BANKERS NEWS

Important Banking News for Bankers and Bank Pensioners /Retirees

BANKERS NEWS- EXCLUSIVELY FOR BANKERS

We have found that we have a large number readers belonging to banking and financial sectors and retirees from the financial sectors . To help such of our readers , we have created this page that gives exclusive news relating to their financial well-being , their expectations and reality of the situation . This page will contain news that , we believe , interests them . Hope our new initiative will be liked by our readers fraternity

DEFINITION OF A FAMILY FOR BANK EMPLOYEES :

Dated 24.03.2024 : In the recently signed bipartite agreement between UFBU and IBA , the definition of a family for bank staff is as follows :

FAMILY of a Bank employee shall include the following family members :

i Employee's spouse,

ii. Wholly dependent unmarried children (including step children and legally adopted children)

iii. wholly dependent physically and mentally challenged brothers I sisters with 40% or more disability,

iv. widowed daughters and dependent divorced I separated daughters,

v. sisters including unmarried/ divorced/ abandoned or separated from husband/ widowed sisters,

vi. parents wholly dependent on the employee.

In the case of physically and mentally challenged children irrespective of age, they shall be construed as dependents even after their marriage subject to however fulfilling the income criteria for dependent .

Dependent's income criteria :

Wholly dependent family member shall mean such member of the family having a monthly income not exceeding Rs.18,000/ (It was Rs. 12,000 under 11th BPS). If the monthly income of the parents exceeds Rs.18,000/- or the aggregate of monthly income of both the parents exceeds Rs.18,000/-, both the parents shall not be considered as wholly dependent on the employee.

Note: For the purpose of medical expenses reimbursement scheme, and Leave Fare Concession, for all employees, any two of the dependent father, mother, father-in law, mother- in-law shall be covered. The employee will have the choice to substitute either of the dependents or both once in a calendar year.

The above criteria for a family member and dependent family member will be applied only

1) for the purpose of availing LFC and

2)for reimbursement hospitalization expenses/coverage under the Medical Insurance Policy,

Dated 24.03.2024 : In the recently signed bipartite agreement between UFBU and IBA , the definition of a family for bank staff is as follows :

FAMILY of a Bank employee shall include the following family members :

i Employee's spouse,

ii. Wholly dependent unmarried children (including step children and legally adopted children)

iii. wholly dependent physically and mentally challenged brothers I sisters with 40% or more disability,

iv. widowed daughters and dependent divorced I separated daughters,

v. sisters including unmarried/ divorced/ abandoned or separated from husband/ widowed sisters,

vi. parents wholly dependent on the employee.

In the case of physically and mentally challenged children irrespective of age, they shall be construed as dependents even after their marriage subject to however fulfilling the income criteria for dependent .

Dependent's income criteria :

Wholly dependent family member shall mean such member of the family having a monthly income not exceeding Rs.18,000/ (It was Rs. 12,000 under 11th BPS). If the monthly income of the parents exceeds Rs.18,000/- or the aggregate of monthly income of both the parents exceeds Rs.18,000/-, both the parents shall not be considered as wholly dependent on the employee.

Note: For the purpose of medical expenses reimbursement scheme, and Leave Fare Concession, for all employees, any two of the dependent father, mother, father-in law, mother- in-law shall be covered. The employee will have the choice to substitute either of the dependents or both once in a calendar year.

The above criteria for a family member and dependent family member will be applied only

1) for the purpose of availing LFC and

2)for reimbursement hospitalization expenses/coverage under the Medical Insurance Policy,

IMPROVEMENT IN LEAVE RULES

Dated 16.03.2024 : In the recently signed bipartite settlement , following changes / improvements have been made under the leave rules for the staff :

1. When leave is applied by an employee and the same is declined by the Manager, the valid reason for such decline of leave will be informed to the employee so that the employee can take up the matter with higher authorities or with the Union.

2. 2 days of Casual leave may be availed for half a day on 4 occasions in a year out of which 2 occasions would be in the morning and 2 occasions in the afternoon. Note: Casual Leave under this category can be availed after applying 24 hours in advance.

3.A single male parent can avail sick leave for the sickness of his child of 8 years and below by production of medical certificate about child's sickness.

4. Employees can avail sick leave for the sickness of their Special Child of 15 years and below for a maximum period of 10 days in a calendar year by production of medical certificate about child's sickness.

5. Women employees shall be allowed to take one day Sick Leave per month without production of any medical certificate.

6. In case of employees of the age of 58 years and above, if wife or husband falls sick and hospitalized in another centre than the place of work, he/she need not avail privilege leave and they will be granted sick leave (maximum of 30 days in a calendar year). This will help the employee to conserve his/her privilege leave which can be encashed at the time of retirement.

7. Employees shall be granted sick leave at the rate of one month for each year of service subject to a maximum of 720 days. (24 years x 30 days). (now it is 540 days for 18 years, then another 90 days after 24 years and another 90 days after 30 years, i.e. 720 days in 33 years)

8. In case of delivery of more than two children in one single delivery, Maternity Leave shall be granted upto 12 months continuously.

9. Maternity Leave shall be granted to a female employee for a maximum period of 9 months, for legally adopting a child who is below one year of age.

10. Maternity Leave will be granted for In vitro fertility (IVF) treatment subject

to production of medical certificate, within the overall limit of 12 months.

11. Special maternity leave upto 60 days shall be granted in case of still born or death of the infant within 28 days of birth.

12. Employees shall be granted Bereavement Leave on the demise of the family members (spouse, children, parents and parent-in-law) and number of days of such leave shall be decided by each Bank at their level.

13. For calculating privilege leave, casual leave and mandatory leave will not be excluded.

14. Principal Office bearers of All India Workmen Unions/Associations (AIBEA, NCBE, etc) shall be granted Special Leave upto 25 days in a calendar year. 15. Advance notice of 10 days for availing privilege leave will be waived for office bearers and Executive Committee members of a registered trade union.

16. Employees who are Defence Representatives in departmental enquiry proceedings will be granted one day special leave for the purpose of preparing the defence submissions of an employee. Such special leave shall be granted for a maximum of ten occasions in a year.

17. Leave Encashment: Accumulated privilege leave can be encashed upto 255 days now 240 days) at the time of retirement or upon unfortunate death of an employee while in service.

18. Introduction of Leave Bank Scheme: Looking to the contingencies where some of the employees get affected with very major ailments like cancer, cerebral stroke, paralysis, major organ transplantation, end stage liver disease, kidney failure, etc., or on account of major accidents, where the hospitalization, treatment and convalescence is prolonged and where in such cases, employees are absent from office on medical grounds for prolonged periods and have exhausted all the leave to their credit and hence are under compulsion to seek grant of extraordinary leave without pay, it has been agreed to evolve a staff welfare scheme under which provision would be made for voluntary encashment of Privilege Leave by the employees and the monetized value of such leave would be pooled under a Leave Bank system in each Bank out of which, special leave would be sanctioned to the employees affected by such contingencies. A Scheme would be formulated within 90 days.

Source : AIBEA CIRCULAR

Dated 16.03.2024 : In the recently signed bipartite settlement , following changes / improvements have been made under the leave rules for the staff :

1. When leave is applied by an employee and the same is declined by the Manager, the valid reason for such decline of leave will be informed to the employee so that the employee can take up the matter with higher authorities or with the Union.

2. 2 days of Casual leave may be availed for half a day on 4 occasions in a year out of which 2 occasions would be in the morning and 2 occasions in the afternoon. Note: Casual Leave under this category can be availed after applying 24 hours in advance.

3.A single male parent can avail sick leave for the sickness of his child of 8 years and below by production of medical certificate about child's sickness.

4. Employees can avail sick leave for the sickness of their Special Child of 15 years and below for a maximum period of 10 days in a calendar year by production of medical certificate about child's sickness.

5. Women employees shall be allowed to take one day Sick Leave per month without production of any medical certificate.

6. In case of employees of the age of 58 years and above, if wife or husband falls sick and hospitalized in another centre than the place of work, he/she need not avail privilege leave and they will be granted sick leave (maximum of 30 days in a calendar year). This will help the employee to conserve his/her privilege leave which can be encashed at the time of retirement.

7. Employees shall be granted sick leave at the rate of one month for each year of service subject to a maximum of 720 days. (24 years x 30 days). (now it is 540 days for 18 years, then another 90 days after 24 years and another 90 days after 30 years, i.e. 720 days in 33 years)

8. In case of delivery of more than two children in one single delivery, Maternity Leave shall be granted upto 12 months continuously.

9. Maternity Leave shall be granted to a female employee for a maximum period of 9 months, for legally adopting a child who is below one year of age.

