakhs . Spouses of expired retirees can take policy for themselves at a discounted premium . People who are desirous of taking cover for higher amount , can opt for super top policies ( Rs 7.00 lakhs for clerical retirees and Rs 9.00 lakhs for retiree officers ) .

As many of the retirees have expressed their anger or dismay to the proposal for the fresh hiked rates , we checked up the websites of various other insurance companies to find any cheaper options are available .

Group policy offered by National insurance Company to bank retirees has some flexibility . The retirees who are unable to pay the premium quoted above can opt for lesser cover amounts from Rs 1.00 lakh to Rs 3.00 lakhs . Spouses of expired retirees can take policy for themselves at a discounted premium . People who are desirous of taking cover for higher amount , can opt for super top policies ( Rs 7.00 lakhs for clerical retirees and Rs 9.00 lakhs for retiree officers ) .

As many of the retirees have expressed their anger or dismay to the proposal for the fresh hiked rates , we checked up the websites of various other insurance companies to find any cheaper options are available .

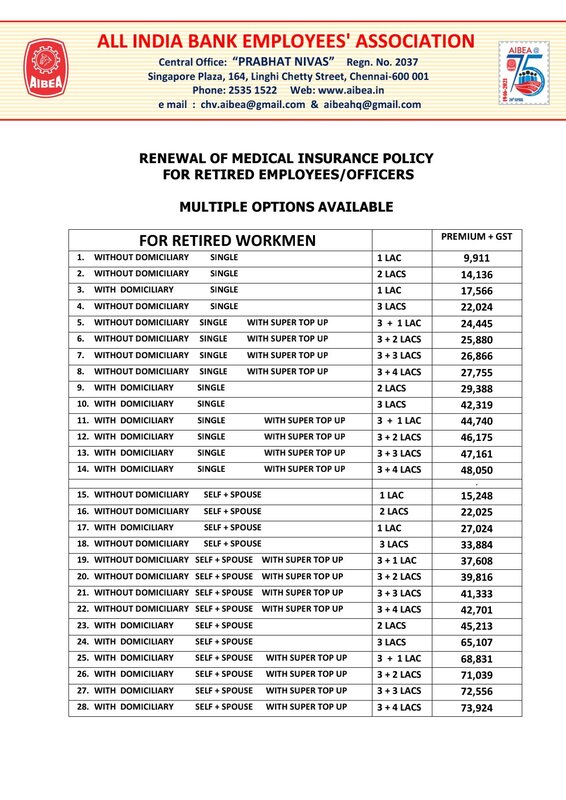

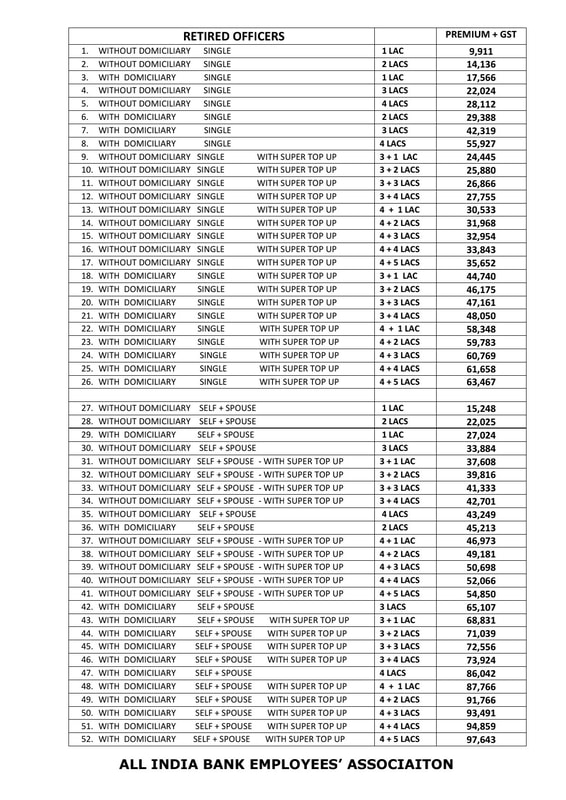

Dated 02.10.2021 AIBEA has published a chart of insurance premium offered by National insurance company for group insurance with multiple options for both Retired staff and retired officers . We are reproducing the charts for the use of retirees

