GOVERNMENT SECURITIES - You can trade direct through RBI

PUBLIC PROVIDENT FUND NSC/KVP BANK DEPOSITS CORPORATE DEPOSITS CORPORATE BONDS

FOR INTEREST RATES ON ALL SMALL SAVINGS ACCOUNTS , CLICK HERE

FOR INCOME TAX NEWS , CLICK HERE FOR BANKING NEWS CLICK HERE FOR NEWS ON IPO , NCD ETC , CLICK HERE

FOR INCOME TAX NEWS , CLICK HERE FOR BANKING NEWS CLICK HERE FOR NEWS ON IPO , NCD ETC , CLICK HERE

PRIMARY DEALERS TO QUOTE TWO WAYS IN RETAIL DIRECT SCHEME :

Dated 05.01.2022 : Reserve Bank of India ( RBI ) now has asked all the Primary Dealers ( PD ) in the scheme to quote both buy and sell prices while quoting prices in the Odd Lot Segment .

RBI has asked Primary Dealers (PDs) to provide buy and sell quotes on the NDS-OM odd lot segment . All PDs have to provide buy/sell quotes for liquid securities throughout market hours. Alternatively, the secondary market trading time may be divided into time slots and it shall be ensured that PDs provide buy/sell quotes during these time slots for the liquid securities that they hold. Primary Dealers Association of India will decide on the allocation of time slots amongst PDs and inform the same to RBI.

In the Request-For-Quotes (RFQ) segment , PDs have to be present on the RFQ platform throughout market hours.

Any request for buy/sell from the Retail Direct Gilt Account Holders have be responded to by the PDs with a market-relevant quote.

The move of RBI is expected to promote more retail participation in Government Securities by providing better transparency to the prices quoted and the prices/quotes to Retail Direct Gilt (RDG) account holders will be nearer to market prices and encourage retail participation in buy/sell securities under the RBI Retail Direct Scheme.

To go through the RBI Notification , CLICK HERE

Dated 05.01.2022 : Reserve Bank of India ( RBI ) now has asked all the Primary Dealers ( PD ) in the scheme to quote both buy and sell prices while quoting prices in the Odd Lot Segment .

RBI has asked Primary Dealers (PDs) to provide buy and sell quotes on the NDS-OM odd lot segment . All PDs have to provide buy/sell quotes for liquid securities throughout market hours. Alternatively, the secondary market trading time may be divided into time slots and it shall be ensured that PDs provide buy/sell quotes during these time slots for the liquid securities that they hold. Primary Dealers Association of India will decide on the allocation of time slots amongst PDs and inform the same to RBI.

In the Request-For-Quotes (RFQ) segment , PDs have to be present on the RFQ platform throughout market hours.

Any request for buy/sell from the Retail Direct Gilt Account Holders have be responded to by the PDs with a market-relevant quote.

The move of RBI is expected to promote more retail participation in Government Securities by providing better transparency to the prices quoted and the prices/quotes to Retail Direct Gilt (RDG) account holders will be nearer to market prices and encourage retail participation in buy/sell securities under the RBI Retail Direct Scheme.

To go through the RBI Notification , CLICK HERE

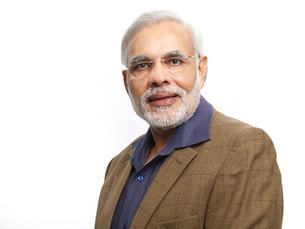

PM INAUGURATES RBI RETAIL DIRECT SCHEME TODAY :

Dated 12.11.2021 : Prime Minister Shri Narenda Modi launched two innovative customer centric initiatives of RBI viz. Retail Direct Scheme and the Reserve Bank - Integrated Ombudsman Scheme, here today via video conference. The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman and the Governor of the Reserve Bank of India Shri Shaktikanta Das were also present at the event.

Referring to the two schemes that have been launched today, the Prime Minister said that these schemes will expand the scope of investment in the country and make access to capital markets easier, more secure for investors. Retail direct scheme has given small investors in the country a simple and safe medium of investment in government securities. Similarly, One Nation, One Ombudsman System has taken shape in the banking sector with the Integrated Ombudsman Scheme today, he said.