10. Maternity Leave will be granted for In vitro fertility (IVF) treatment subject

to production of medical certificate, within the overall limit of 12 months.

11. Special maternity leave upto 60 days shall be granted in case of still born or death of the infant within 28 days of birth.

12. Employees shall be granted Bereavement Leave on the demise of the family members (spouse, children, parents and parent-in-law) and number of days of such leave shall be decided by each Bank at their level.

13. For calculating privilege leave, casual leave and mandatory leave will not be excluded.

14. Principal Office bearers of All India Workmen Unions/Associations (AIBEA, NCBE, etc) shall be granted Special Leave upto 25 days in a calendar year. 15. Advance notice of 10 days for availing privilege leave will be waived for office bearers and Executive Committee members of a registered trade union.

16. Employees who are Defence Representatives in departmental enquiry proceedings will be granted one day special leave for the purpose of preparing the defence submissions of an employee. Such special leave shall be granted for a maximum of ten occasions in a year.

17. Leave Encashment: Accumulated privilege leave can be encashed upto 255 days now 240 days) at the time of retirement or upon unfortunate death of an employee while in service.

18. Introduction of Leave Bank Scheme: Looking to the contingencies where some of the employees get affected with very major ailments like cancer, cerebral stroke, paralysis, major organ transplantation, end stage liver disease, kidney failure, etc., or on account of major accidents, where the hospitalization, treatment and convalescence is prolonged and where in such cases, employees are absent from office on medical grounds for prolonged periods and have exhausted all the leave to their credit and hence are under compulsion to seek grant of extraordinary leave without pay, it has been agreed to evolve a staff welfare scheme under which provision would be made for voluntary encashment of Privilege Leave by the employees and the monetized value of such leave would be pooled under a Leave Bank system in each Bank out of which, special leave would be sanctioned to the employees affected by such contingencies. A Scheme would be formulated within 90 days.

Source : AIBEA CIRCULAR

NO CHANGE IN BANKERS DA

Dated 01 .02.2024 : No change in bankers DA as the average consumer index points have decreased in the quarter ending December 2023 to 9122.33 points from earlier average of 9124.51 points . Accordingly the DA slabs have remained same at 693 .

The next review of DA will be for the month of May 2024 salary

To read AIBEA CIRCULAR on the subject , CLICK HERE

Dated 01 .02.2024 : No change in bankers DA as the average consumer index points have decreased in the quarter ending December 2023 to 9122.33 points from earlier average of 9124.51 points . Accordingly the DA slabs have remained same at 693 .

The next review of DA will be for the month of May 2024 salary

To read AIBEA CIRCULAR on the subject , CLICK HERE

AIBEA WITHDRAWS STRIKE NOTICE :

Dated 18.01.2024 : AIBEA had planned strikes on 19th & 20th, January 2024 to press for their demand for stopping outsourcing of manpower and more recruitment of staff in banks . it had also issued strike notice .

A reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi yesterday . In the meeting IBA reiterated that the above issues are part of charter of demands submitted by the unions and it would be discussed in the on-going 12 th bipartite negotiations . Further IBA will issue circulars to banks to maintain status quo in the matter of outsourcing .

In view of te above development , AIBEA has decided to withdraw the notice / call for the strike .

Dated 18.01.2024 : AIBEA had planned strikes on 19th & 20th, January 2024 to press for their demand for stopping outsourcing of manpower and more recruitment of staff in banks . it had also issued strike notice .

A reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi yesterday . In the meeting IBA reiterated that the above issues are part of charter of demands submitted by the unions and it would be discussed in the on-going 12 th bipartite negotiations . Further IBA will issue circulars to banks to maintain status quo in the matter of outsourcing .

In view of te above development , AIBEA has decided to withdraw the notice / call for the strike .

STRIKE CALL BY CENTRAL BANK OF INDIA EMPLOYEES / OFFICERS WITHDRAWN :

Date 19.12.2023 : Various employee unions and officers associations of Central Bank of India affiliated to AIBEA , AIBOA , INBEF , BEFI & NOBW had given a strike call on 26th , December 2023 pressing their demands for stopping harassment of officers and violation of agreements .

Yesterday discussion between unions and management representatives of CBI took place in the Dy CLC office on all the issues mentioned Strike notice given by the trade unions and an Understanding has been reached . In view of the developments Unions have withdrawn the proposed Strike on 26th December .

Date 19.12.2023 : Various employee unions and officers associations of Central Bank of India affiliated to AIBEA , AIBOA , INBEF , BEFI & NOBW had given a strike call on 26th , December 2023 pressing their demands for stopping harassment of officers and violation of agreements .

Yesterday discussion between unions and management representatives of CBI took place in the Dy CLC office on all the issues mentioned Strike notice given by the trade unions and an Understanding has been reached . In view of the developments Unions have withdrawn the proposed Strike on 26th December .

BANK EMPLOYEES STRIKE DEFERRED :

Dated 25.11.2023 : After AIBEA served notice of strike , a reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi . CLC advised the banks that ID act and settlements should not be violated by banks.

With regard to outsourcing of man power , managements agreed to maintain status quo on outsourcing. With regard to demand for recruitment of adequate staff , it was agreed that manpower policy will be discussed at IBA level. Hence AIBEA agreed to defer the bankwise and statewise strikes and continue the discussions. However all India Strike on 19 and 20 January 2024 is not withdrawn .

Next Conciliation meeting with CLC is scheduled on 12th January 2024 .

To read AIBEA circular on the issue , CLICK HERE

Dated 25.11.2023 : After AIBEA served notice of strike , a reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi . CLC advised the banks that ID act and settlements should not be violated by banks.

With regard to outsourcing of man power , managements agreed to maintain status quo on outsourcing. With regard to demand for recruitment of adequate staff , it was agreed that manpower policy will be discussed at IBA level. Hence AIBEA agreed to defer the bankwise and statewise strikes and continue the discussions. However all India Strike on 19 and 20 January 2024 is not withdrawn .

Next Conciliation meeting with CLC is scheduled on 12th January 2024 .

To read AIBEA circular on the issue , CLICK HERE

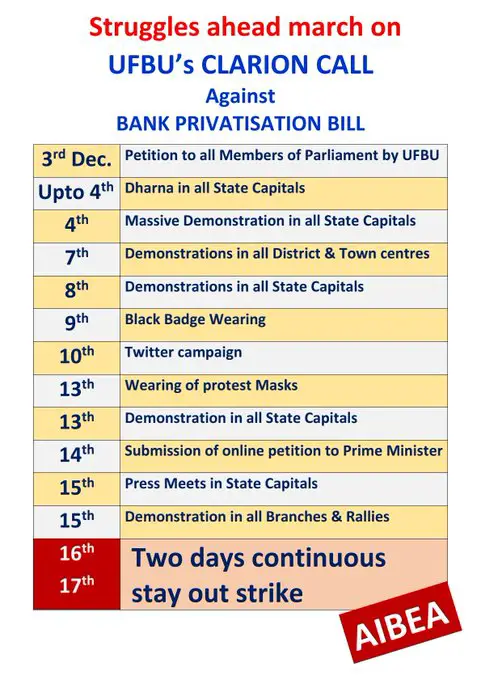

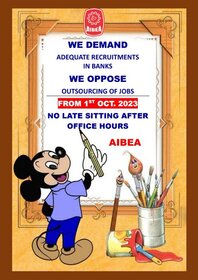

AIBEA ISSUES NOTICE ON PROPOSED STRIKES :

Dated 17.11.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has served notices , under sections 22 of Industrial Dispute Act , to the managements of various banks with regard to their proposal to go on strike in the month of December 2023 and January 2024 to press for their demand for adequate recruitment of staff in the banking industry .

The schedule of strikes is as follows :

04th December 2023 : All India strike in PNB , PSB and State Bank of India

05th December 2023 : All India strike in Bank of India and Bank of Baroda

06th December 2023 : All India strike in Canara Bank and Central Bank of India

07th December 2023 : All India strike in Indian Bank and UCO Bank

08th December 2023 : All India strike in Union Bank of India and Bank of Maharashtra

11th December 2023 : All India strike in private banks

2nd January 2024 : All Banks in Tamilnadu, Kerala, Andhra Pradesh, Telangana, Karnataka, Puducherry, Andaman & Nicobar, Lakshwadeep

3rd January 2024 : All Banks in Gujarat, Maharashtra, Goa, Dadar, Daman, Diu

4th January 2024 : All Banks in Rajasthan, Uttar Pradesh, Madhya Pradesh, Chhattisgarh

5th January 2024 : All Banks in Delhi Punjab, Haryana, J & K, Ladak, Uttarakhand, Himachal Pradesh

6th January 2024 : West Bengal, Odisha, Bihar, Jharkhand, Assam, Tripura, Meghalaya, Manipur, Nagaland, Mizoram, Arunachal Pradesh, Sikkim

19th & 20th , January 2024 : 2 Days Continuous All India Strike in all Banks

Demands made by AIBEA are :

1. Adequate recruitment of Award staff in all the Banks

2. No outsourcing of permanent jobs in Banks

3. Stop violation of provisions of BP settlement relating to outsourcing

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA had launched a nationwide campaign to press for their demand of more recruitments . It had called all its members to not to work beyond the regular office hours from 1st , October 2023 .