PROS AND CONS OF SWITCHING TO NEW INSURANCE POLICY

If the retirees like to shift from the existing group policy to any other individual cover , we found following hassles they have to face :

1. Existing ailments will not be covered for 24/ 36 / 48 months by the new insurance company . In an advanced age to lose benefit for 2 to 4 years for retirees will be a great risk , unless they have already some insurance individually .

2. Premium will vary in each case and will be based on the age of the retirees , of their family members and of their health conditions . Retirees between 60 to 70 years may get some benefits on premium , but older retirees may not get cover and have to pay higher premium even if an insurance company agrees to issue policy .

3 . Many insurance companies require medical examination and many of the retirees may not be eligible for cover after medical examination .

4 . Some of the insurance companies will have riders limiting claims on various types of claims .

5. Most of the insurance companies will cover 80 % to 90 % of the expenses and balance is to be borne by the policy holders . Presently the group insurance policy has 100 % coverage .

In the circumstances recently retired bankers aged below 65 ( maximum up to 70 years ) may be able to get themselves and their families covered at a lesser premium while the retirees in advanced ages may be left out of any cover , if the existing group cover lapses .

If the retirees like to shift from the existing group policy to any other individual cover , we found following hassles they have to face :

1. Existing ailments will not be covered for 24/ 36 / 48 months by the new insurance company . In an advanced age to lose benefit for 2 to 4 years for retirees will be a great risk , unless they have already some insurance individually .

2. Premium will vary in each case and will be based on the age of the retirees , of their family members and of their health conditions . Retirees between 60 to 70 years may get some benefits on premium , but older retirees may not get cover and have to pay higher premium even if an insurance company agrees to issue policy .

3 . Many insurance companies require medical examination and many of the retirees may not be eligible for cover after medical examination .

4 . Some of the insurance companies will have riders limiting claims on various types of claims .

5. Most of the insurance companies will cover 80 % to 90 % of the expenses and balance is to be borne by the policy holders . Presently the group insurance policy has 100 % coverage .

In the circumstances recently retired bankers aged below 65 ( maximum up to 70 years ) may be able to get themselves and their families covered at a lesser premium while the retirees in advanced ages may be left out of any cover , if the existing group cover lapses .

INVESTMENT OPTIONS FOR SENIOR CITIZENS

CLICK HERE TO READ

CLICK HERE TO READ

ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAAR

e-INSURANCE Account ( eIA )

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAAR

e-INSURANCE Account ( eIA )

ALTERNATE HEALTH INSURANCE COVERS AVAILABLE FOR SENIOR CITIZENS

In case of failure to get a favorable renewed cover for retirees under group insurance , then some retirees may try to find new alternatives to cover themselves . We have searched and found few insurance companies who entertain senior citizens for fresh policies and the details are as follows :

HDFC ERGO HEALTH INSURANCE : Cover is available from Rs 1 lakh to Rs 50 lakhs for senior citizens . For a cover of Rs 3 lakhs for 2 members , premium is from Rs 18,683 to Rs 53,561 + GST . For a cover of Rs 4 Lakhs , premium is from Rs 23,354 to Rs 66,951 . Entry and exit ages are life long . Higher priced products are available with higher benefits . .For website link , CLICK HERE

STAR HEALTH INSURANCE FOR SENIOR CITIZENS : Cover is available from Rs 1 lakh to Rs 25 lakhs for senior citizens . For a cover of Rs 3 lakhs for 1 members , premium is Rs 12,900 + GST up to 75 years . For website link , CLICK HERE

IOB EASY HEALTH in association with APOLLO MUNICH :

Cover is available from Rs 3 lakhs to Rs 10 lakhs for senior citizens . Maximum entry age 69 years . For a cover of Rs 3 lakhs for 2 members , premium starts from Rs 12,497 to 15,963 ( Inclusive of GST ) depending up on age up to 75 years . For website link , CLICK HERE

We have sampled out some of the alternate insurance cover available above . For complete list of health insurers and their websites , CLICK HERE

There are websites which offer comparing insurance policies and their premium like policybazaar.com and bankbazaar.com . One can also go to such sites and compare .