To read the Press Release in this regard , CLICK HERE

Dated 12.11.2021 : Prime Minister Shri Narenda Modi launched two innovative customer centric initiatives of RBI viz. Retail Direct Scheme and the Reserve Bank - Integrated Ombudsman Scheme, here today via video conference. The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman and the Governor of the Reserve Bank of India Shri Shaktikanta Das were also present at the event.

Referring to the two schemes that have been launched today, the Prime Minister said that these schemes will expand the scope of investment in the country and make access to capital markets easier, more secure for investors. Retail direct scheme has given small investors in the country a simple and safe medium of investment in government securities. Similarly, One Nation, One Ombudsman System has taken shape in the banking sector with the Integrated Ombudsman Scheme today, he said.

To read the Press Release in this regard , CLICK HERE

RBI RETAIL GILT ACCOUNT TO BUY & SELL GOVERNMENT SECURITIES

RBI Retail Direct’ is a comprehensive scheme which provides the following facilities to retail investors in government securities market through an online portal to :

i) Open and maintain a ‘Retail Direct Gilt Account’ (RDG Account)

ii) Access to primary issuance of Government securities

iii) Access to NDS -OM (Negotiated Dealing System-Order Matching) , Managed by RBI

i) Open and maintain a ‘Retail Direct Gilt Account’ (RDG Account)

ii) Access to primary issuance of Government securities

iii) Access to NDS -OM (Negotiated Dealing System-Order Matching) , Managed by RBI

HOW TO REGISTER AND TRADE IN RBI DIRECT PORTAL ?

For opening Retail Direct Gilt Account ( RDG ) with RBI Direct ,

To go to the RBI RETAIL PORTAL , CLICK HERE .

1. Click on " Open RBI Direct Account " and you will get a new screen

2. Fill Joint Account or Single account , Full Name , PAN Number , e-mail , mobile number , Date of Birth and Log-in name .

3. Accept Terms & Conditions and Submit

You will receive OTP for confirming e-mail , mobile number and registration .

Once your submission is accepted , you have to verify your KYC credential before account is activated .

For KYC process , you have to keep copy of your scanned signature , scanned copy of cancelled cheque .

In case there is an address change , you have to keep a copy of passport or Driving Licence or voter's ID or Proof of Aadhaar number .

Once youe E-KYC is approved, you may start operating the account .

For opening Retail Direct Gilt Account ( RDG ) with RBI Direct ,

To go to the RBI RETAIL PORTAL , CLICK HERE .

1. Click on " Open RBI Direct Account " and you will get a new screen

2. Fill Joint Account or Single account , Full Name , PAN Number , e-mail , mobile number , Date of Birth and Log-in name .

3. Accept Terms & Conditions and Submit

You will receive OTP for confirming e-mail , mobile number and registration .

Once your submission is accepted , you have to verify your KYC credential before account is activated .

For KYC process , you have to keep copy of your scanned signature , scanned copy of cancelled cheque .

In case there is an address change , you have to keep a copy of passport or Driving Licence or voter's ID or Proof of Aadhaar number .

Once youe E-KYC is approved, you may start operating the account .

What are Government securities that are allowed under RBI RETAIL SCHEME ?

Government securities, for the purpose of this scheme, mean securities issued in form of stock by credit to SGL/CSGL account maintained with RBI as defined under Section 3(iii) of Government Securities Act 2006. These include:

1. Government of India Treasury Bills;

2. Government of India dated securities;

3.Sovereign Gold Bonds (SGB);

4.State Development Loans (SDLs).

1. Government of India Treasury Bills;

2. Government of India dated securities;

3.Sovereign Gold Bonds (SGB);

4.State Development Loans (SDLs).

GOVERNMENT OF INDIA TREASURY BILLS

Treasury bills are money market instruments issued as a promissory note guaranteed repayment at a later date by the Government of India . Funds collected through the treasury bills are used to meet short term requirements of the government, hence and to reduce the overall fiscal deficit of a country.

At present, the Government of India issues four types of treasury bills, namely, 14-day, 91-day, 182-day and 364-day. They are available for Rs.25,000 and in multiples of Rs. 25,000. T-bills are issued at a discount and are redeemed at par.