Dated 17.11.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has served notices , under sections 22 of Industrial Dispute Act , to the managements of various banks with regard to their proposal to go on strike in the month of December 2023 and January 2024 to press for their demand for adequate recruitment of staff in the banking industry .

The schedule of strikes is as follows :

04th December 2023 : All India strike in PNB , PSB and State Bank of India

05th December 2023 : All India strike in Bank of India and Bank of Baroda

06th December 2023 : All India strike in Canara Bank and Central Bank of India

07th December 2023 : All India strike in Indian Bank and UCO Bank

08th December 2023 : All India strike in Union Bank of India and Bank of Maharashtra

11th December 2023 : All India strike in private banks

2nd January 2024 : All Banks in Tamilnadu, Kerala, Andhra Pradesh, Telangana, Karnataka, Puducherry, Andaman & Nicobar, Lakshwadeep

3rd January 2024 : All Banks in Gujarat, Maharashtra, Goa, Dadar, Daman, Diu

4th January 2024 : All Banks in Rajasthan, Uttar Pradesh, Madhya Pradesh, Chhattisgarh

5th January 2024 : All Banks in Delhi Punjab, Haryana, J & K, Ladak, Uttarakhand, Himachal Pradesh

6th January 2024 : West Bengal, Odisha, Bihar, Jharkhand, Assam, Tripura, Meghalaya, Manipur, Nagaland, Mizoram, Arunachal Pradesh, Sikkim

19th & 20th , January 2024 : 2 Days Continuous All India Strike in all Banks

Demands made by AIBEA are :

1. Adequate recruitment of Award staff in all the Banks

2. No outsourcing of permanent jobs in Banks

3. Stop violation of provisions of BP settlement relating to outsourcing

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA had launched a nationwide campaign to press for their demand of more recruitments . It had called all its members to not to work beyond the regular office hours from 1st , October 2023 .

BANK EMPLOYEES TO GO ON STRIKE :

AIBEA proposes strikes in various banks

Dated 14.11.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has called all its members from various banks to go on strike in the month of December 2023 to press for their demand for adequate recruitment of staff in the banking industry . However the strike will be on different dates as per the following schedule :

04th December 2023 : All India strike in PNB , PSB and State Bank of India

05th December 2023 : All India strike in Bank of India and Bank of Baroda

06th December 2023 : All India strike in Canara Bank and Central Bank of India

07th December 2023 : All India strike in Indian Bank and UCO Bank

08th December 2023 : All India strike in Union Bank of India and Bank of Maharashtra

11th December 2023 : All India strike in private banks

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA has launched a nationwide campaign to press for their demand of more recruitments . It had called all its members to not to work beyond the regular office hours from 1st , October 2023 .

Now AIBEA has proposed its strike plan .

AIBEA proposes strikes in various banks

Dated 14.11.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has called all its members from various banks to go on strike in the month of December 2023 to press for their demand for adequate recruitment of staff in the banking industry . However the strike will be on different dates as per the following schedule :

04th December 2023 : All India strike in PNB , PSB and State Bank of India

05th December 2023 : All India strike in Bank of India and Bank of Baroda

06th December 2023 : All India strike in Canara Bank and Central Bank of India

07th December 2023 : All India strike in Indian Bank and UCO Bank

08th December 2023 : All India strike in Union Bank of India and Bank of Maharashtra

11th December 2023 : All India strike in private banks

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA has launched a nationwide campaign to press for their demand of more recruitments . It had called all its members to not to work beyond the regular office hours from 1st , October 2023 .

Now AIBEA has proposed its strike plan .

BANKERS DA SET FOR AN INCREASE FROM NOVEMBER 2023

Dated 31 .10.2023 : The salary of bankers is set for enhancement from the month of November 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from November 2023 to January 2024 will go up by 61 slabs .

The average consumer index points have increased in the quarter ending September 2023 to 9124.51 points from earlier average of 8881.28 points . Accordingly the DA slabs have gone up by 61 slabs from 632 slabs to 693 . DA as % of Basic pay will increase by 2.52 % from 44.24 % to 48.51 % .

To read AIBEA CIRCULAR on the subject , CLICK HERE

IBA Circular dated 01.11.2023

Dated 31 .10.2023 : The salary of bankers is set for enhancement from the month of November 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from November 2023 to January 2024 will go up by 61 slabs .

The average consumer index points have increased in the quarter ending September 2023 to 9124.51 points from earlier average of 8881.28 points . Accordingly the DA slabs have gone up by 61 slabs from 632 slabs to 693 . DA as % of Basic pay will increase by 2.52 % from 44.24 % to 48.51 % .

To read AIBEA CIRCULAR on the subject , CLICK HERE

IBA Circular dated 01.11.2023

FOR LATEST UPDATES ON BANK PRIVATIZATION :

CABINET PANEL MEETS TO DISCUSS NITI AYOG RECOMMENDATIONS

GOVERNMENT TO AMEND BANKING LAW TO FACILITATE PRIVATISATION : CLICK HERE TO READ

CABINET PANEL MEETS TO DISCUSS NITI AYOG RECOMMENDATIONS

GOVERNMENT TO AMEND BANKING LAW TO FACILITATE PRIVATISATION : CLICK HERE TO READ

Bank Pensioners Latest News Today

AIBEA TO OBSERVE " WORK TO TIME " :

Also proposes 2 days strike

Dated 27.09.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has called all its members from various banks to " Work to Time " from 1st , October 2023 to press for their demand for adequate recruitment of staff in the banking industry .

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA has launched a nationwide campaign to press for their demand of more recruitments . It has called all its members to not to work beyond the regular office hours from 1st , October 2023 .

AIBEA has also proposed 2 days Employees strike on 19th & 20th January 2024 , if bank managements do not respond to the demands by the time .

Also proposes 2 days strike

Dated 27.09.2023 : All India Bank Employees Association ( AIBEA ) , the leading labour union in bank industry , has called all its members from various banks to " Work to Time " from 1st , October 2023 to press for their demand for adequate recruitment of staff in the banking industry .

Bank employees have been complaining of not filling more than 2 lakh vacant positions in the bank which has resulted in additional burden on the existing staff . Hence AIBEA has launched a nationwide campaign to press for their demand of more recruitments . It has called all its members to not to work beyond the regular office hours from 1st , October 2023 .

AIBEA has also proposed 2 days Employees strike on 19th & 20th January 2024 , if bank managements do not respond to the demands by the time .

BANKERS DA SET FOR AN INCREASE FROM AUGUST 2023

Dated 31 .07.2023 : The salary of bankers is set for enhancement from the month of August 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from August 2023 to October 2023 will go up by 36 slabs .

The average consumer index points have increased in the quarter ending June 2023 to 8881.28 points from earlier average of 8736 points . Accordingly the DA slabs have gone up by 36 slabs from 596 slabs to 632 . DA as % of Basic pay will increase by 2.52 % from 41.72 % to 44.24 % .

To read AIBEA circular , CLICK HERE

Official circular is yet to be issued .

Dated 31 .07.2023 : The salary of bankers is set for enhancement from the month of August 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from August 2023 to October 2023 will go up by 36 slabs .

The average consumer index points have increased in the quarter ending June 2023 to 8881.28 points from earlier average of 8736 points . Accordingly the DA slabs have gone up by 36 slabs from 596 slabs to 632 . DA as % of Basic pay will increase by 2.52 % from 41.72 % to 44.24 % .

To read AIBEA circular , CLICK HERE

Official circular is yet to be issued .

IBA MEETS UFBU CONSTITUENTS

YESTERDAY'S MEETING OF UFBU WTH IBA :

Dated 20.07 .2023 : A meeting between IBA and UFBU constituents took place yesterday and and an agreement was reached on retired bankers insurance policy. For the details , click here .

The meeting also discussed residual issues of 11th bipartite settlement along with the delay in commencing 12th bipartite negotiations .

The following Issues were discussed in the meeting :

1. 5 Banking Days per week: IBA assured that the matter is under active consideration . UFBU once again urged for the immediate implementation .