Please note that some of the websites of insurance companies , compare sites ask for your personal details before giving you a quote for premium and such companies will make follow up calls which may be irritating .

In case of failure to get a favorable renewed cover for retirees under group insurance , then some retirees may try to find new alternatives to cover themselves . We have searched and found few insurance companies who entertain senior citizens for fresh policies and the details are as follows :

HDFC ERGO HEALTH INSURANCE : Cover is available from Rs 1 lakh to Rs 50 lakhs for senior citizens . For a cover of Rs 3 lakhs for 2 members , premium is from Rs 18,683 to Rs 53,561 + GST . For a cover of Rs 4 Lakhs , premium is from Rs 23,354 to Rs 66,951 . Entry and exit ages are life long . Higher priced products are available with higher benefits . .For website link , CLICK HERE

STAR HEALTH INSURANCE FOR SENIOR CITIZENS : Cover is available from Rs 1 lakh to Rs 25 lakhs for senior citizens . For a cover of Rs 3 lakhs for 1 members , premium is Rs 12,900 + GST up to 75 years . For website link , CLICK HERE

IOB EASY HEALTH in association with APOLLO MUNICH :

Cover is available from Rs 3 lakhs to Rs 10 lakhs for senior citizens . Maximum entry age 69 years . For a cover of Rs 3 lakhs for 2 members , premium starts from Rs 12,497 to 15,963 ( Inclusive of GST ) depending up on age up to 75 years . For website link , CLICK HERE

We have sampled out some of the alternate insurance cover available above . For complete list of health insurers and their websites , CLICK HERE

There are websites which offer comparing insurance policies and their premium like policybazaar.com and bankbazaar.com . One can also go to such sites and compare .

Please note that some of the websites of insurance companies , compare sites ask for your personal details before giving you a quote for premium and such companies will make follow up calls which may be irritating .

OUR OPINION :

The proposed premium schedule by the present insurer , although substantially hiked , still compares well with insurance cover provided by others . But there are insurance companies who offer lower premiums for the retirees below 70 years age . For example , HDFC Ergo offers premium of Rs 18,683 plus GST for senior citizens aged between 61 to 65 years and Rs 23,354 plus GST for Rs 4.00 lakhs cover for the same age group . But group insurance premium is much higher than the above quoted premium . But any migration to other insurance companies individually will deprive the retirees of cover for existing diseases and older retirees may be left out without any cover .

Hence retirees below the age 70 years , who are having no premedical condition like Diabetes , Blood Pressure and have no medical history , may consider migration to other insurance companies . But for all others , there no option other than continuing with the present arrangement .

The proposed premium schedule by the present insurer , although substantially hiked , still compares well with insurance cover provided by others . But there are insurance companies who offer lower premiums for the retirees below 70 years age . For example , HDFC Ergo offers premium of Rs 18,683 plus GST for senior citizens aged between 61 to 65 years and Rs 23,354 plus GST for Rs 4.00 lakhs cover for the same age group . But group insurance premium is much higher than the above quoted premium . But any migration to other insurance companies individually will deprive the retirees of cover for existing diseases and older retirees may be left out without any cover .

Hence retirees below the age 70 years , who are having no premedical condition like Diabetes , Blood Pressure and have no medical history , may consider migration to other insurance companies . But for all others , there no option other than continuing with the present arrangement .

|

New Updated Article

TAX PLANNING FOR FY 2021-22 ( AY 2022-23 ) Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation CLICK HERE TO READ |

|