At present, the Government of India issues four types of treasury bills, namely, 14-day, 91-day, 182-day and 364-day. They are available for Rs.25,000 and in multiples of Rs. 25,000. T-bills are issued at a discount and are redeemed at par.

GOVERNMENT OF INDIA DATED SECURITIES

Government Bonds or Dated G-Securities are those government securities which are issued for a longer period either at a fixed or floating interest rate (Coupon). The coupon on Dated G-securities are paid on face value and the maturity period varies from 5 years to 40 years.

For the list of present outstanding dated securities , CLICK HERE

For the list of present outstanding dated securities , CLICK HERE

SOVEREIGN GOLD BOND SCHEME 2021-22

Sovereign Gold Bond Scheme 2021-22 Series VII , VIII , IX & X

Dated 24.10.201 : Government of India has vide its Notification No F.No4.(5)-B (W&M)/2021 dated October 21, 2021 has announced the extension of Sovereign Gold Bond Scheme 2021-22 and add Series VII, VIII, IX and X to the scheme . . Under the scheme there will be a distinct series (starting from Series VII) for every tranche. The terms and conditions of the issuance of the Bonds shall be as per the above notification.

The Bonds will be sold through Scheduled Commercial banks (except Small Finance Banks and Payment Banks), Stock Holding Corporation of India Limited (SHCIL), Clearing Corporation of India Limited (CCIL), designated post offices, and recognised stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange Limited.

ISSUE DATES FOR VARIOUS TRANCHE :

7. 2021-22 Series VII DATE OF SUBSCRIPTION : October 25 - 29, 2021 ISSUE DATE : November 02, 2021

8. 2021-22 Series VIII DATE OF SUBSCRIPTION November 29 - December 03, 2021 ISSUE DATE DDecember 07, 2021

9. 2021-22 Series IX DATE OF SUBSCRIPTION January 10 2022 - 14, 2022 ISSUE DATE January 18, 2022

10. 2021-22 Series X DATE OF SUBSCRIPTION February 28, 2022 to March-04, 2022 ISSUE DATE March 08, 2022

To read RBI Notification , CLICK HERE

Sovereign Gold Bond Scheme 2021-22 Series II,III,IV, V & VI

Dated 30.05.201 : Issue Price for Series III ( May 31 – June 1 , 2021 ) is ₹ 4, 839 /- per gram of gold.

Dated 24.05 .2021 : Issue Price for Series II ( May 24 – May 28, 2021 ) is ₹ 4,792 /- per gram of gold.

: Government of India has announced the Sovereign Gold Bond Scheme 2021-22, Series I, II, III , IV , V & VI . Under the scheme there will be a distinct series (starting from Series I for every tranche) . The terms and conditions of the issuance of the Bonds shall be as below :

1 . Bonds will be issued by Reserve Bank of India on behalf of the Government of India.

2. The Bonds will be sold only to to resident individuals, HUFs, Trusts, Universities and Charitable Institutions.

4. The Bonds will be denominated in multiples of gram(s) of gold with a basic unit of 1 gram.

5. Bonds will be for a period of 8 years with exit option after 5th year to be exercised on the next interest payment dates.

6. Individuals and HUF can subscribe up to 4 KG and 20 Kg limit for trusts .

7. Joint holder In case of joint holding, the investment limit of 4 KG will be applied to the first applicant only.

8. Issue price Price of Bond will be fixed on the basis of simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited for the last 3 working days of the week preceding the subscription period. The issue price of the Gold Bonds will be ₹ 50 per gram less for those who subscribe online and pay through digital mode.

9. One can pay up to ₹ 20,000 by cash and higher amounts can be paid or demand draft or cheque or electronic banking.

10. The Bonds are eligible for conversion into demat form.

11. The redemption price will be based on simple average of closing price of gold of 999 purity, of previous 3 working days published by IBJA Ltd.

12. Bonds will be sold through Commercial banks, Stock Holding Corporation of India Limited (SHCIL), designated post offices (as may be notified) and recognised stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange, either directly or through agents.