2. Updation of Pension and improvement in Pension Scheme: UFBU raised the issue of updation of pension and also took up the issue of DA neutralization on pension for pre-November, 2002 retirees and emphasized that this issue also needs to be resolved amicably.

3. Charter of Demands for 12th BP Wage Revision: The negotiations will begin shortly and the first meeting will be held on 28.07.2023

To read the AIBEA Circular on the proceedings of the meeting , CLICK HERE

YESTERDAY'S MEETING OF UFBU WTH IBA :

Dated 20.07 .2023 : A meeting between IBA and UFBU constituents took place yesterday and and an agreement was reached on retired bankers insurance policy. For the details , click here .

The meeting also discussed residual issues of 11th bipartite settlement along with the delay in commencing 12th bipartite negotiations .

The following Issues were discussed in the meeting :

1. 5 Banking Days per week: IBA assured that the matter is under active consideration . UFBU once again urged for the immediate implementation .

2. Updation of Pension and improvement in Pension Scheme: UFBU raised the issue of updation of pension and also took up the issue of DA neutralization on pension for pre-November, 2002 retirees and emphasized that this issue also needs to be resolved amicably.

3. Charter of Demands for 12th BP Wage Revision: The negotiations will begin shortly and the first meeting will be held on 28.07.2023

To read the AIBEA Circular on the proceedings of the meeting , CLICK HERE

IBA MEETS UFBU CONSTITUENTS

YESTERDAY'S MEETING OF UFBU WTH IBA :

Dated 22.06 .2023 : A meeting between IBA and UFBU constituents took place yesterday and discussed residual issues of 11th bipartite settlement along with the delay in commencing 12th bipartite negotiations .

The following Issues were discussed in the meeting :

1. Medical Insurance Scheme: UFBU submitted their suggestions in detail like clubbing the policies of in-service employees and retirees, working out a base policy with defined risk coverage, graded bed charges, cap on reimbursement for certain specified treatments like cataract operation, old age ailments, etc . UFBU also sought ythe premium for this base policy to be born by the Banks . Further Top Up schemes on optional basis for which the additional premium to be paid by the retirees. IBA assured to examine these suggestions.

IBA suggested that in order to involve more insurance companies/bidders which will result in their quoting more favourable premium rates, we may consider working out a uniform policy for the retirees along with a uniform policy for the in-service employees and the quotations may be obtained at each Bank level or alternatively reimbursement of hospitalization expenses by the management instead of taking a policy cover.

2. 5 Banking Days per week: UFBU informed the IBA there seems to be no development with regard to the introduction of 5 banking days per week after the mutual discussions held on 28-2-2023 and there is growing anxiety amongst the rank and file over the delay in resolving this important issue. IBA assured that the matter is receiving their best attention and the same is very much in process. UFBU conveyed their dissatisfaction over the delay and that it is difficult to keep further patience in this regard.

3. Updation of Pension and improvement in Pension Scheme: UFBU raised the issue of updation of pension and also referred to the Committee set up the Government in regard to various pension-related issues in SBI. IBA informed that they are quite seized of the matter and . UFBU also took up the issue of DA neutralization on pension for pre-November, 2002 retirees and emphasized that this issue also needs to be resolved amicably.

4 . Charter of Demands for 12th BP Wage Revision: UFBU informed the IBA that despite the assurances during the conciliation meeting and subsequent discussions with IBA, the IBA has not commenced the negotiations on the Charter of Demands and the delay is a matter of concern . After discussion, IBA indicated that the negotiations may commence by mid-July, 2023.

5. Adequate Recruitments in Banks: UFBU pointed out that there is acute shortage of staff in clerical, sub-staff and part-time cadres which is resulting in heavy workload on the staff, pressure on the officers, deficiencies in customer services, etc. and hence Banks should resort to adequate recruitments. IBA stated that recruitments is a bank-level issue and hence IBA has no role in the matter.

YESTERDAY'S MEETING OF UFBU WTH IBA :

Dated 22.06 .2023 : A meeting between IBA and UFBU constituents took place yesterday and discussed residual issues of 11th bipartite settlement along with the delay in commencing 12th bipartite negotiations .

The following Issues were discussed in the meeting :

1. Medical Insurance Scheme: UFBU submitted their suggestions in detail like clubbing the policies of in-service employees and retirees, working out a base policy with defined risk coverage, graded bed charges, cap on reimbursement for certain specified treatments like cataract operation, old age ailments, etc . UFBU also sought ythe premium for this base policy to be born by the Banks . Further Top Up schemes on optional basis for which the additional premium to be paid by the retirees. IBA assured to examine these suggestions.

IBA suggested that in order to involve more insurance companies/bidders which will result in their quoting more favourable premium rates, we may consider working out a uniform policy for the retirees along with a uniform policy for the in-service employees and the quotations may be obtained at each Bank level or alternatively reimbursement of hospitalization expenses by the management instead of taking a policy cover.

2. 5 Banking Days per week: UFBU informed the IBA there seems to be no development with regard to the introduction of 5 banking days per week after the mutual discussions held on 28-2-2023 and there is growing anxiety amongst the rank and file over the delay in resolving this important issue. IBA assured that the matter is receiving their best attention and the same is very much in process. UFBU conveyed their dissatisfaction over the delay and that it is difficult to keep further patience in this regard.

3. Updation of Pension and improvement in Pension Scheme: UFBU raised the issue of updation of pension and also referred to the Committee set up the Government in regard to various pension-related issues in SBI. IBA informed that they are quite seized of the matter and . UFBU also took up the issue of DA neutralization on pension for pre-November, 2002 retirees and emphasized that this issue also needs to be resolved amicably.

4 . Charter of Demands for 12th BP Wage Revision: UFBU informed the IBA that despite the assurances during the conciliation meeting and subsequent discussions with IBA, the IBA has not commenced the negotiations on the Charter of Demands and the delay is a matter of concern . After discussion, IBA indicated that the negotiations may commence by mid-July, 2023.

5. Adequate Recruitments in Banks: UFBU pointed out that there is acute shortage of staff in clerical, sub-staff and part-time cadres which is resulting in heavy workload on the staff, pressure on the officers, deficiencies in customer services, etc. and hence Banks should resort to adequate recruitments. IBA stated that recruitments is a bank-level issue and hence IBA has no role in the matter.

New Updated Article

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 )

Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

EXPEDITE RESOLUTION OF RESIDUAL ISSUES AND COMMENCE NEGOTIATIONS : UFBU

Dated 03.06.2023 : UFBU has one again urged the Indian Bankers Association to begin the negotiation on charter of demand submitted by them and the residual issues of the 11th bipartite settlement like 5 day banking , pension updation and restoration of old pension scheme .

The last meeting between UFBU and IBA was held on 28.02.2023 wherein tentative agreement was reached on 5 day banking and IBA had agreed to take up with DFS for the final approval . But so far IBA has not come out with any final decision on the issue .

UFBU had also submitted Charters of Demands prepared by Employees unions and Officers Associations in the month of October 2022 . The ministry of Finance had given green signal to IBA to go ahead with negotiations while IBS is waiting for the mandate from all affiliated banks .

Now once again UFBU has asked IBA to fix a date for commencement of 12th BPS negotiations pending receipt of mandate from the remaining associate banks .

To read UFBU letter dated 02.06.2023 , CLICK HERE

Dated 03.06.2023 : UFBU has one again urged the Indian Bankers Association to begin the negotiation on charter of demand submitted by them and the residual issues of the 11th bipartite settlement like 5 day banking , pension updation and restoration of old pension scheme .

The last meeting between UFBU and IBA was held on 28.02.2023 wherein tentative agreement was reached on 5 day banking and IBA had agreed to take up with DFS for the final approval . But so far IBA has not come out with any final decision on the issue .

UFBU had also submitted Charters of Demands prepared by Employees unions and Officers Associations in the month of October 2022 . The ministry of Finance had given green signal to IBA to go ahead with negotiations while IBS is waiting for the mandate from all affiliated banks .

Now once again UFBU has asked IBA to fix a date for commencement of 12th BPS negotiations pending receipt of mandate from the remaining associate banks .

To read UFBU letter dated 02.06.2023 , CLICK HERE

FOR NEWS ON DEMONETISTION AND NEW CURRENCY FEATURES CLICK HERE

FOR BANKING TIPS , CLICK HERE FOR INCOME TAX NEWS , CLICK HERE FOR SAFE BANKING TIPS , CLICK HERE

FOR INCOME TAX RETURN FORMS AND INFORMATION , CLICK HERE

FOR BANKING NEWS CLICK HERE

FOR BANKING TIPS , CLICK HERE FOR INCOME TAX NEWS , CLICK HERE FOR SAFE BANKING TIPS , CLICK HERE

FOR INCOME TAX RETURN FORMS AND INFORMATION , CLICK HERE

FOR BANKING NEWS CLICK HERE

BANKERS DA SET FOR A SLIGHT INCREASE FROM MAY 2023

Dated 29 .04.2023 : The salary of bankers is set for enhancement from the month of May 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from May 2023 to July 2023 will go up by 8 slabs .

The average consumer index points have increased in the quarter ending March 2023 to 8763 points from earlier average of 8704 points . Accordingly the DA slabs have gone up by 8 slabs from 588 slabs to 596 . DA as % of Basic pay will increase by 0.56 % from 41.16 % to 41.72 % .

To read AIBEA circular , CLICK HERE

Official circular is yet to be issued .

Dated 29 .04.2023 : The salary of bankers is set for enhancement from the month of May 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from May 2023 to July 2023 will go up by 8 slabs .

The average consumer index points have increased in the quarter ending March 2023 to 8763 points from earlier average of 8704 points . Accordingly the DA slabs have gone up by 8 slabs from 588 slabs to 596 . DA as % of Basic pay will increase by 0.56 % from 41.16 % to 41.72 % .

To read AIBEA circular , CLICK HERE

Official circular is yet to be issued .

DEMAND FOR MIGRATION FROM NPS TO OPS

TO BE ONLY TAKEN UP IN 12TH BIPATITE NEGOTIATIONS :

Dated 08.03.2023 : UFBU had demanded covering all post 01.04.2010 employees and officers under old pension scheme instead of the present New pension scheme and it was one of the residual issues in 11th bipartite settlement .

Now IBA has stated that the issue involves changes in the settlement and hence asked UFBU to take up the matter during the 12th bi-partite negotiations to be held . IBA has forwarded charter of demands submitted by employee unions and officers associations to the member banks and is yet to get to mandate from them for commencing negotiations .

The information is revealed by the circular issued by AIBEA with regard yo UFBU meeting held with IBA on 28.02.2023 .

Source AIBRA circular dated 07.03.2023

TO BE ONLY TAKEN UP IN 12TH BIPATITE NEGOTIATIONS :

Dated 08.03.2023 : UFBU had demanded covering all post 01.04.2010 employees and officers under old pension scheme instead of the present New pension scheme and it was one of the residual issues in 11th bipartite settlement .

Now IBA has stated that the issue involves changes in the settlement and hence asked UFBU to take up the matter during the 12th bi-partite negotiations to be held . IBA has forwarded charter of demands submitted by employee unions and officers associations to the member banks and is yet to get to mandate from them for commencing negotiations .

The information is revealed by the circular issued by AIBEA with regard yo UFBU meeting held with IBA on 28.02.2023 .

Source AIBRA circular dated 07.03.2023

NEW ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

NEW ARTICLES ON

SMALL FINANCE BANKS PAYMENT BANKS

UNIFIED PAYMENT INTERFACE BHARAT BILL PAYMENT SYSTEM

BHIM APP AADHAR

e-INSURANCE Account ( eIA )

RESIDUAL ISSUES

TODAY'S MEETING OF UFBU WTH IBA :

Dated 28.02 .2023 : It is reported that the meeting between IBA and UFBU constituents took place today and discussed residual issues of 11th bipartite settlement . It is reported that the 5 day banking issue has been settled amicably and an agreement has been reached between IBA and UFBU . However agreement needs approval of the finance ministry

It is reported that the following Issues were discussed :

1) UPDATION OF PENSION : IBA will study the complete data such as no. of pensioners, present outgo and future burden etc. Thereafter further discussion will take place.

2) FIVE DAY WEEK : There was discussion on adjustment of working hours, cash hours, customer service hours. This discussion was carried forward from last Meeting on Residual Issues. It was agreed to have uniform office hours from 9.50 am to 5.30 pm on all working days. Cash hours will be from 10 am to 4 pm. Customer Service will be rendered till 4.30 pm. On the above lines , recommendation for Five Day Week will be sent to DFS (Dept of Financial Services) of Govt of India by IBA.

3) Fitment of Ex Servicemen Employees : Ex Servicemen recruited between 1.11.2017 and 10.11.2020 are facing issue of recovery due to anomalies in fitment. IBA has agreed to ensure that Banks don't make any recovery.

4) Medical Insurance : IBA has asked for names of TPAs with cases pending. IBA may have Meeting with those TPAs. IBA is requested to have Meeting with top management of Insurance Company also.

5) Deputation Allowance : In the current settlement quantum of Deputation Allowance is not specified. IBA asked Unions to not to pursue this issue as the settlement is already signed. This issue will be taken care during finalisation of forthcoming Bipartite. Overall tone of the Meeting was positive.

TODAY'S MEETING OF UFBU WTH IBA :

Dated 28.02 .2023 : It is reported that the meeting between IBA and UFBU constituents took place today and discussed residual issues of 11th bipartite settlement . It is reported that the 5 day banking issue has been settled amicably and an agreement has been reached between IBA and UFBU . However agreement needs approval of the finance ministry

It is reported that the following Issues were discussed :

1) UPDATION OF PENSION : IBA will study the complete data such as no. of pensioners, present outgo and future burden etc. Thereafter further discussion will take place.

2) FIVE DAY WEEK : There was discussion on adjustment of working hours, cash hours, customer service hours. This discussion was carried forward from last Meeting on Residual Issues. It was agreed to have uniform office hours from 9.50 am to 5.30 pm on all working days. Cash hours will be from 10 am to 4 pm. Customer Service will be rendered till 4.30 pm. On the above lines , recommendation for Five Day Week will be sent to DFS (Dept of Financial Services) of Govt of India by IBA.

3) Fitment of Ex Servicemen Employees : Ex Servicemen recruited between 1.11.2017 and 10.11.2020 are facing issue of recovery due to anomalies in fitment. IBA has agreed to ensure that Banks don't make any recovery.

4) Medical Insurance : IBA has asked for names of TPAs with cases pending. IBA may have Meeting with those TPAs. IBA is requested to have Meeting with top management of Insurance Company also.

5) Deputation Allowance : In the current settlement quantum of Deputation Allowance is not specified. IBA asked Unions to not to pursue this issue as the settlement is already signed. This issue will be taken care during finalisation of forthcoming Bipartite. Overall tone of the Meeting was positive.

RESIDUAL ISSUES

NEXT MEETING OF UFBU WTH IBA :

Dated 07.02 .2023 : It is reported that the next meeting between IBA and UFBU constituents is fixed for 28th , February 2023 to discuss residual issues of 11th bipartite settlement .

The meeting , is scheduled to begin at 2.00 PM on the day with all invited representatives of UFBU constituents . At 2.30 , IBA will discuss with the representatives of AIBEA , NCNE , NOBW & INBEF and the meeting will end by 3.30 pm

At 3.30 , IBA representatives will meet the representatives of Officers Associations viz AIBOC , INBOC & NOBO .

NEXT MEETING OF UFBU WTH IBA :

Dated 07.02 .2023 : It is reported that the next meeting between IBA and UFBU constituents is fixed for 28th , February 2023 to discuss residual issues of 11th bipartite settlement .

The meeting , is scheduled to begin at 2.00 PM on the day with all invited representatives of UFBU constituents . At 2.30 , IBA will discuss with the representatives of AIBEA , NCNE , NOBW & INBEF and the meeting will end by 3.30 pm

At 3.30 , IBA representatives will meet the representatives of Officers Associations viz AIBOC , INBOC & NOBO .

BANKERS DA SET FOR A INCREASE FROM FEBRUARY 2023

Dated 31 .01.2023 : The salary of bankers is set for enhancement from the month of February 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from February 2023 to April 2023 will go up by 32 slabs .

The average consumer index points have increased in the quarter ending December 2022 to 8705 points from earlier average of 8576.69 points . Accordingly the DA slabs have gone up by 32 slabs from 556 slabs to 588 . DA as % of Basic pay will increase by 2.10 % from 38.92 % to 41.16 % .

Official circular is yet to be issued .

Dated 31 .01.2023 : The salary of bankers is set for enhancement from the month of February 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from February 2023 to April 2023 will go up by 32 slabs .

The average consumer index points have increased in the quarter ending December 2022 to 8705 points from earlier average of 8576.69 points . Accordingly the DA slabs have gone up by 32 slabs from 556 slabs to 588 . DA as % of Basic pay will increase by 2.10 % from 38.92 % to 41.16 % .

Official circular is yet to be issued .