13. Interest Rate : 2.50 percent per annum payable semi-annually on the nominal value.

14. Bonds can be used as collateral for loans.

15. KYC documentation Know-your-customer (KYC) norms will be the same as that for purchase of physical gold. KYC documents such as Voter ID, Aadhaar card/PAN or TAN /Passport will be required. Every application must be accompanied by the ‘PAN Number’ issued by the Income Tax Department to individuals and other entities.

16. Interest is taxable . But no capital gains tax to be paid on redemption . The indexation benefits will be provided to long term capital gains arising to any person on transfer of bond.

17. Bonds will be tradable on stock exchanges.

ISSUE DATES FOR VARIOUS TRANCHE :

1. 2021-22 Series I DATE OF SUBSCRIPTION : May 17 - 21, 2021 ISSUE DATE : May 25, 2021

2. 2021-22 Series II DATE OF SUBSCRIPTION May 24 - 28, 2021 ISSUE DATE June 01, 2021

3. 2021-22 Series III DATE OF SUBSCRIPTION May 31 2021 - June 04, 2021 ISSUE DATE June 08, 2021

4. 2021-22 Series IV DATE OF SUBSCRIPTION July 12-16, 2021 ISSUE DATE July 20, 2021

5. 2021-22 Series V DATE OF SUBSCRIPTION August 09- 13 , 2021 ISSUE DATE August 17, 2021

6. 2021-22 Series VI DATE OF SUBSCRIPTION Augut 30 , 2021 - September03, 2021 ISSUE DATE September 07, 2021

To read RBI Notification , CLICK HERE and HERE

STATE DEVELOPMENT LOANS ( SDL )

State Developments Loans ( SDL ) are similar to dated securities of Government of india , but are issued and managed by state governments in India .

SDLs are auctioned by the RBI through the e-Kuber which is dedicated electronic auction system for government securities and other instruments. RBI holds SDL auctions once in a fortnight.

SDLs are auctioned by the RBI through the e-Kuber which is dedicated electronic auction system for government securities and other instruments. RBI holds SDL auctions once in a fortnight.

Who can open account in RBI Retail direct scheme ?

Retail investors ,who are individuals , can register under the Scheme and maintain a RDG Account, if they have the following:

i) Rupee savings bank account maintained in India;

ii) Permanent Account Number (PAN) issued by the Income Tax Department;

iii) Any OVD for KYC purpose;

iv) Valid email id; and

v) Registered mobile number.

However the RDG account can be opened singly or jointly with another retail investor who meets the eligibility criteria.

Non-Resident retail investors, who are eligible to invest in Government Securities under Foreign Exchange Management Act, 1999, are also eligible to open the account under the scheme.

i) Rupee savings bank account maintained in India;

ii) Permanent Account Number (PAN) issued by the Income Tax Department;

iii) Any OVD for KYC purpose;

iv) Valid email id; and

v) Registered mobile number.

However the RDG account can be opened singly or jointly with another retail investor who meets the eligibility criteria.

Non-Resident retail investors, who are eligible to invest in Government Securities under Foreign Exchange Management Act, 1999, are also eligible to open the account under the scheme.

PROCEDURE FOR OPENING AND OPERATING RDG ACCOUNT

Registration

i) Investors can register on the online portal by filling up the online form and use the OTP received on the registered mobile number and email id to authenticate and submit the form.

ii) Instructions issued under RBI-Know Your Customer (KYC) Direction, 2016, updated from time to time, will be adhered to during onboarding the investors. Upon successful registration, ‘Retail Direct Gilt Account’ will be opened and details for accessing the online portal will be conveyed through SMS/e-mail.

iii) RDG Account shall be available for primary market participation as well as secondary market transactions on NDS-OM.

Primary market participation

iv) Participation and allotment of securities will be as per the non-competitive scheme for participation in primary auction of government securities and procedural guidelines for SGB issuance.

v) Only one bid per security is permitted. On submission of the bid, the total amount payable will be displayed.

vi) Payment to the aggregator / receiving office can be made through either of the following ways:

a) Using the net-banking/UPI facility from the linked bank account, whereby funds will be debited at the time of submission of bids on the portal.

b) Using the UPI facility, whereby funds in the linked bank account can be blocked at the time of submission of bids on the portal which will be debited from this account on successful allotment in the auction. Similar facility through banks will be made available in due course.

c) Refund, if any, will be credited to the investor’s bank account as per the timelines specified by the aggregator.

vii) Allotted securities will be issued to the investors by credit to their RDG Account on the day of settlement.