5 days banking :

UFBU AND IBA DIFFER

Dated 31.01.2023 : IBA held meeting today with UFBU constituents with regard to implementation of 5 day banking . IBA proposed to increase 45 min per day in lieu of two Saturdays/month as against the proposal submitted by UFBU for extension of 30 min per day.

It is reported that UFBU suggested total Office hours of 37 hours 30 minutes ( 0945 to 1715 for 5 days ) , IBA wanted to be increased to 38 hrs 45 min per week ( 0945 to 1730 hrs for 5 days ) . Similarly there was a difference in Cash Tran. hours and customer service hours timings also . UFBU proposed cash hours 25 hrs per week ( 0945 to 1515 )while IBA suggested 27 hrs , 30 minutes per week ( ( 0945 hrs to 1545 hrs ) . Similarly UFBU proposed Customer service hours of 30 hrs per week ( 0945 hrs to 1615 hrs ) while IBA suggested 31 hrs 15 minutes 0945 hrs to 1630 .

Now the next meeting is expected to take place before the end of february 2023 .

UFBU AND IBA DIFFER

Dated 31.01.2023 : IBA held meeting today with UFBU constituents with regard to implementation of 5 day banking . IBA proposed to increase 45 min per day in lieu of two Saturdays/month as against the proposal submitted by UFBU for extension of 30 min per day.

It is reported that UFBU suggested total Office hours of 37 hours 30 minutes ( 0945 to 1715 for 5 days ) , IBA wanted to be increased to 38 hrs 45 min per week ( 0945 to 1730 hrs for 5 days ) . Similarly there was a difference in Cash Tran. hours and customer service hours timings also . UFBU proposed cash hours 25 hrs per week ( 0945 to 1515 )while IBA suggested 27 hrs , 30 minutes per week ( ( 0945 hrs to 1545 hrs ) . Similarly UFBU proposed Customer service hours of 30 hrs per week ( 0945 hrs to 1615 hrs ) while IBA suggested 31 hrs 15 minutes 0945 hrs to 1630 .

Now the next meeting is expected to take place before the end of february 2023 .

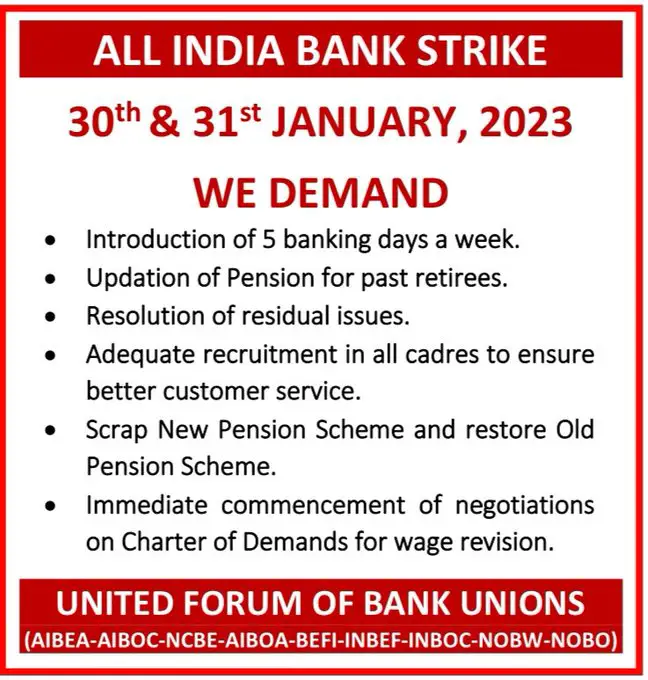

BANKERS' STRIKE DEFERRED

Dated 27.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai had called a meeting on 24.01.2023 and a follow up meeting was arranged today between IBA and UFBU

UFBU has decided to defer the strike call after today's meeting as all the issues raised by them were discussed with IBA /.

Bank unions under the umbrella of UFBU had called for a bank strike on 30th & 31st , January 2023 to press for their various demands .

In the meeting following decisions were taken unanimously :

1. The schedule of meetings will be adhered . If , in any meeting decisions are not arrived , the date next meeting will be decided in the meeting

2. The three issues viz 5 DAY BANKING , UPDATION OF PENSION AND RESTORATION OF OLD PENSION SCHEME , will be discussed in common meetings which will be attended by both officers and staff representatives . All other issues will be separately discussed in meetings with staff unions and officers associations .

3. IBA has sought mandate from banks for initiating negotiations .

4. Modality for implementing 5 day banking will be finalized within a month .

To read the minutes of the meeting held on 27.01.2023 , CLICK HERE

Dated 27.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai had called a meeting on 24.01.2023 and a follow up meeting was arranged today between IBA and UFBU

UFBU has decided to defer the strike call after today's meeting as all the issues raised by them were discussed with IBA /.

Bank unions under the umbrella of UFBU had called for a bank strike on 30th & 31st , January 2023 to press for their various demands .

In the meeting following decisions were taken unanimously :

1. The schedule of meetings will be adhered . If , in any meeting decisions are not arrived , the date next meeting will be decided in the meeting

2. The three issues viz 5 DAY BANKING , UPDATION OF PENSION AND RESTORATION OF OLD PENSION SCHEME , will be discussed in common meetings which will be attended by both officers and staff representatives . All other issues will be separately discussed in meetings with staff unions and officers associations .

3. IBA has sought mandate from banks for initiating negotiations .

4. Modality for implementing 5 day banking will be finalized within a month .

To read the minutes of the meeting held on 27.01.2023 , CLICK HERE

STRIKE CALL : CONCILATORY MEETING ADJOURNED :

Dated 24.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai had called a meeting today in their Mumbai office and invited the representatives of IBA and member unions of UFBU .

It is reported that the today's meeting between IBA and the unions was inconclusive and adjourned to the Friday 27th , January 2023 for further negotiations .

Bank unions under the umbrella of UFBU have called for a bank strike on 30th & 31st , January 2023 to press for their various demands .

Dated 24.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai had called a meeting today in their Mumbai office and invited the representatives of IBA and member unions of UFBU .

It is reported that the today's meeting between IBA and the unions was inconclusive and adjourned to the Friday 27th , January 2023 for further negotiations .

Bank unions under the umbrella of UFBU have called for a bank strike on 30th & 31st , January 2023 to press for their various demands .

STRIKE CALL : CLC CALLS FOR CONCILATORY MEETING :

Dated 19.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai has called a meeting in their Mumbai office on 24th, January 2023 and invited the representatives of IBA and member unions of UFBU . The meeting is called under Industrial dispute Act and is aimed at bringing an amicable settlement to avoid the proposed strike on 30th & 31st , January 2023 .

Dated 19.01.2023 : In response to the strike notice issued by UFBU , Office of the Deputy Labour Commissioner, Mumbai has called a meeting in their Mumbai office on 24th, January 2023 and invited the representatives of IBA and member unions of UFBU . The meeting is called under Industrial dispute Act and is aimed at bringing an amicable settlement to avoid the proposed strike on 30th & 31st , January 2023 .

WAGE SETTLEMENT - RESIDUAL ISSUES

UFBU REVIVES AGITATIONAL PLAN :

Dated 13.01.2023 : UFBU ( United Forum of Bank Unions ) held a meeting yesterday in Mumbai to discuss the progress made on residual issues left out in the 11th Bipartite settlement . Since there is no response from IBA on the demands made by UFBU and followed on with letters , it was decided to revive their agitation and to give a call for strike on 30th and 31st January 2023 on the following demands:

1. Five Day banking :

2. Updation of Pension :

3. Improvement of pension scheme :

4. Scrap NPS :

5. Immediate starting of negotiations on charter of demands submitted by UFBU

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations . Representatives of UFBU had met IBA representatives , last time in September 2022 to discuss the residual issues , They had also submitted the charter of Demands in October 2022 with regard to wage revision as earlier agreement has lapsed in October 2022 . UFBU also has submitted a proposal in December 2022 for introduction of 5 day banking .

UFBU REVIVES AGITATIONAL PLAN :

Dated 13.01.2023 : UFBU ( United Forum of Bank Unions ) held a meeting yesterday in Mumbai to discuss the progress made on residual issues left out in the 11th Bipartite settlement . Since there is no response from IBA on the demands made by UFBU and followed on with letters , it was decided to revive their agitation and to give a call for strike on 30th and 31st January 2023 on the following demands:

1. Five Day banking :

2. Updation of Pension :

3. Improvement of pension scheme :

4. Scrap NPS :

5. Immediate starting of negotiations on charter of demands submitted by UFBU

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations . Representatives of UFBU had met IBA representatives , last time in September 2022 to discuss the residual issues , They had also submitted the charter of Demands in October 2022 with regard to wage revision as earlier agreement has lapsed in October 2022 . UFBU also has submitted a proposal in December 2022 for introduction of 5 day banking .

5 days banking :

UFBU SUBMITS REVISED PROPOSAL

Dated 17.12.2022 : The workmen unions , viz AIBEA , NCBE , NOBW & INBEF had suggested to IBA to enhance the working hours per day by 30 minutes and to prepone the present working hours by 30 minutes in the morning. for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays . 5 day banking is one of the important residual issues left out in the bipartite settlement . While workmen unions wanted preponement of working hours by 30 minutes , officers associations had proposed extending the working hours at the end of the day .

Now UFBU had a meeting of its constituents on 15th , December 2022 and has recommended to IBA fresh compromise proposal to the IBA .

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations .

The suggestions made by the UFBU are are

1. Present working hours may be increased by 30 minutes per day.

2. All Saturdays and Sundays to be declared as holidays .

3. Present respective timings of working hours may be preponed by 15 minutes in the morning and increased by 15 minutes in the evening .

4. Existing customer service hours/non-cash transaction banking hours may be increased by 30 minutes.

5. Existing cash transaction hours to remain the same.

UFBU has requested for an early decision by the IBA .

To read AIBEA circular in this regard , CLICK HERE

UFBU SUBMITS REVISED PROPOSAL

Dated 17.12.2022 : The workmen unions , viz AIBEA , NCBE , NOBW & INBEF had suggested to IBA to enhance the working hours per day by 30 minutes and to prepone the present working hours by 30 minutes in the morning. for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays . 5 day banking is one of the important residual issues left out in the bipartite settlement . While workmen unions wanted preponement of working hours by 30 minutes , officers associations had proposed extending the working hours at the end of the day .

Now UFBU had a meeting of its constituents on 15th , December 2022 and has recommended to IBA fresh compromise proposal to the IBA .

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations .

The suggestions made by the UFBU are are

1. Present working hours may be increased by 30 minutes per day.

2. All Saturdays and Sundays to be declared as holidays .

3. Present respective timings of working hours may be preponed by 15 minutes in the morning and increased by 15 minutes in the evening .

4. Existing customer service hours/non-cash transaction banking hours may be increased by 30 minutes.

5. Existing cash transaction hours to remain the same.

UFBU has requested for an early decision by the IBA .

To read AIBEA circular in this regard , CLICK HERE

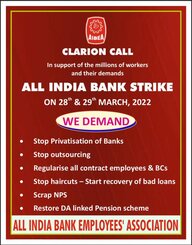

AIBEA DEFERS THE STRIKE PLAN FOR A DAY'S STRIKE :

Dated 20.11.2022 : All India Bank Employees Union ( AIBEA ), the leading employees union in the banking industry had given a call to its member to observe a day's strike on 19th , November 2022 . The call was given in protest against " the increasing attacks in various banks , against its leaders and attack on workmen rights "

After a series of discussion with IBA and concerned bank managements under the guidance of CLC ( Chief Labour Commissioner ) , assurances were given by CLC with regard to holding of bilateral meetings on various issues raised by AIBEA . CLC also advised the bank managements to comply labour laws while dealing with labour unions and its office bearers . In view of the assurances , AIBEA hasdeferred the strike plan .

To read the detailed circular of AIBEA dated 18.11.2022 , CLICK HERE

Dated 20.11.2022 : All India Bank Employees Union ( AIBEA ), the leading employees union in the banking industry had given a call to its member to observe a day's strike on 19th , November 2022 . The call was given in protest against " the increasing attacks in various banks , against its leaders and attack on workmen rights "

After a series of discussion with IBA and concerned bank managements under the guidance of CLC ( Chief Labour Commissioner ) , assurances were given by CLC with regard to holding of bilateral meetings on various issues raised by AIBEA . CLC also advised the bank managements to comply labour laws while dealing with labour unions and its office bearers . In view of the assurances , AIBEA hasdeferred the strike plan .

To read the detailed circular of AIBEA dated 18.11.2022 , CLICK HERE

BANKERS DA SET FOR A INCREASE FROM NOVEMBER 2022

Dated 01 .11.2022 : The salary of bankers is set for enhancement from the month of November 2022 , as the Dearness Allowance ( DA ) payable to bank employees / officers from November 2022 to January 2023 will go up by 30 slabs .

The average consumer index points have increased in the quarter ending September 2022 to 8576.69 points from earlier average of 8456 points . Accordingly the DA slabs have gone up by 30 slabs from 526 slabs to 556 . DA as % of Basic pay will increase by 2.10 % from 36.82 % % to 38. 92% .

For Official notifications from IBA , CLICK HERE

To read AIBEA circular , CLICK HERE

Dated 01 .11.2022 : The salary of bankers is set for enhancement from the month of November 2022 , as the Dearness Allowance ( DA ) payable to bank employees / officers from November 2022 to January 2023 will go up by 30 slabs .

The average consumer index points have increased in the quarter ending September 2022 to 8576.69 points from earlier average of 8456 points . Accordingly the DA slabs have gone up by 30 slabs from 526 slabs to 556 . DA as % of Basic pay will increase by 2.10 % from 36.82 % % to 38. 92% .

For Official notifications from IBA , CLICK HERE

To read AIBEA circular , CLICK HERE

11h Bipartite agreement is going to lapse :

BANKERS TO SUBMIT CHARTER OF DEMANDS :

Dated 21.10.2022 : The 11th Bipartite agreement between various bank workmen unions and bank officers associations , who are the constituents of UFBU except BEFI , was signed in November 2020 and is effective for 5 years from 01.11.2017 . It will come to an end on 31.10.2022 .

As scheduled , the four workman unions (AIBEA, NCBE , NOBW , & INBEF) have made a common charter of Demand and submitted to IBA today . Similarly the four officers associations ( AIBOC , AIBOA, INBOC , & NOBO) have also made their common charter of Demand and submitted to IBA today . To read the salient points of demands , CLICK HERE

SOURCE : Twitter CHV

BANKERS TO SUBMIT CHARTER OF DEMANDS :

Dated 21.10.2022 : The 11th Bipartite agreement between various bank workmen unions and bank officers associations , who are the constituents of UFBU except BEFI , was signed in November 2020 and is effective for 5 years from 01.11.2017 . It will come to an end on 31.10.2022 .

As scheduled , the four workman unions (AIBEA, NCBE , NOBW , & INBEF) have made a common charter of Demand and submitted to IBA today . Similarly the four officers associations ( AIBOC , AIBOA, INBOC , & NOBO) have also made their common charter of Demand and submitted to IBA today . To read the salient points of demands , CLICK HERE

SOURCE : Twitter CHV

AIBEA CALLS FOR A DAY'S STRIKE :

Dated 21.10.2022 : All India Bank Employees Union ( AIBEA ), the leading employees union in the banking industry has given a call to its member to observe a day's strike on 19th , November 2022 . The call is given in protest against " the increasing attacks in various banks , against its leaders and attack on workmen rights "

Dated 21.10.2022 : All India Bank Employees Union ( AIBEA ), the leading employees union in the banking industry has given a call to its member to observe a day's strike on 19th , November 2022 . The call is given in protest against " the increasing attacks in various banks , against its leaders and attack on workmen rights "

5 days banking :

OFFICERS ASSOCIATIONS PROPOSE DIFFERENTLY

Dated 16.10.2022 : Just like workmen unions , viz AIBIC , AIBOA , INBOC & NOBO had attended a meeting with IBA on 23rd , September 2022 to discuss the residual issues left out in the Bipartite settlements . Like workmen unions , they have also suggested to IBA to enhance the working hours per day by 30 minutes for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays .

But officers association differ from workmen unions in how to utilize the additional working hours . Officers Associations propose

a. That the present working hours shall be increased by 30 minutes a day, ergo revising the closure time of working hours by extending it to further 30 minutes in the evening.

b. That Non cash transaction hours shall be extended by stretching 30 minutes in the evening.

c. The cash transaction hours to be reduced by 1 hour to provide a fillip to alternate channel transactions and thereby allow the officers to focus on compliance .

While workmen unions wanted preponement of working hours by 30 minutes , officers associations propose extending the working hours at the end of the day . Further while workmen unions wanted to retain cash transaction hours , officers associations seek reduction of cash transaction hour by 60 minutes so that branches can use them for other channel promotions.

We have to see how IBA and the Government will react to both the proposals .