Secondary market transaction-NDS-OM

viii) Registered investors can access the secondary market transaction link on the online portal to buy or sell government securities through NDS-OM (odd lot segment/RFQ).

Buy

ix) Payment can be made through either of the following ways:

Sell

xi) Securities identified for sale will be blocked at the time of placing order till the settlement of the trade.

xii) Funds from the sale transactions will be credited to the linked bank account on the day of settlement.

Non-Trade transactions – Value Free Transactions (VFT)

xiii) Transactions permitted under VFT guidelines issued by RBI on November 16, 2018, as amended from time to time, as applicable to retail investors, will be available under the scheme.

xiv) For such purposes, the investors should submit an application on the online portal.

V. Investor services

Registered investors can use the online portal for the following investor services:

a. Account Statement

Transaction history and balance position of securities holdings in the Retail Direct Gilt Account can be obtained from the link provided. All transaction alerts will be provided through e-mail/SMS.

b. Nomination facility

The nomination form in the prescribed format duly signed can be filled up and uploaded. There can be a maximum of two nominees. In the event of death of the registered investor, the securities available in the RDG Account can be transmitted to the RDG Account or any other Government securities account of the nominee on submission of death certificate and transmission form.

c. Pledge/Lien

Securities held in the RDG Account will be available for pledge/lien.

d. Gift Transactions

‘Retail Direct Investors’ will have an online facility to gift government securities to other Retail Direct Investors.

Fee and charges for RDG

To go through RBI Circular CLICK HERE

i) Investors can register on the online portal by filling up the online form and use the OTP received on the registered mobile number and email id to authenticate and submit the form.

ii) Instructions issued under RBI-Know Your Customer (KYC) Direction, 2016, updated from time to time, will be adhered to during onboarding the investors. Upon successful registration, ‘Retail Direct Gilt Account’ will be opened and details for accessing the online portal will be conveyed through SMS/e-mail.

iii) RDG Account shall be available for primary market participation as well as secondary market transactions on NDS-OM.

Primary market participation

iv) Participation and allotment of securities will be as per the non-competitive scheme for participation in primary auction of government securities and procedural guidelines for SGB issuance.

v) Only one bid per security is permitted. On submission of the bid, the total amount payable will be displayed.

vi) Payment to the aggregator / receiving office can be made through either of the following ways:

a) Using the net-banking/UPI facility from the linked bank account, whereby funds will be debited at the time of submission of bids on the portal.

b) Using the UPI facility, whereby funds in the linked bank account can be blocked at the time of submission of bids on the portal which will be debited from this account on successful allotment in the auction. Similar facility through banks will be made available in due course.

c) Refund, if any, will be credited to the investor’s bank account as per the timelines specified by the aggregator.

vii) Allotted securities will be issued to the investors by credit to their RDG Account on the day of settlement.

Secondary market transaction-NDS-OM

viii) Registered investors can access the secondary market transaction link on the online portal to buy or sell government securities through NDS-OM (odd lot segment/RFQ).

Buy

ix) Payment can be made through either of the following ways:

- Before start of trading hours or during the day, the investor should transfer funds to the designated account of CCIL (Clearing corporation of NDS-OM) using net-banking/UPI from the linked bank account. Based on actual transfer/success message, a funding limit (Buying Limit) will be given for placing ‘Buy’ orders. At the end of the trading session, any excess funds lying to the credit of the investor will be refunded.

- Using the UPI facility, whereby funds in the linked bank account can be blocked at the time of placing order which will be debited from this account on the day of settlement. Similar facility through banks will be made available in due course.

Sell

xi) Securities identified for sale will be blocked at the time of placing order till the settlement of the trade.

xii) Funds from the sale transactions will be credited to the linked bank account on the day of settlement.

Non-Trade transactions – Value Free Transactions (VFT)

xiii) Transactions permitted under VFT guidelines issued by RBI on November 16, 2018, as amended from time to time, as applicable to retail investors, will be available under the scheme.

xiv) For such purposes, the investors should submit an application on the online portal.