OFFICERS ASSOCIATIONS PROPOSE DIFFERENTLY

Dated 16.10.2022 : Just like workmen unions , viz AIBIC , AIBOA , INBOC & NOBO had attended a meeting with IBA on 23rd , September 2022 to discuss the residual issues left out in the Bipartite settlements . Like workmen unions , they have also suggested to IBA to enhance the working hours per day by 30 minutes for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays .

But officers association differ from workmen unions in how to utilize the additional working hours . Officers Associations propose

a. That the present working hours shall be increased by 30 minutes a day, ergo revising the closure time of working hours by extending it to further 30 minutes in the evening.

b. That Non cash transaction hours shall be extended by stretching 30 minutes in the evening.

c. The cash transaction hours to be reduced by 1 hour to provide a fillip to alternate channel transactions and thereby allow the officers to focus on compliance .

While workmen unions wanted preponement of working hours by 30 minutes , officers associations propose extending the working hours at the end of the day . Further while workmen unions wanted to retain cash transaction hours , officers associations seek reduction of cash transaction hour by 60 minutes so that branches can use them for other channel promotions.

We have to see how IBA and the Government will react to both the proposals .

5 days banking :

WORKMEN UNIONS PROPOSE ADDITIONAL WORKING TIME

Dated 14.10.2022 : The four workmen unions , viz AIBEA , NCBE , NOBW & INBEF had attended a meeting with IBA in September 2022 to discuss the residual issues left out in the Bipartite settlements . Now they have suggested to IBA to enhance the working hours per day by 30 minutes and to prepone the present working hours by 30 minutes in the morning. for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays . 5 day banking is one of the important residual issues left out in the bipartite settlement .

The suggestions made by the unions are

1. Present working hours may be increased by 30 minutes per day.

2. Present respective timings of working hours may be preponed by 30 minutes in the morning.

3. Existing customer service hours/non-cash transaction banking hours may be increased by 30 minutes.

4. Existing cash transaction hours to remain the same.

Unions have also urged the management of IBA to resolve the issue of 5 day banking at the earliest , by implementing their suggestions .

WORKMEN UNIONS PROPOSE ADDITIONAL WORKING TIME

Dated 14.10.2022 : The four workmen unions , viz AIBEA , NCBE , NOBW & INBEF had attended a meeting with IBA in September 2022 to discuss the residual issues left out in the Bipartite settlements . Now they have suggested to IBA to enhance the working hours per day by 30 minutes and to prepone the present working hours by 30 minutes in the morning. for the purpose of declaring all the Saturdays as holidays as against the present position of 2 nd and 4th Saturdays as holidays . 5 day banking is one of the important residual issues left out in the bipartite settlement .

The suggestions made by the unions are

1. Present working hours may be increased by 30 minutes per day.

2. Present respective timings of working hours may be preponed by 30 minutes in the morning.

3. Existing customer service hours/non-cash transaction banking hours may be increased by 30 minutes.

4. Existing cash transaction hours to remain the same.

Unions have also urged the management of IBA to resolve the issue of 5 day banking at the earliest , by implementing their suggestions .

WAGE SETTLEMENT - RESIDUAL ISSUES

WORKMEN UNIONS ISSUE A JOINT CIRCULAR

Dated 24.09.2022 : IBA had met separately the representatives officers unions and staff unions yesterday afternoon to discuss the residual issues listed in the MOU . The four workmen unions , viz AIBEA , NCBE , NOBW & INBEF had attended the meeting on behalf of employees . In the meeting , the residual issues that including 5-day banking , pension updation , payment of stagnation increment , LFC and other issues were discussed . Now workmen unions have come out with a circular explaining what transpired in the meeting

1. FIVE DAY BANKING : Unions demanded 5 days banking by making all Saturdays and Sundays as holidays . IBA wanted revision of customer hours and working hours in all the five working days to compensate the additional holidays . Workmen unions have agreed for an extra 30 minutes working each day and matter will be discussed further .

2. UPDATION OF PENSION : Unions suggested to kickstart the updation in a phased manner beginning with 5th , 6th & 7th BPS , in case cost is the issue for banks . IBA wants alternate suggestions for updation of pension , as the present proposals require additional cost to be met .

3. EX-GRATIA FOR PRE-1986 RETIREES : The matter will be discussed with the managing committee of IBA

4. IMPROVEMENT IN PENSION SCHEME : IBA didn't accept any suggestions made in this regard including 50% pay for those retired after 20 years of service .

5. CHANGE IN DA SCHEME - SHIFTING OF BASE YEAR TO 2016 : IBA advised that issue may be taken in the next BPS discussion .

6. ALLOCATION TO STAFF WELFARE FUND BASED ON OPERATING PROFIT : The matter is with the government .

7. INCREASE IN CONBEYANCE ALLOWANCE FOR THE DISABLED EMPLOYEES : The matter is with the government

8. SPECIAL ALLOWANCE FOR NORTH EAST , SIKKIM , JAMMU & KASHMIR AND SIKKIM : IBA told that the matter requires approval from the government .

9. IMPROVEMENT IN MEDICAL INSURANCE SCHEME : The scheme is already finalized for the year 2022-23 . However the matter of adding cover for the parents of the staff will be taken up with the insurance company .

To read the joint circular dated 24.09.2022 , CLICK HERE

WAGE SETTLEMENT - RESIDUAL ISSUES

IBA MEETING WITH UNIONS INCONCLUSIVE

Dated 24.09.2022 : It is reported that the representatives of IBA met separately the representatives officers unions and staff unions yesterday afternoon to discuss the residual issues listed in the MOU .

In the meeting with officers unions Viz AIBOC , AIBOA, INBOC & NOBO , it is reported that exchange of views took place on the residual issues that included 5-day banking , pension updation , payment of stagnation increment , LFC and other issues were discussed .

In the meeting with workmen unions , the similar issues were also discussed . In the meeting it was suggested to increase daily working hours by 35 minutes to implement 5 day banking with Saturdays and Sundays to be off on all weeks .

It is also reported that no conclusive decision was taken with regard to any item in the agenda in both the meetings .

However official communications with regards to the meetings from unions are awaited

IBA MEETING WITH UNIONS INCONCLUSIVE

Dated 24.09.2022 : It is reported that the representatives of IBA met separately the representatives officers unions and staff unions yesterday afternoon to discuss the residual issues listed in the MOU .

In the meeting with officers unions Viz AIBOC , AIBOA, INBOC & NOBO , it is reported that exchange of views took place on the residual issues that included 5-day banking , pension updation , payment of stagnation increment , LFC and other issues were discussed .

In the meeting with workmen unions , the similar issues were also discussed . In the meeting it was suggested to increase daily working hours by 35 minutes to implement 5 day banking with Saturdays and Sundays to be off on all weeks .

It is also reported that no conclusive decision was taken with regard to any item in the agenda in both the meetings .

However official communications with regards to the meetings from unions are awaited

WAGE SETTLEMENT - RESIDUAL ISSUES

Dated 04.09.2022 : It is reported that the representatives of officers unions and staff unions AIBEA, NCBE, INBEF and NOBW are being invited for a meeting with IBA team on the Friday , 23.09.2022 at 2.00 pm to discuss the residual issues listed in the MOU .

The IBA has allotted a time slot of 90 minutes between 2.00 pm to 3.30 pm and the meeting will be preceded by a lunch hosted by IBA . It is also reported that IBA has invited two representatives each from AIBEA & NCBE and one each from NOBW & INBEF . BEFI has been left out of the meeting .

We presently have no information on how many representatives have been invited from officers associations .

The residual issues include 5-day banking , pension updation , family pension , NPS contribution etc

Dated 04.09.2022 : It is reported that the representatives of officers unions and staff unions AIBEA, NCBE, INBEF and NOBW are being invited for a meeting with IBA team on the Friday , 23.09.2022 at 2.00 pm to discuss the residual issues listed in the MOU .

The IBA has allotted a time slot of 90 minutes between 2.00 pm to 3.30 pm and the meeting will be preceded by a lunch hosted by IBA . It is also reported that IBA has invited two representatives each from AIBEA & NCBE and one each from NOBW & INBEF . BEFI has been left out of the meeting .

We presently have no information on how many representatives have been invited from officers associations .

The residual issues include 5-day banking , pension updation , family pension , NPS contribution etc

BANKERS DA SET FOR A INCREASE FROM AUGUST 2022

Dated 30 .07.2022 : The salary of bankers is set for enhancement from the month of August 2022 , as the Dearness Allowance ( DA ) payable to bank employees / officers from August 2022 to October 2022 will go up by 54 slabs .

The average consumer index points have increased in the quarter ending June 2022 to 8495 points from earlier average of 8241 points . Accordingly the DA slabs have gone up by 54 slabs from 472 slabs to 526 .