V. Investor services

Registered investors can use the online portal for the following investor services:

a. Account Statement

Transaction history and balance position of securities holdings in the Retail Direct Gilt Account can be obtained from the link provided. All transaction alerts will be provided through e-mail/SMS.

b. Nomination facility

The nomination form in the prescribed format duly signed can be filled up and uploaded. There can be a maximum of two nominees. In the event of death of the registered investor, the securities available in the RDG Account can be transmitted to the RDG Account or any other Government securities account of the nominee on submission of death certificate and transmission form.

c. Pledge/Lien

Securities held in the RDG Account will be available for pledge/lien.

d. Gift Transactions

‘Retail Direct Investors’ will have an online facility to gift government securities to other Retail Direct Investors.

Fee and charges for RDG

- No fee will be charged for opening and maintaining ‘Retail Direct Gilt account’ with RBI.

- No fee will be charged by the aggregator for submitting bids in the primary auctions.

- Fee for payment gateway etc., as applicable, will be borne by the registered investor.

To go through RBI Circular CLICK HERE

27.05.2020 : The Union Cabinet had earlier in the month approved extension of Pradhan MantriVayaVandanaYojana (PMVVY) up to 31st March, 2023 . Now Life Insurance Corporation of India has announced the relaunch of Pradhan Mantri VayaVandana Yojana ( Modified 2020 ) scheme and is available for public to invest .

You may go through the salient features of the plan by visiting our page "PRADHANAMANTRI VAYA VANDANA YOJANA ( MODIFIED -2020 ) "

You may go through the salient features of the plan by visiting our page "PRADHANAMANTRI VAYA VANDANA YOJANA ( MODIFIED -2020 ) "

NEW ARTICLE PUBLISHED

TAX PLANNING FOR FY 2022-23 ( AY 20223-24 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

TAX PLANNING FOR FY 2022-23 ( AY 20223-24 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

FOR READING ARTICLE TAX ON RETIREMENT BENEFITS , CLICK HERE

PRECAUTIONS TO BE TAKEN WHILE INVESTING STOCK MARKETS , CLICK HERE

FINANCIAL PLANNING FOR YOUNG , CLICK HERE HOW TO LINK AADHAR WITH PAN ? CLICK HERE

Compare Fixed Deposit Interest rates offered by various banks before investing

VISIT : LATEST BANK DEPOSIT INTEREST RATES - A COMPARISON

PRECAUTIONS TO BE TAKEN WHILE INVESTING STOCK MARKETS , CLICK HERE

FINANCIAL PLANNING FOR YOUNG , CLICK HERE HOW TO LINK AADHAR WITH PAN ? CLICK HERE

Compare Fixed Deposit Interest rates offered by various banks before investing

VISIT : LATEST BANK DEPOSIT INTEREST RATES - A COMPARISON

HAPPY TO RECORD

www.plannprogress.com has crossed

500,000 PAGE VIEWS

THANK ALL READERS , WELL WISHERS WHO HAVE HELPED US TO REACH THE MILESTONE

TO KNOW ABOUT TAX ON RETIREMENT BENEFITS , CLICK HERE

TO KNOW ALL ABOUT IT RETURNS , CLICK HERE

HOW TO LINK AADHAR TO PAN ? CLICK HERE

PLAN YOUR FINANCE PRUDENTLY . For Financial Planning , CLICK HERE

www.plannprogress.com has crossed

500,000 PAGE VIEWS

THANK ALL READERS , WELL WISHERS WHO HAVE HELPED US TO REACH THE MILESTONE

TO KNOW ABOUT TAX ON RETIREMENT BENEFITS , CLICK HERE

TO KNOW ALL ABOUT IT RETURNS , CLICK HERE

HOW TO LINK AADHAR TO PAN ? CLICK HERE

PLAN YOUR FINANCE PRUDENTLY . For Financial Planning , CLICK HERE

DISCLAIMER

We are not SEBI registered advisor and the the articles contained in the website , including this page , is not an investment advice . In case if you are interested in Investing , you may contact your Financial Advisor for the same . We cannot be held for any loss arising out of your investment made as per the article .